Insurance Australia Group Limited (ASX: IAG) shares have fallen out of favour over the years. Its FY21 results may not help the situation.

IAG is the largest general insurance company in Australia and New Zealand. It sells insurance under many leading brands like NRMA Insurance, RACV and CGU Insurance.

Some of its key competitors include QBE Insurance Group Ltd (ASX: QBE) and Suncorp Group Ltd (ASX: SUN).

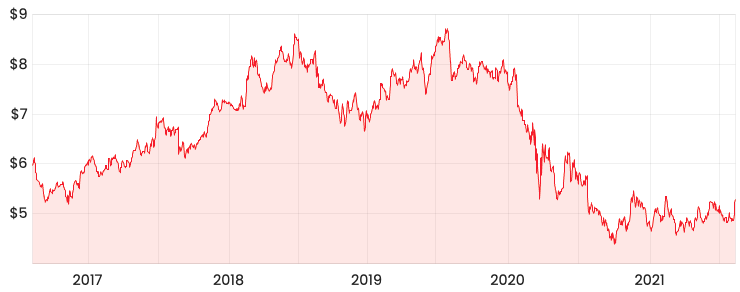

IAG share price

FY21 revenue up but a net loss

IAG’s top line jumped with revenue increasing by 3.8% in FY21 relative to FY20. The company notes this was mainly driven by a hike in rates (premiums) rather than new customers.

However, IAG recorded a net loss of $427 million, a stark contrast to a net profit of $435 million in FY20.

Interestingly, the business advises the big loss was due to significant one-off corporate expenses relating to business interruption, customer refunds and payroll remediation.

Zooming into the annual report, we can see an increase in the provision for business interruption related claims due to the COVID-19 pandemic. How come?

The Supreme Court of New South Wales Court of Appeal made a judgement that certain pandemic related policy exclusion wordings were ineffective, resulting in IAG needing to account for potential future claims.

Why is this important?

IAG generates profit on the spread between the premium charged and claims it needs to payout. If claims like those related to the pandemic in NSW ramp up, this will reduce IAG’s margins.

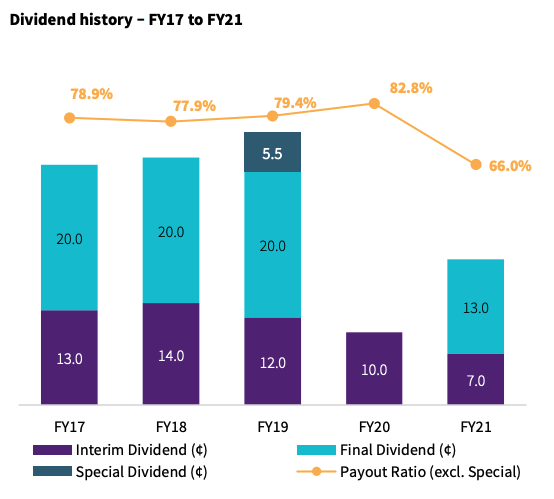

More importantly, lower profits result in limiting IAG’s potential dividend.

IAG declared a final dividend of 13 cents per share and this has been on the decline.

FY22 outlook

In terms of revenue, IAG expects ‘low single-digit’ growth primarily driven by continued rate (premium) increases.

IAG also expects its margins to fall within 13.5-15.5% assuming the COVID-19 situation improves, executing rate (premium) increases as well as other factors.

My take on IAG

The last two years have been a torrid time for insurance companies given the pandemic and rise in natural disasters like bushfires.

As you can see, when such catastrophes occur, things can quickly turn pear-shaped.

This is why at Rask, we prefer to invest in businesses that are less influenced by external forces and are more ‘weather-proof’.

IAG’s guidance assumes things returning to normal but the recent spread of the delta variant suggests otherwise. In such difficult circumstances, increasing premiums could lead to a rise in customer churn.

The IAG business is in a pickle on the revenue side as well as expenses, so a lot needs to go right for it to turn around.

If you are interested in another ASX dividend share, check out Jaz Harrison’s article on Washington H. Soul Pattinson and Co. Ltd (ASX: SOL).