Four-wheel drive accessory retailer ARB Corporation Limited (ASX: ARB) has achieved record sales and profit as closed international borders forced travellers to explore their own backyard.

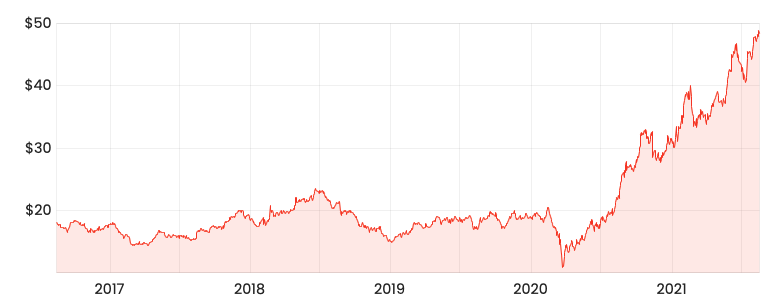

The ARB share price has been on a tear in the last 18 months, up 136% on its pre-pandemic market capitalisation.

ARB share price

Double-digit growth across three divisions

Sales of accessories for the full year increased 33.9% to $623.1 million. The company recorded double-digit sales growth across its 3 customer categories.

Australian aftermarket

Australian aftermarket represents products sold through the Australian ARB store network in addition to distributors.

Sales increased 20.9% in FY21, led by growth in new car sales of four-wheel drives, however was limited by fitment and supply chain constraints.

Aftermarket remains the largest contributor to revenue, representing 54.9% of group sales.

Exports

ARB’s export division supplies products to over 100 countries across the globe with offices in the US, Europe and the Middle East.

Exports sales increased 50.2%, with each subsidiary recording sales growth. The division now represents 36.7% of group sales, up from 32.7% in FY20.

Original equipment

ARB works with original equipment (OE) manufacturers such as Ford to create accessories for particular four-wheel drive models.

FY21 was a bumper year for OE, with sales up 73.9% as a result of several new contracts with OE customers. Similar to Australian aftermarket, OE growth was subdued by supply chain, labour and fitment constraints.

Original Equipment represents 8.3% of sales, up from 6.4% in FY20.

Profits soar on bumper sales

As a result of the strong sales growth, ARB achieved a full-year net profit of $112.8 million, a 97.0% increase on FY20.

This was a result of the company achieving operating leverage from spreading overheads across higher sales volume, increased gross profit margins and a strengthening Australian dollar.

The board has declared a fully franked dividend of 39 cents, taking total dividends for FY21 to 68 cents. This represents a gross dividend yield of 2%.

After accounting for capital expenditure on growth opportunities, the company increased its cash on hand from $43 million to $85 million. The company has no debt.

My take

Pleasingly, exports and OE are recording strong growth numbers as the business continues its expansion abroad.

This reduces ARB’s reliance on its core Australian aftermarket division while also providing new avenues for growth.

ARB remains dedicated to growing its competitive advantage by investing in its research & development pipeline, which will further spur growth.

Management noted despite strong demand, lockdowns across the globe are impacting shipping networks, customer fulfilment and supply chains. No quantitative guidance was provided.

At 36x FY21 profits, ARB is trading above its historical market multiple. I think it’s a high-quality retailer, however, I want to see what demand looks like in a post-pandemic world.

To keep to date with all the latest ASX news, be sure to bookmark the Rask Media home page.