The Domino’s Pizza Enterprises Ltd (ASX: DMP) share price is absolutely cooking this morning after the company released its FY21 results.

The share price has lifted 6.77% on the news to $135.56.

DMP is the exclusive master franchisee to Australia, New Zealand, Belgium, France, Netherlands, Japan, Germany, Luxembourg, Denmark and Taiwan.

DMP share price

Pandemic spurs pizza sales

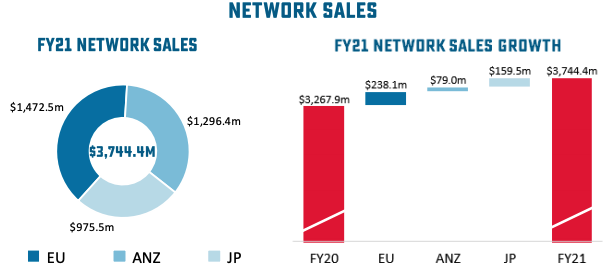

Sales across the store network increased 14.6% to $3.74 billion led by the addition of 285 new stores and same-store sales growth of 9.3%.

Stores in Europe and Japan were the strongest performers recording revenue growth of 18.7% and 19.3% respectively.

Growth in the mature Australian and New Zealand market was more modest at 9.1%.

Online orders increased 21.5% to $2.93 billion spurred by pandemic movement restrictions forcing customers to order at home.

Online represented 78.2% of all network sales, increasing from 73.8% in FY20.

Domino’s operates its own delivery network, therefore is able to retain the margin competitors lose when using delivery services such as Uber Eats.

Profits outpace sales growth

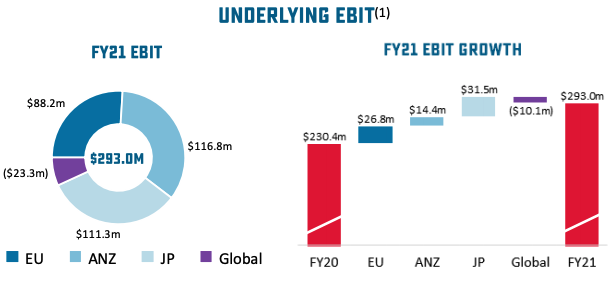

The company achieved record earnings before interest and tax (EBIT) of $293.0 million, increasing 27.2%.

This was a result of the aforementioned network sales growth as well as high performing corporate-owned stores.

The relatively higher operating profit to revenue is due to the high volume of orders resulting in operating leverage across the group.

Similarly, net profit after tax (NPAT) increased 30.3% to $197.6 million.

CEO and Managing Director Don Meij said:

“We expect Domino’s Pizza Enterprises Ltd to deliver significant profit increases over the medium term, driven by new store openings and network sales growth.

Increased dividend

As a result of the record profits, the company will pay a final dividend of 85.1 cents per share at 70% franking. The company previously paid an interim dividend of 88.4 cents per share 50% franked.

Overall, this brings total dividends to 173.5 cents per share, a 45.4% increase on FY20.

Domino’s announced a change in dividend strategy. The business will share more of the pizza with shareholders, increasing the payout ratio from 70% of underlying NPAT to 80%.

Future dividends are forecasted to be franked at 70%.

Outlook for FY22

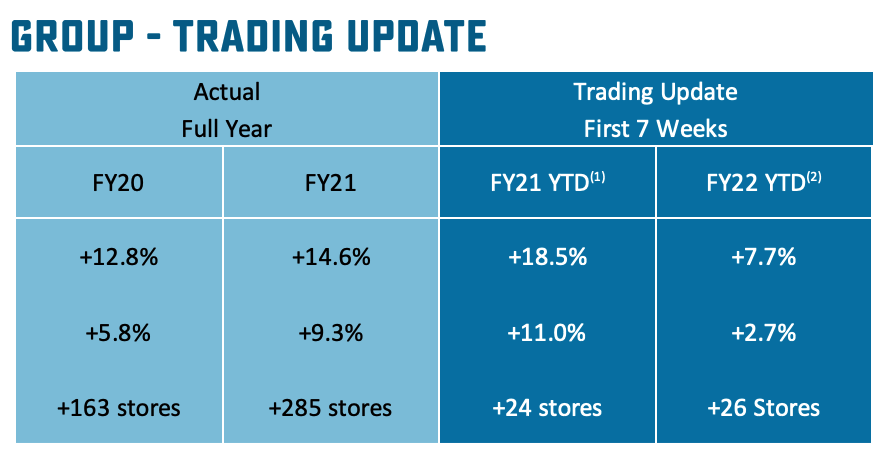

The acceleration in demand over the first seven weeks of FY21 has not been replicated in FY22.

Network sales have grown 7.7% in FY22 compared to 18.5% in FY21. Similarly, same-store sales growth in FY22 is 2.7%, down from 11.0% in FY21.

However, management is lifting the pace of its store rollout strategy from 7% to 9% increase in new stores to 9% to 12%. This likely led to the share price pop.

Internal modelling has increased expectations across Europe and Japan for new stores and the company now expects to have 6,650 stores by 2033 (FY21: 2,949).

My take

Ripping result by Domino’s. The market clearly liked the acceleration in store rollout in addition to the record dividends and profits.

The company currently trades on a free cash flow multiple of 54, meaning it is priced for significant growth. For that reason, it’s a hold for me at the moment without doing further valuation work.

To keep up to date on all the latest news regarding Domino’s and the ASX, be sure to bookmark the Rask Media home page.