Global biotech leader and Australia’s third-largest public company CSL Limited (ASX: CSL) achieved steady growth in FY21 despite intermittent lockdowns impacting the business.

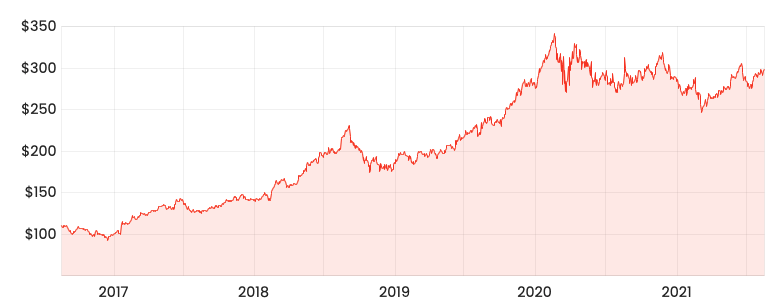

CSL share price

Operating divisions

Before delving into the results, it’s worth reminding ourselves of the key parts of CSL’s business.

CSL Behring (85% of group revenue) delivers treatments for rare and serious diseases including conditions in the immunology, haematology (blood) and cardiovascular areas.

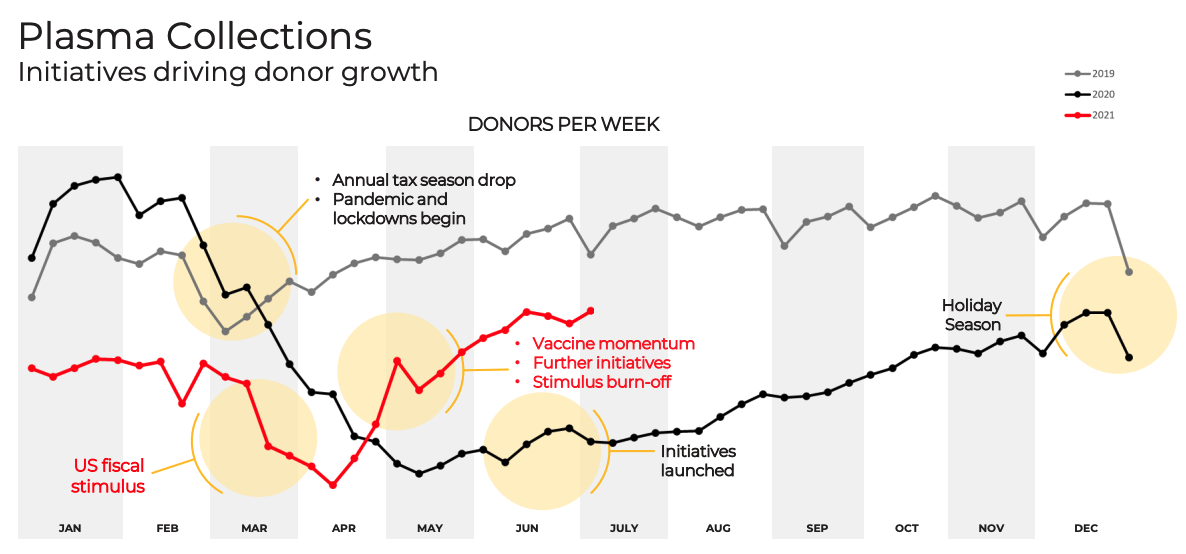

A key part of the business is the collection of plasma, which has been impacted by pandemic movement restrictions.

Seqirus (15% of group revenue) focuses on the development and production of influenza vaccines.

Steady financial growth in FY21

Total revenue for the year increased 13% to US$10.3 billion. This was led by growth in both Behring and Seqirus.

Behring increased sales by 6% driven by higher demand across its immunoglobulin and speciality products.

This was somewhat mitigated by a decrease in haemophilia sales because of mobility restrictions and government stimulus checks.

CSL collects blood in donor centres predominantly based in the United States.

Despite being the smaller division by revenue, Seqirus had a bumper year increasing sales by 30%.

The pandemic has demonstrated the importance of vaccinating populations against influenza resulting in a 41% increase in seasonal influenza vaccines.

On the expenses side of the ledger, research and development (R&D) increased 5%, marketing 7% and administration 5%.

The notable expense increase was depreciation up 38%, however, this is a non-cash item.

As a result, net profit after tax (NPAT) increased 13% to US$2.375 billion. This equates to earnings per share of US$5.22.

The company has declared a US$2.22 dividend, a 10% increase on FY20. The dividend is largely unfranked.

FY22 guidance

CSL expects revenue growth of 2% to 5% in FY22 in constant currency terms.

Additionally, management has guided net profit after tax range of $$2.15 billion to $2.25 billion for FY22 in constant currency.

Even at the higher end of guidance, this would be a decrease in earnings compared to FY21.

CEO Paul Perreault commented on the results:

“We see FY22 as a transitional year as we continue to invest and deliver against our long term strategy”.

My take

It’s a sound result by CSL given the mobility restrictions. The company has a number of new products in its development pipelines that will spur future growth.

The FY22 guidance is somewhat concerning, however, management is playing the long game with its 2030 strategy.

To keep up to date on all the latest news regarding CSL and the ASX, be sure to bookmark the Rask Media home page.