Commonwealth Bank of Australia (ASX: CBA) came out with a bumper result headlined by a 19% jump in profits, a $3.50 full-year dividend and a $6 billion buy-back.

Let’s unpack the result and what it means for shareholders.

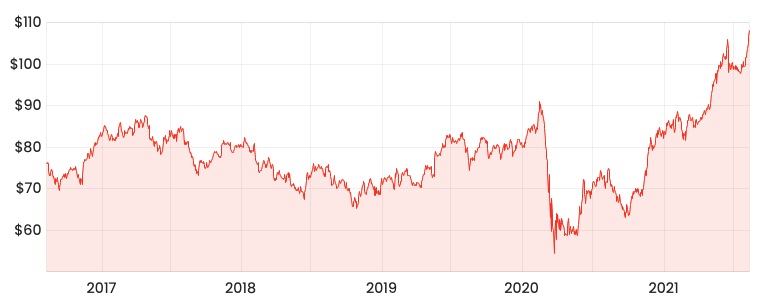

CBA share price

Operationally resilient

The company remains unquestionably strong by global standards, with a CET1 capital ratio of 19.4%. In absolute terms, the bank has $5.5 billion in excess capital above APRA requirements.

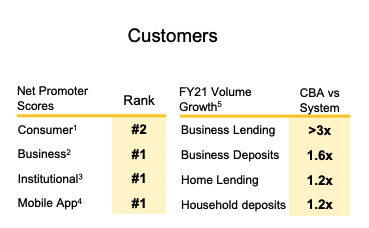

Business lending volumes are 3x above the sector, while home lending and deposits are 20% higher than peers. Additionally, the company ranked no lower than number two across all core markets.

Furthermore, CBA’s focus on its technology stack and providing a best-in-class digital experience is paying off, ranking well across all mobile banking metrics.

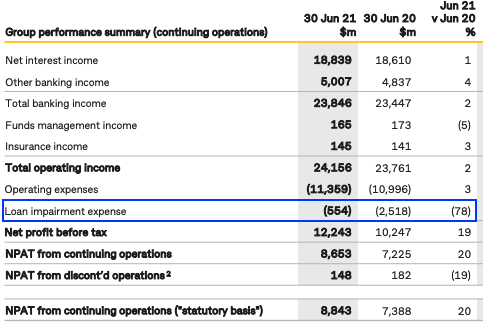

Loan impairments have fallen 78%, as the Australian economy rebounds from the Covid-19 pandemic.

From a qualitative perspective, it’s difficult to fault CBA.

Read beyond the headlines

Delving deeper into the FY21 result, CBA recorded low revenue growth across its key divisions.

Notwithstanding strong operating metrics, the retail, business and institutional business – which accounts for 87% of profits before corporate costs, all grew at 1% or less.

If you strip out the effect of unwinding loan provisions (highlighted in blue), profit for the year is mostly in line with FY20. This means investors should not project FY21 profits out into the future, as it accounts for one-off capital releases.

Over a five-year time frame, revenue and profits growth has been stagnating. FY21 headline numbers are flattered by an underwhelming FY20 when banks across the world were asked by regulators to preserve capital.

This isn’t to say CBA is a poor company.

Quite the contrary given in the past five years it has faced a Royal Banking Commission, global pandemic and fierce competition from buy-now-pay-later (BNPL) entrants, Afterpay Ltd (ASX: APT) and Zip Co Ltd (ASX: Z1P). Despite all this, the share price is up 42%.

However, investors should question if the headline 19% profit growth is sustainable longer-term.

$6 billion sugar hit

Due to selling a number of assets including its wealth and insurance arms, CBA has accumulated $6.2 billion in proceeds. $6.0 billion of this will be returned to shareholders via a share buyback rather than dividends.

The board believes this is the “most efficient and value-enhancing strategy”. This involves CBA purchasing its shares from existing shareholders, thus decreasing the share count and increasing earnings per share

.

For tax-exempt investors (charities, pension phase retirees and individuals below the tax-free threshold), the estimated value is $121.63 representing a 12% premium to today’s current price.

The one-time sugar hit is a positive for shareholders but not particularly material. CBA’s market capitalisation of $190 billion means the buy-back only represents around 3% of shares on issue.

More importantly, CBA has reduced its growth prospects. Instead, the company has chosen to laser in on its lending business.

My take

CBA trades on a price-to-book ratio of 2.4, extremely expensive compared to global peers.

With low growth prospects, BNPL taking market share and the unwinding of capital returns behind it, I don’t see much upside at today’s prices.

The buy-back is subsidised by asset sales and the profits by unwinding loan provisions. Neither are recurring therefore its unlikely CBA will replicate this result in FY22.

To read more, I’d recommend signing up for a free Rask account and accessing our full stock reports. Click this link to join for free and access our analyst reports.