Telix Pharmaceuticals Ltd (ASX: TLX) shares continue its upward trajectory, jumping 6% today. Can Telix shares keep lifting the bar?

Telix is a radiopharmaceutical company established and listed on ASX in 2017. Wait, what does it do?

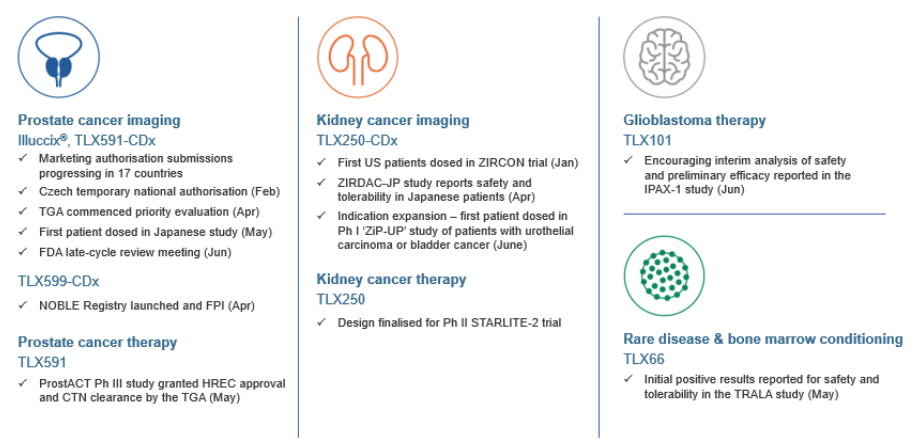

It is developing a portfolio of products that address unmet medical needs in oncology (cancer) and rare diseases.

Today’s strong share price movement comes on the back of a solid set of results in FY20.

TLX share price

HY21 on track

As with most biotech companies, Telix continues to record significant losses as a lot of capital is deployed to develop medical products.

Telix ended the half-year with a loss of $33.4 million.

However, Telix notes its made significant progress towards becoming a commercial stage, financially sustainable and revenue generating company.

Below is a snapshot of the achievements to date.

As you can see, the market is excited about Telix’s strong momentum in segments that present huge market opportunities.

The company estimates the total addressable market value for just illuccix to be around US$900 million.

The launch of illuccix will be subject to a decision by the US Food and Drug Administration agency on 23 September 2021.

Given the numerous advancements made, it’s no surprise that research and development costs jumped by 58% to $13.67 million relative to FY20.

My take

The optimism in Telix continues to grow as it continues to demonstrate traction in the development of a wide range of drug products.

It can be often enticing to join the ride, especially when the waves are high but this one is outside my circle of competence

.

So, it’s not on my radar for shares to watch.

However, if you have advanced knowledge of the aforementioned science, Telix could prove to be a fruitful investment.

To learn more about Rask, I’d highly recommend signing up for free Rask account and accessing our full stock reports. Click this link to join for free and access all of our free analyst reports.