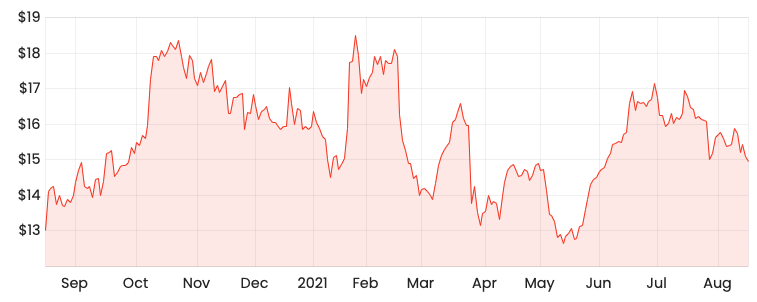

Despite record operating metrics and profit growth, the Netwealth Group Ltd (ASX: NWL) share price has fallen 5.75% to $14.10.

At the open, the market hammered the Netwealth share price over 9% before it recovered some of its losses.

NWL share price

Operating leverage kicks in

Total income increased 16.9% to $144.9 million in FY21, spurred by 49.6% growth in funds under administration (FUA) and strong net inflows.

Operating expenses for the year increased at a reduced rate to revenue, rising 13.5% to $65.5 million.

The increase was largely a result of a rise in headcount, of which 68% were in technology roles to improve functionality for advisors and clients.

As a result, Netwealth achieved earnings before interest, tax, depreciation and amortisation (EBITDA) of $79.3 million, increasing 19.9% of FY20.

This correlated strongly with the operating cash flow pre-tax of $77.9 million signalling profits are being converted into cash.

Net profit after tax (NPAT) increased 23.9% to $54.1 million, translating to earnings per share of 22.1 cents.

The company announced a 9.5 cent fully franked final dividend. This brings a total dividend for FY21 to 18.56 cents.

At the current share price, Netwealth has a dividend yield of 1.89% including franking credits.

Netwealth and Hub gain traction

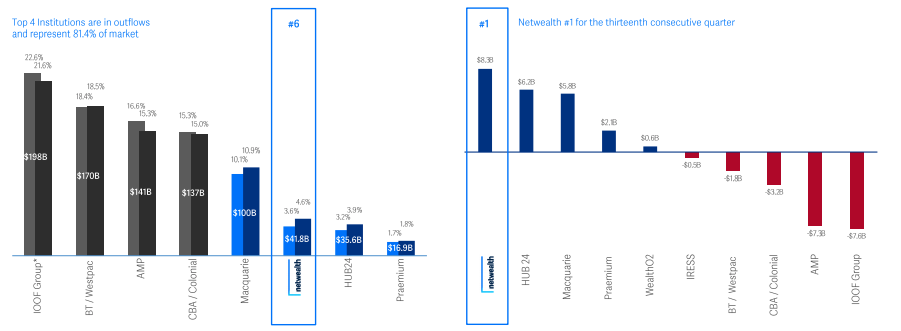

Netwealth achieved number one for overall satisfaction among users by Investment trends. The company is often competing with Hub24 Ltd (ASX: HUB) for first and second place.

The company grew its market share by 100 basis points in FY21 to 4.6%. For perspective, Netwealth’s market share stood at 1.4% in 2017.

Net outflows from large incumbents IOOF Holdings Limited (ASX: IFL) and AMP Ltd (ASX: AMP) have directly benefited Netwealth and Hub.

This is largely due to a change in industry dynamics, as advisors migrate towards independent operating structures from platform aligned.

Keep an eye on margins

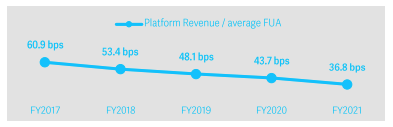

The bear case for Netwealth largely centres on margin compression within the platform space. The chart below illustrates the average revenue achieves from FUA.

This has fallen 41% since FY17 indicating the business may not have high pricing power.

However, it should be noted that as customer FUA increases, this attracts a proportionally lower average fee.

Outlook for next year

Netwealth expects expenses to increase over the short term before normalising in FY23. An additional 35 staff will be hired, predominantly in technology to continue platform improvement.

Net inflows for the year is expected to be around $10 billion, which would represent a 21% increase in FUA before market movements.

My take

It’s difficult to find a company with a dominant product offering, paying a near 2% dividend yield and still growing at a double-digit run rate.

I don’t own shares today, but post the result I will be looking to make my first entry into Netwealth.

Netwealth has a long runway of growth ahead and I can see a future where the company replaces IOOF as the number one wealth platform.

To keep up to date on all the latest news regarding Netweallth and the ASX, be sure to bookmark the Rask Media home page.