Santos Limited (ASX: STO) shares faced an uphill battle after the pandemic last year. However, HY21 results suggest Santos shares are on track to reach former highs.

Santos Ltd (ASX:STO) is one of Australia’s largest oil and gas companies, competing with Woodside Petroleum Ltd (ASX: WPL) and others.

STO share price

HY21 sets records

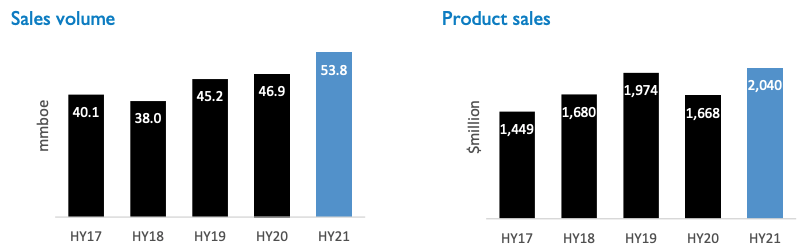

Santos released its HY21 results with Olympic breaking records, reporting record production and sales as depicted below.

The ramp-up in demand for liquified natural gas (LNG) produced in the Bayu-Undan/Darwin project primarily drove the rise in sales. Higher oil prices also played a key role in these results.

As a result, sales revenue soared by 22% from HY20 to HY21.

This ultimately led to a staggering turnaround in net profit after tax from -$US289 million to $US354 million. However, improvement in revenue was not the only contributor.

Santos’ bottom line received a major boost from a revaluation of its non-current assets.

Santos relies on its non-current assets like plant and equipment to produce LNG. The long-term value of these assets is reassessed on their expected future cash flow estimation.

In HY20, Santos had to revalue these assets downwards significantly due to the pandemic and uncertainty around future cash flow generation. However, conditions have improved since then as Santos uses more optimistic estimates of future oil prices and discount rates.

So, rather than a downward revaluation of -$US756 million in HY20, it only needed to take a -$US8 million hit. This is a big improvement of $US748 million.

The big jump in net profit after tax resulted in Santos distributing an interim dividend of US5.5 cents per share compared to US2.1 cents per share in HY20.

Is Santos a Mentos?

The favourable oil prices and market conditions seem like a breath of fresh mentos. However, don’t let it get stuck in your teeth.

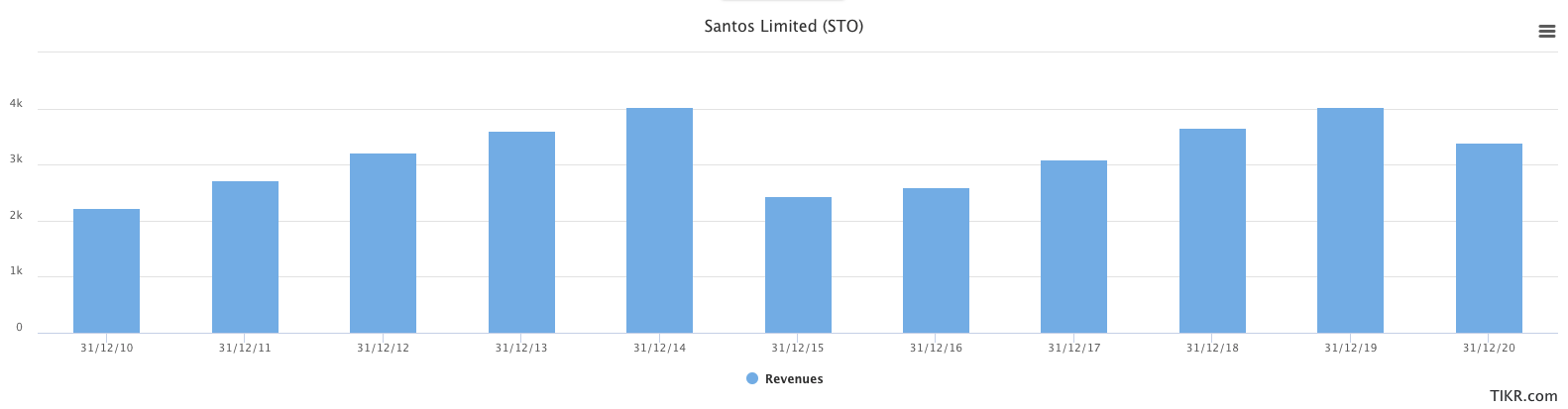

These conditions tend to flip at any time and are outside of Santos’ control. The volatile nature of Santos’ revenue below speaks to this.

Given the erratic movement in sales dictated by external market forces, it’s a company I tend to steer away from. Another reason is that it falls outside of my circle of competence.

On the other side of the fence, if you have some sort of informational or analytical edge, Santos may be a sound investment due to its size and scale.

If you are strongly considering Santos, bear in mind that the more factors a business relies on, it becomes harder to forecast.

If you want to become a better investor, I’d recommend signing up free Rask account and accessing our full stock reports. Click this link to join for free and access all of our free analyst reports.