Online automotive classifieds business Carsales.Com Ltd (ASX: CAR) has accelerated profit growth in FY21 after a pandemic affected FY20.

The market has reacted positively to the FY21 result, up 2.57% to $23.17.

Australia slows, international speeds up

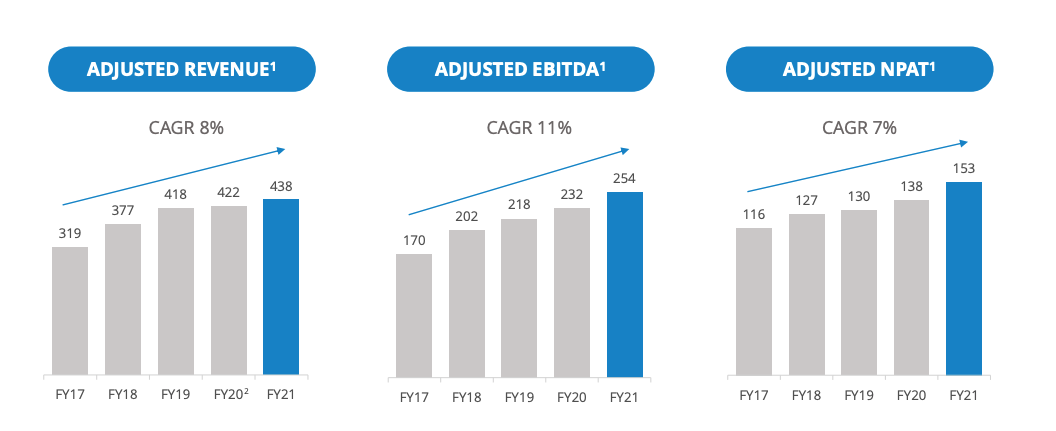

Carsales reported adjusted revenue growth of 4% to $437.8 million resulting from a 38% increase in car inspections and a 17% rise in search sessions.

Australian operations

The company’s flagship classified, Australian based carsales.com.au recorded a 2% increase in sales to $304 million. Revenue growth in FY21 was weighed on by low car inventory and intermittent lockdowns.

However, the business firmly remains the number one automotive classified in Australia, with 24x more page views and nearly 7x more search sessions compared to its nearest competitor.

Data, research and services revenue remained largely stagnant, decreasing 1% to $42.8 million.

International platforms

Asia was the standout performer led by South Korea’s Encar platform, which recorded a 20% increase in constant currency revenue to $84.3 million.

Latin America also contributed meaningfully with strong growth recorded in Brazil of 16%. This was a result of increased dealer numbers, volume growth and premium products.

However, when translated back to Australian dollars, Latin America revenue decreased 12% to $6.7 million.

Operating leverage kicks in

Earnings before interest, tax, depreciation and amortisation (EBITDA) – Carsales reporting metric of choice, increased 10% for the year to $254.2 million. This represents an EBITDA margin of 58.1%, an increase of 3.1% on FY20.

Adjusted net profit for the year increased 11% to $152.8 million largely a result of the operating leverage achieved.

Online classifieds are highly scalable businesses. Once you build the website platform, each incremental listing costs very little. That is why despite a modest revenue rise, profits increased at a higher rate.

Carsales has announced a dividend of 22.5 cents per share down 10% on FY20 as a result of the capital raise to purchase Trader Interactive.

My take

Carsales did not provide concrete guidance, however, believes the business will “deliver solid growth in group adjusted revenue, adjusted EBITDA and adjusted NPAT in FY22”.

I think overall it was a solid result. The Australian business is quite mature, however, management has expanded abroad into new markets, which are contributing meaningful revenue and EBITDA.

The company is not cheap, trading on about 42x profits but I think it has ample growth opportunities ahead to capitalise on.

To read more, I’d recommend signing up for a free Rask account and accessing our full stock reports. Click this link to join for free and access our analyst reports.