Mirvac Group

(ASX: MGR) shares seem to be on track to reach their former highs. Will the FY21 results push Mirvac shares even higher?

The company designs, develops and sells residential and commercial and other buildings like offices, warehouses and retail precincts. It also manages an investment portfolio of office, industrial and retail assets.

The business competes with the likes of DEXUS Property Group (ASX: DXS) and Charter Hall Group (ASX: CHC).

MGR share price

FY21 snapshot

It’s always interesting to identify what management hasn’t focused on in their results announcement. In this case, a lot of attention was devoted to statutory profit and earnings before interest and taxation.

Before diving into the bottom line, let’s check out something that Mirvac didn’t include as a key metric on the first page – revenue.

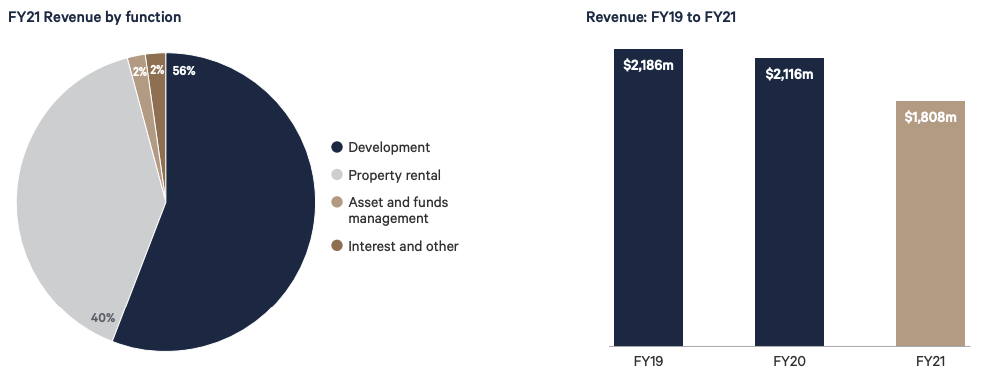

FY21 operating revenue

dropped by 14.56% from $2.116 billion in FY20 to $1.808 billion.

Development and construction management services revenue was the biggest contributor to this fall with a decline of $289 million. As for Mirvac’s investment portfolio, property rental revenue fell slightly by $13 million.

The asset and funds management revenue it generated stood tall, increasing by $13 million.

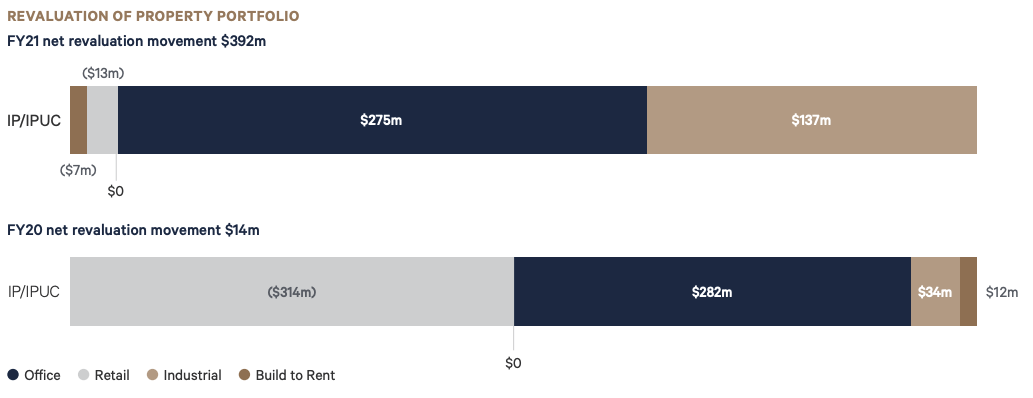

In terms of total revenue, this actually went up by $67 million due to the inclusion of the increase in the valuation of Mirvac’s investment properties as ‘other income’. I consider this to be unearned revenue because Mirvac essentially re-valued its industrial investment properties with more aggressive assumptions due to the rise in e-commerce. Mirvac will only ‘earn’ this revenue once these properties are sold.

Accordingly, I would focus on operating revenue.

But how did Mirvac generate a significant improvement of 61% in statutory profit to $901 million?

Development revenue dropped significantly, which naturally results in a fall in development expenses. In FY21, this fell at a higher rate of 23.63%, creating a material flow of cost savings.

In a nutshell, Mirvac beat earnings expectations by cutting down on its development expenses and revaluing its industrial investment properties.

FY22 outlook

Mirvac expects to achieve earnings per share (EPS) of at least 15 cents per share in FY22, which would represent a jump of at least 7.1%.

It has declared a distribution of $390 million, equivalent to a dividend per share (DPS) of 9.9 cents per share.

The company notes it is aiming to record growth of 3% in DPS to 10.2 cents per share in FY22.

My take on Mirvac

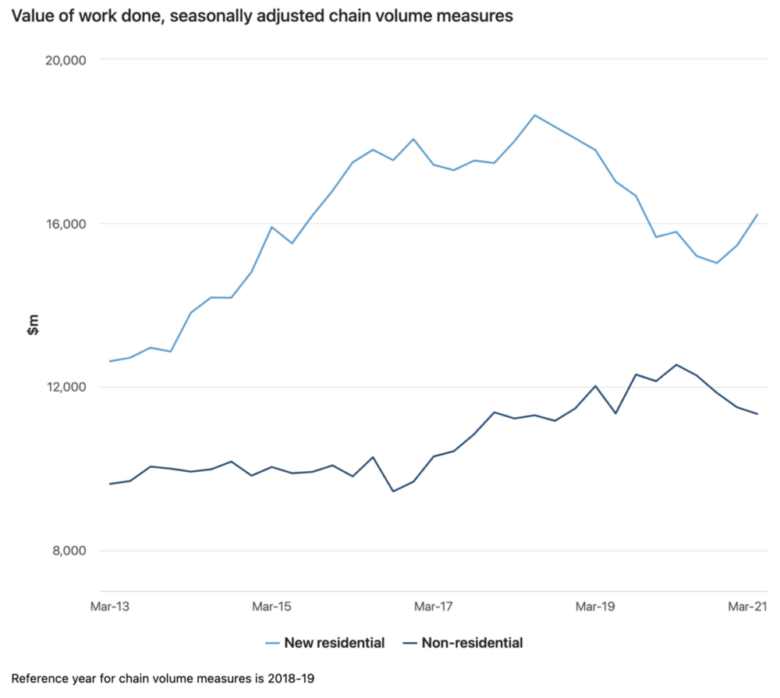

The steady decline in its biggest revenue segment is concerning. If we look at the below graph, it seems construction activity for new residential is picking up again but the same cannot be said for new non-residential buildings.

Mirvac makes much more bread and butter in non-residential projects, so the outlook doesn’t look great, especially in the office buildings space.

In saying that, industrial property like warehouses present a strong pipeline opportunity for Mirvac.

As part of the Rask Investment Philosophy, I prefer businesses where all its key operating segments are benefiting from strong structural tailwinds.

In this case, I would like to see whether Mirvac is raking in more development projects before considering investing.

If you are interested in other ASX growth shares, I suggest checking out Patrick Melville’s article on Objective Corporation (ASX: OCL).