Fintech EML Payments Ltd (ASX: EML) has released its FY21 results underlined by meaningful increases in volume and revenue.

Its been a rollercoaster year for shareholders, with the share price halving in May after the Central Bank of Ireland (CBI) launched regulatory action.

EML share price

Volumes, revenue and EBITDA up

Gross Debit Volume (GDV) – the amount of money flowing through EML, increased 42% to $19.7 billion.

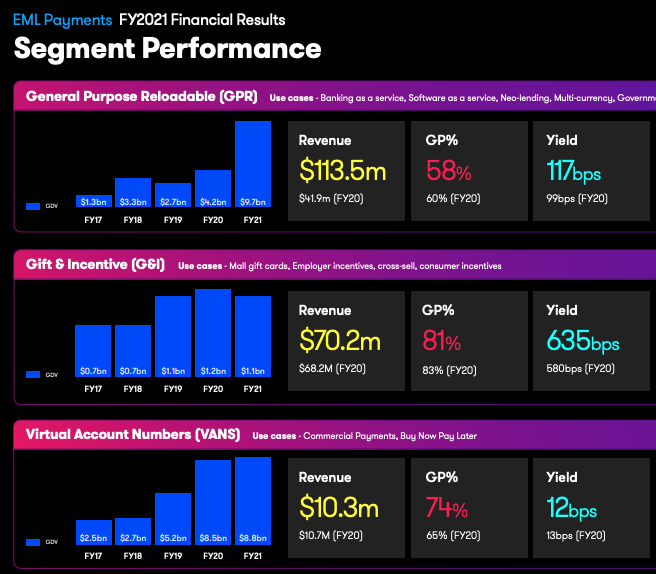

This was largely a result of volume growth in one out of the three divisions, General Purpose Reloadable (GPR).

GPR volumes increased 130% stemming from the acquisition of PFS in addition to growth in salary packaging and gaming volumes.

Gift and Incentive (G&I) volumes declined 6% due to the closure of malls across the globe due to the pandemic.

Virtual Account Numbers (VANs) increased volumes by 4%.

As a result, the company recorded a 60% jump in total revenue for the year to $194.2 million. This represents a revenue yield of 0.99% and beat previous guidance of $180 million to $190 million.

Gross profit increased proportionally less than revenue, up 47% to $130.4 million. This was a result of a change in product mix towards GPR, which has lower gross margins.

Earnings before interest, tax, depreciation and amortisation (EBITDA) – EML’s reporting metric of choice, increased 65% to $53.5 million on an underlying basis spurred by revenue growth outpacing costs.

Operational results

EML signed 121 new contracts in FY21 with 70% coming from new GPR growth verticals.

Currently, the business has a sales pipeline equal to $10.5 billion in GDV, spread across GPR and G&I.

The company expects the Sentenial acquisition to be completed by September and be earnings accretive by FY24. EML will include Sentenial and VANs into a new segment named Digital Payments.

Sentenial operates Nuapay in Europe’s fast-growing open banking sector.

CBI regulatory update

In May, the CBI raised issues regarding EML’s PFS Card Services Ireland Limited business.

EML has provided the CBI with a remediation plan and is engaged with the CBI to implement the plan.

It is expected to be largely completed by the end of 2021 with the remaining items remediated by March 2022.

The company has made an $11.4 million provision for costs related to “professional advisory, remediation and other potential costs associated with resolving the matter“.

FY22 guidance

EML provided a guidance range for key financial metrics in FY22, which infer solid growth next year:

- GDV between $93 billion to $100 billion

- Prepaid GDV of $24 billion to $26 billion (FY21: $19.7 billion)

- Sentenial acquisition generating GDV of $69 billion to $74 billion

- Revenue between $220 million to $255 million (FY21: $194.2 million)

- Underlying EBITDA of $58 to $65 million (FY21: $53.5 million)

- Operating cash flow 80-90% of EBITDA (FY21: 87%)

My take

Phew!

The $11.4 million provision is no splash in the ocean, but significantly better than the worst-case outcome of a major fine or further action by the CBI.

The market should react favourably to the news in trading tomorrow.

Overall, EML continued its growth by acquiring adjacent payment verticals to expand its product offering. Positively, the company provided guidance that suggests FY22 will be another year of growth.

To keep up to date on all the latest news regarding EML and the ASX, be sure to bookmark the Rask Media home page.