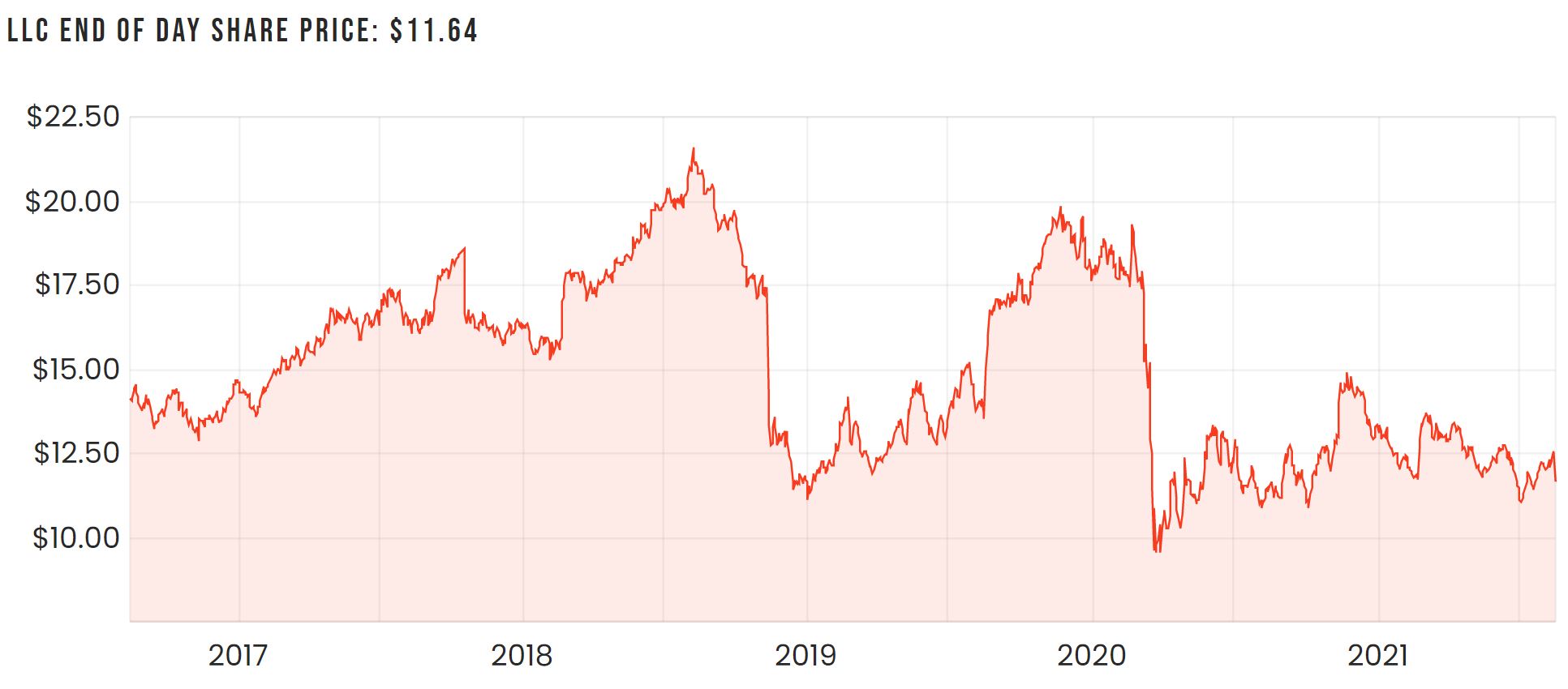

Yesterday, global property group Lendlease Group Stapled (ASX: LLC) released its FY21 results which sent its shares down 7.5% by the end of the day.

The below share price chart paints an accurate picture of its long and complicated history.

FY21 results

For the full year, Lendlease reported statutory net profit after tax of $222 million, a significant improvement from FY20’s loss of $310 million. This improvement was largely driven however by the recent divestment of its underperforming engineering and services divisions.

Divestments aside, management noted the COVID-19 pandemic is still a headwind, particularly for its development division.

This side of the business saw production delays with other impacts around leasing and sales. Due to weaker rental demand and lower rents in London’s Elephant Park, Lendlease provisioned $60 million in pre-tax earnings.

These impacts saw construction revenue fall 16% with EBITDA also affected due to lower productivity, site shutdowns, and commencement delays. Lendlease’s current development pipeline sits at around $114 billion.

Its investment division also struggled, reporting management EBITDA of $165 million, down from $198 million in FY20. It was however still able to grow its funds under management, which is currently just shy of $40 billion.

Future outlook

Lendlease is currently undergoing an organisational and management restructure that can hopefully turn the company around from its past challenges.

It’s targeting around $160 million in annual cost savings which will partly come from the recent decision to consolidate its Australian segment into one business unit.

More details around the restructure will be released at the end of August.

What to do with Lendlease shares?

Notwithstanding COVID impacts, it seems as though the core business is performing okay. With the divested engineering and services divisions now out of the picture, there seems to be a clearer picture of the company’s direction and how it plans to get there.

Something worth keeping an eye on is its investment division. When Lendlease completes a project, it can hold on to these assets and collect rental income, or in other cases, monetise them by packaging them into various funds. This could lead to more consistent annuity-style income streams, which is preferable over lumpy project revenue.

A major weakness to Lendlease’s business model involves the bidding process around new projects. When a new project is announced, Lendlease and its competitors must make an offer to win the project. A lot of the time, the lowest bid is accepted. Not only does this mean less project revenue for Lendlease, it often results in projects going over budget and over time, which can damage the company’s reputation.

The capital-intensive nature of development/construction and the bidding headwind leads to believe that Lendlease isn’t a fantastic business. That being said, if this turnaround proves to be successful, I could easily see its shares re-rate as the market appears to have lost interest in recent years.

If you want to become a better investor, I’d recommend signing up free Rask account and accessing our full stock reports. Click this link to join for free and access all of our free analyst reports.