Domain Holdings Australia Ltd (ASX: DHG) shares are at record levels. Will there be greener pastures ahead for Domain shares?

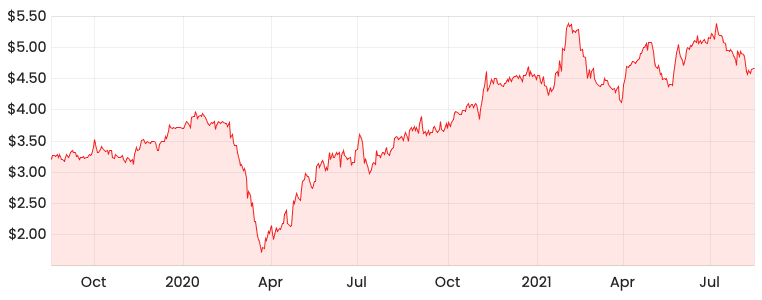

DHG share price

FY21 results spearheaded by first final dividend in 2 years

Domain finished FY21 in emphatic style, declaring a final dividend of 4 cents per share. It’s been a long time coming, its first final dividend since FY19.

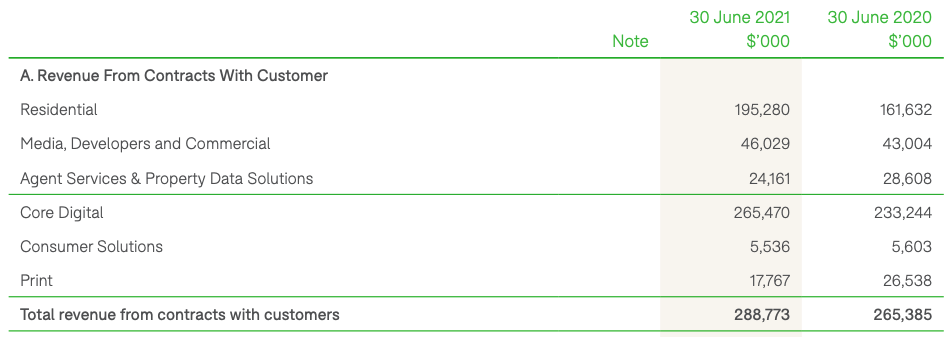

Digital revenue from residential listings was the key driver behind Domain’s strong revenue rise. It comes as no surprise given the constant media reports of a hot property market.

Consumer solutions relate to property related services like home loans, insurance, trade services and utility connections. This didn’t change much, which is surprising.

I thought a rise in revenue in residential listings would have resulted in a corresponding increase in consumer solutions. Perhaps purchasers are using alternative providers, it’s food for thought.

It seems COVID has accelerated the continual decline in print revenue.

The top line did great, how about the bottom line?

Domain recorded a 21.1% improvement in earnings before interest, taxation, depreciation and amortisation (EBITDA explained) and net profit after tax leapt up by 66.2% to $37.9 million.

Unlike last financial year, Domain did not record an impairment charge (-$256 million) for its intangible assets. This occurred in FY20 because of the unprecedented COVID impact on the property market.

With things slowly returning to normal, Domain felt it was unnecessary to revalue its intangible assets.

As a result, this made a major contribution towards the enhanced net profit line.

FY21 outlook

Domain’s management team expects residential listings to taper off a bit due to current lockdown restrictions. However, they are positive about future growth prospects.

In terms of costs, this is expected to fall in the high single-digit to low double-digit range from the FY21 ongoing expense base of $195.5 million.

My thoughts on Domain

Whilst Domain is the little brother to REA Group Limited (ASX: REA), it still enjoys the benefits of operating in an oligopolistic market within Australia.

The barriers to entry remain high and there will always be demand for properties to either rent or purchase.

It may not enjoy the benefit of REA Group’s first-mover advantage but its relatively high gross margins will likely continue to blossom as its print segment slowly fades.

However, it needs to continue to win more market share and grow that top line to meet current expectations at today’s share price.

If you want to find out why REA Group dominates Domain, click here.