Shares in kitchen appliance retailer Breville Group Ltd (ASX: BRG) have sunk despite the business exceeding $1 billion in sales for the first time.

This morning, the company released its FY21 results, with the share price subsequently falling 8% to $30.59.

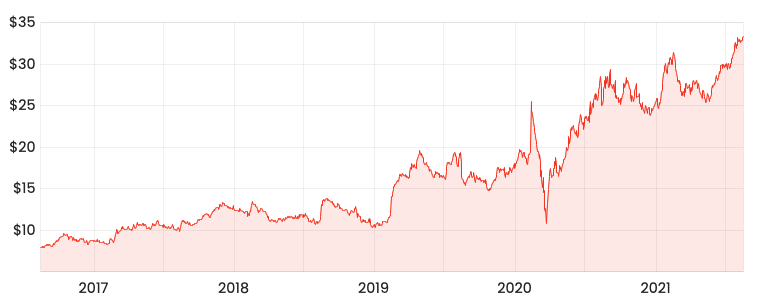

Notwithstanding today’s share price fall, Breville’s share price has been rising steadily for long-term shareholders.

BRG share price

Breville blasts through $1 billion in sales

Despite intermittent lockdowns across its key markets, Breville increased FY21 group revenue by 24.7% to $1.18 billion.

The rise in demand was driven by increased work from home and reduced travel resulting in households splurging on premium appliances including pizza ovens and coffee machines.

Europe and the Asia Pacific were the standout performers, achieving constant currency sales rises of 58.4% and 37.4% respectively.

Gross profit for FY21 was proportionally higher than revenue, up 29% to $413 million. This was largely a result of higher average prices due to reduced promotions and marketing.

The higher average prices more than offset input inflation costs.

Net profit after tax (NPAT) increased 42.3% to $91 million stemming from strong overhead control.

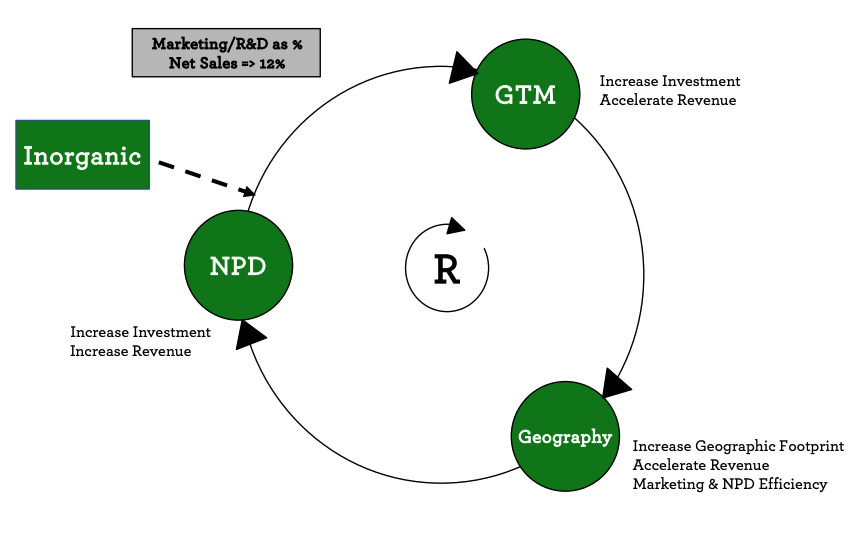

NPAT would have likely been higher if not for investments in marketing, research and development (R&D) and IT to support growth.

The company announced a 13.5 cent fully franked dividend, taking FY21 total dividends to 26.5 cents. This is a 35% reduction on FY20.

Net cash (cash – debt) remained steady at $130 million, however, is expected to fall as working capital returns to historical levels. Currently, low inventory levels and receivables are elevating cash on hand.

Operational update

Breville expanded into four new geographies in FY21 – France, Portugal, Italy and Mexico. Moreover, the company completed the Baratza acquisition, a specialist in coffee appliances.

The company is still experiencing inventory issues, as demand for materials and shipping soars. Of the $216 million of inventory on the balance sheet, a third remains in transit.

Management has flagged increased marketing and R&D spend from the historical level of 8% of sales to 12% in order to accelerate growth.

Why are shares falling?

CEO Jim Clayton noted the company will experience a “transitional year” in FY22 given the unwinding of working capital and reopening of economies.

Breville is facing a number of headwinds including availability and cost of parts plus shipping delays. Furthermore, the US dollar depreciated, mitigating profitability.

This is unlikely what shareholders want to hear, given the company now trades as a growth company on a price-earnings multiple of 46.

Another reason may be the reduction in dividends despite growing profits.

The company had already flagged this in earlier announcements, opting to reduce the payout ratio from 70% of NPAT to 40% to support future growth.

I’d argue Breville and ARB Corporation Limited (ASX: ARB) are two of the best global Australian retailers on the ASX.

But today’s price bakes in a lot of future growth.

I’d hold if I owned shares after today’s drop, but I want to see what demand is like in a post-pandemic world before deciding to invest.

To keep up to date with Breville updates and ASX news, be sure to bookmark the Rask Media home page.