Industrial property manager Goodman Group (ASX: GMG) recorded a 15% increase in FY21 operating profits as the rise of e-commerce spurred demand in logistic centres.

Despite beating guidance, the share price has fallen 2.25% to $22.64 at the time of writing.

Goodman Group is Australia’s largest industrial real estate investment trust (REIT).

The company builds, owns and manages warehouses and logistic centres for customers such as Amazon.com Inc. (NASDAQ: AMZN) and Wesfarmers Ltd (ASX: WES).

Strong financial performance from rising demand

Goodman recorded an operating profit of $1.22 billion, an increase of 15% on FY20.

This led to earnings per share (EPS) for the year of 65.6 cents, up 14.1%. This values the company on a price to earnings ratio of 34.

The company is seeing strong demand for logistic hubs and warehouses as customers shift to online purchases. This requires large and complex distribution centres in strategic locations.

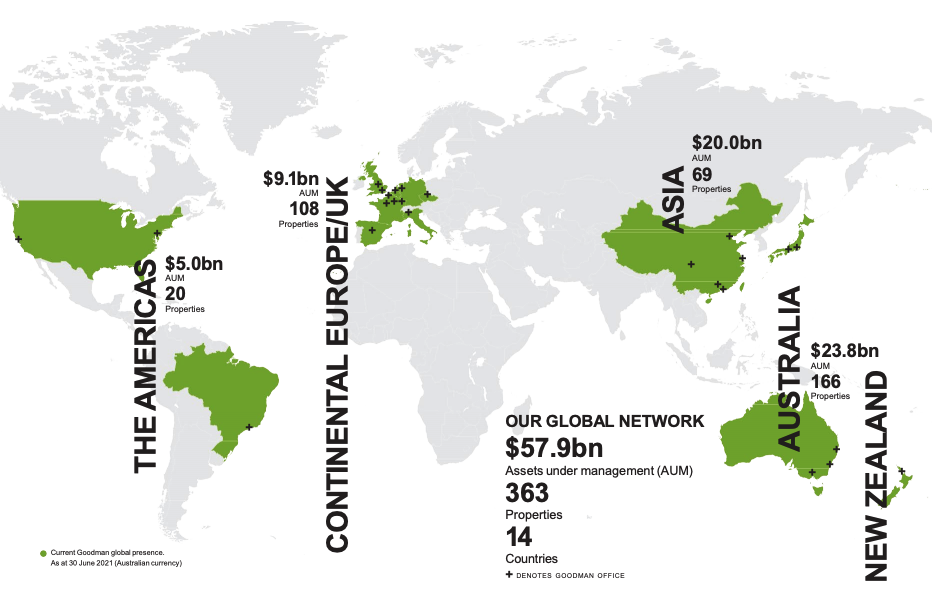

As a result, the company incurred a non-cash $5.8 billion upwards revaluation across its 363 properties. Net tangible assets for the group increased 14.4% to $6.88 per share.

The company will pay a 30 cent distribution to shareholders, in line with the FY20 payment.

Operational metrics

Total assets under management (AUM) for the year increased 12% to $57.9 billion.

The company has a strong development pipeline, with work in progress rising 63% to $10.6 billion across 73 projects.

Of the projects completed in FY21, 96% are already leased.

Across Goodman’s portfolio of properties, the company maintained an occupancy rate of 98.1% with a net increase in income of 3.2%. The weighted average lease expiry (WALE) remained steady at 4.5 years.

Goodman achieved carbon neutrality across its global operations, 4 years ahead of its 2025 goal.

FY22 guidance

The company is bringing forward a number of projects that were previously planned years away.

Goodman is forecasting a 10% increase in EPS to 72.2 cents per share and a 30 cent distribution.

Similar to FY21, AUM is expected to rise 12% to $65 billion.

My take

Another great result from Goodman Group. The only downside for shareholders is the stagnating distribution.

However, investors should take comfort that the business is reinvesting its profits to drive long-term returns.

Logistic and warehouse demand will only increase as e-commerce becomes more mainstream. Goodman is a great company to get exposure to this trend.

To read more news and analysis, I’d recommend signing up for a free Rask account and accessing our full stock reports. Click this link to join for free and access our analyst reports.