Dicker Data Ltd (ASX: DDR) is the dark horse ASX share most investors probably wish they paid more attention to.

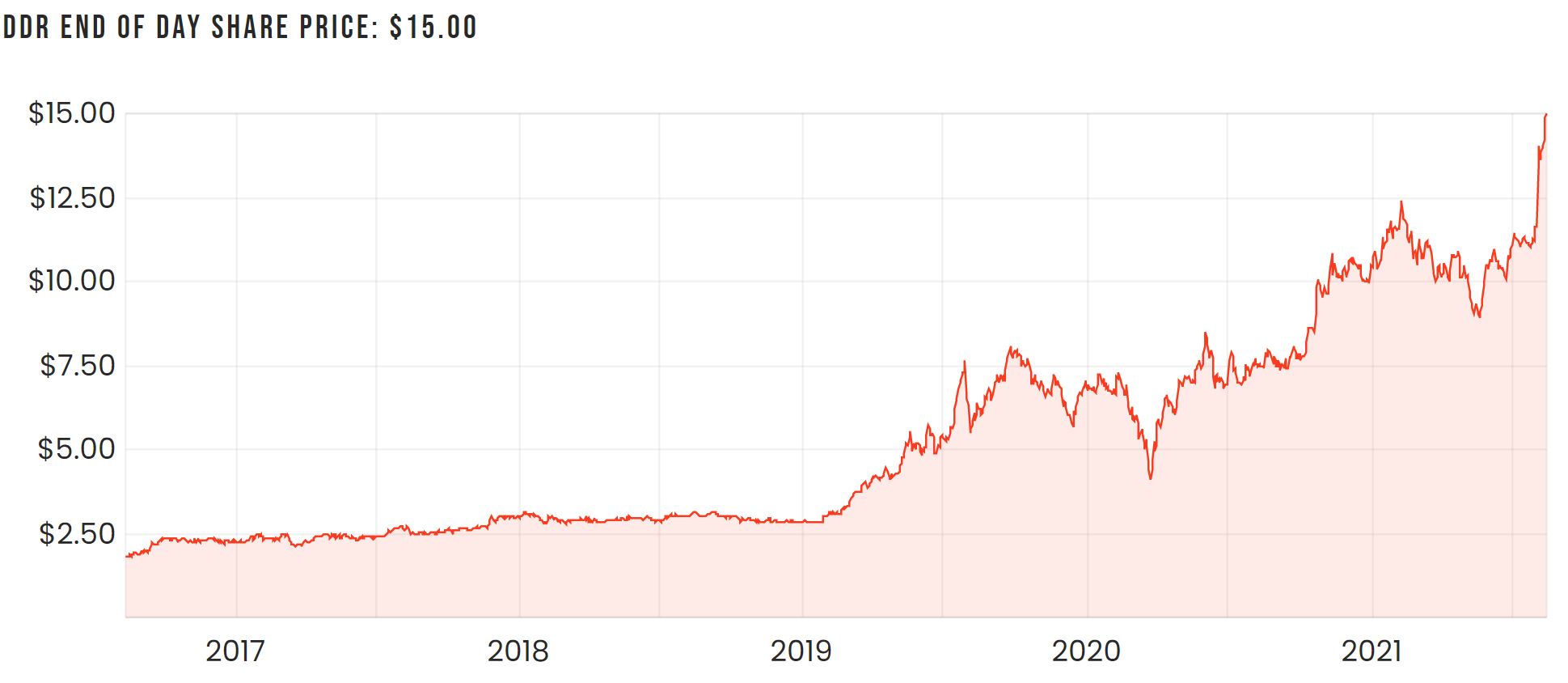

The 5-year chart below shows why. During this timeframe, Dicker Data’s shares have returned over 700% excluding dividends. Are they a worthy candidate for an ASX dividend share portfolio?

Company background

Dicker Data is a wholesaler of technology hardware, software, and cloud-based solutions that’s been running since 1978. It distributes to over 6,900 resellers across Australia and New Zealand and is an official distributor of brands such as Toshiba, Cisco, Hewlett Packard Enterprise, and Microsoft.

COVID-19 has been a boon for sales, spurred on by the shift to a work from environment. Yet, this has partly been negated by a global chip shortage causing many of its vendors to be unable to keep up with demand.

Recent results

All things considered, the company continues to show strength. When it last reported its H1 FY21 results, it was revealed that revenue and earnings (profit) growth were still trending upwards. This was compared to H1 FY20 where it delivered strong revenue growth of 18.2% on the pcp.

While some have suggested Dicker Data might be a one-hit COVID wonder, management seems confident that there are some more tailwinds likely to work to its advantage.

Given the accelerated technology adoption, management thinks cybersecurity will play an important role and will be necessary to accommodate for the increase in new devices. The same can be said for other areas such as data capture, machine learning, and analysis tools.

Management also says that the 5G rollout is playing a significant role across governments and businesses which is also likely to play to its advantage.

Dividend policy

Dicker Data runs a slightly unconventional dividend policy and pays out 100% of its earnings to shareholders in the form of dividends. CEO David Dicker does not pay himself a salary and solely relies on dividend income to the tune of around $18 million per year.

As a potential investor, it would definitely strengthen my conviction to know that the CEO has aligned himself to other shareholders to an extent such as this.

https://education.rask.com.au/2020/01/09/what-are-share-dividends/

Based on its last Q1 update, it looks the like company is on track to pay a full FY21 dividend of 37.5 cents per share, an increase of 5.6% on FY20. This represents a dividend yield of around 2.5% based on the current share price.

Summary

Wholesaling definitely seems to be a tough business to be in. Margins are razor-thin (9% gross margin in FY20) and there doesn’t seem to be any obvious competitive advantages apart from exclusive distribution rights and scale advantages.

Low-margin retailers and wholesalers can still perform well though. Look at successful companies like JB Hi-Fi Limited (ASX: JBH) or Lovisa Holdings Ltd (ASX: LOV) for example.

Dicker Data could continue to do well, but I think there might be some higher growth areas to have a look around in.

If you’re after more ASX share ideas, I’d highly recommend signing up for a free Rask account to gain access to our stock reports.