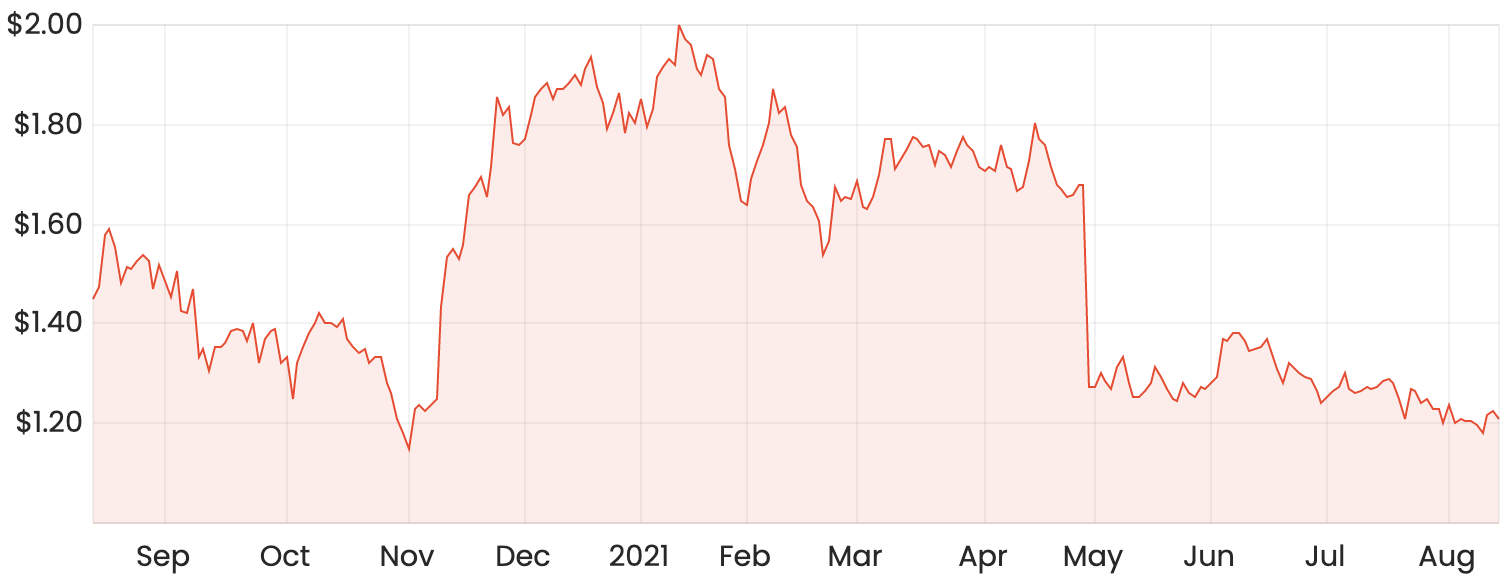

The Beach Energy Ltd (ASX: BPT) share price is coming under pressure today after the ASX energy company released its full-year FY21 results.

At midday, Beach Energy shares are tumbling more than 8%, meaning shares have fallen around 40% year-to-date.

Beach Energy share price chart

Digging into Beach Energy’s FY21 results

Starting at the top-line, Beach Energy achieved sales revenue of $1.5 billion, down 8% from $1.6 billion in the prior year. The company attributed the reduction in sales revenue to lower volumes and unfavourable A$/US$ exchange rates, partly offset by favourable US dollar oil and liquids prices.

Sales volumes for the year were 26.1 million barrels of oil equivalent (MMboe), down 6% from 27.7MMboe in FY20.

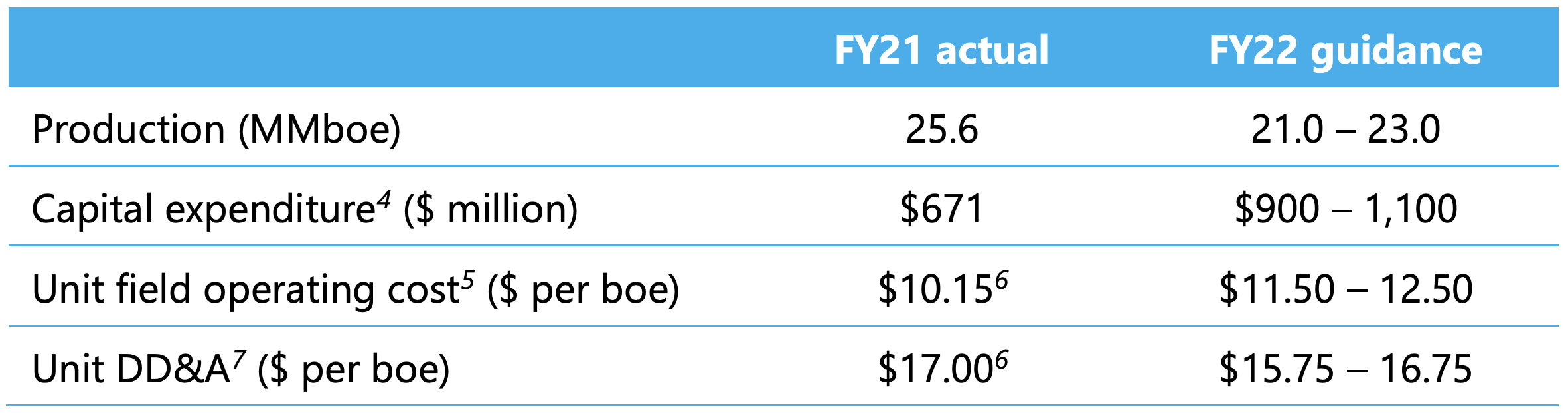

The company’s unit field operating cost came in at $10.15 while capital expenditure totalled $671.3 million, an improvement of 22% compared to $863.0 million in FY20.

On the bottom line, Beach Energy delivered net profit after tax (NPAT) of $316.5 million, down 37% from nearly $500 million in the prior year. The company said its profit result reflected lower sales and other revenue, and higher impairment and exploration expenses.

Turning to the balance sheet, the company ended the period with $113 million cash and $174 million debt on its books. It also has a further $275 million in undrawn loan facilities.

Managing Director, Matt Kay, said that while FY21 was a challenging year for Beach on the Western Flank, the company remains in a strong position as it delivers on its gas growth projects, primarily in the Perth and Victorian Otway Basins.

Beach Energy’s dividend

Despite the recent downgrade to Western Flank production and reserves, Beach declared a final dividend of 1 cent per share, fully franked.

This takes the full-year dividend to 2 cents per share, putting Beach Energy shares on a raw dividend yield of around 1.8%.

FY22 guidance

Commenting on FY22 guidance, Mr Kay said that Beach expects production to be further impacted by the declining Western Flank fields, ahead of the ramp up of production in the Perth Basin and Victorian Otway Basin development projects.

The following table, courtesy of Beach, neatly summarises guidance for the upcoming financial year.

Summary

It’s been a tough few days for ASX energy shares, with the AGL Energy Limited (ASX: AGL) share price tumbling last week in response to the company’s disappointing FY21 results.

Other ASX shares to keep an eye on today include BlueScope Steel Limited (ASX: BSL) and JB Hi-Fi Limited (ASX: JBH), both of which also reported full-year results.

To stay up to date this August, make sure to bookmark Rask Media’s ASX reporting season calendar.