Australia’s largest wine company Treasury Wine Estates Ltd (ASX: TWE) returned to profit in FY21 despite negligible sales to China.

It’s been tough sailing for Treasury Wines over the past two years, with the company first impacted by pandemic restrictions and then 175.6% import duties into China.

TWE share price

Organic growth offers light at end of the tunnel

The headline numbers for Treasury Wine are not outstanding, however admirable given the difficult operating conditions, which is no fault of the business.

For the year ending 30 June 2021, Treasury achieved:

- Net sales revenue (NSR) of $2.6 billion, decreasing 3.0% on FY20

- Earnings before interest, tax and SGARA (EBITS) of $510.3 million, falling 0.4% on FY20

- Net profit after tax (NPAT) of $250 million, modestly increasing 1.8%

- Final dividend of 13 cents per share, FY21 dividend of 28 cents per share fully franked

The 3% fall in NSR is a decent outcome given Treasury effectively lost the Chinese market due to import duties.

The portfolio actually increased sales on a 4.4% organic growth basis, excluding the impact of the planned US commercial brands divestment.

Positively, NSR per case increased 7.0%, indicating Treasury has pricing power among its premium wine portfolio.

Similarly, EBITS increased 3.5% on an organic basis, despite Treasury losing $77.3 million in earnings from China.

Assuming those earnings would have been repeated in FY21, EBITS for the year would have increased 15%.

On a regional basis, Americas was the standout performer with a 22% increase in EBITS.

Additionally, excess Penfolds capacity from China has been redirected to Hong Kong, Singapore, Malasia and Thailand where management is seeing the potential for unmet demand.

Conversely, Asia and Europe experienced 14.9% and 5.9% falls in EBITS respectively.

Outlook for FY22

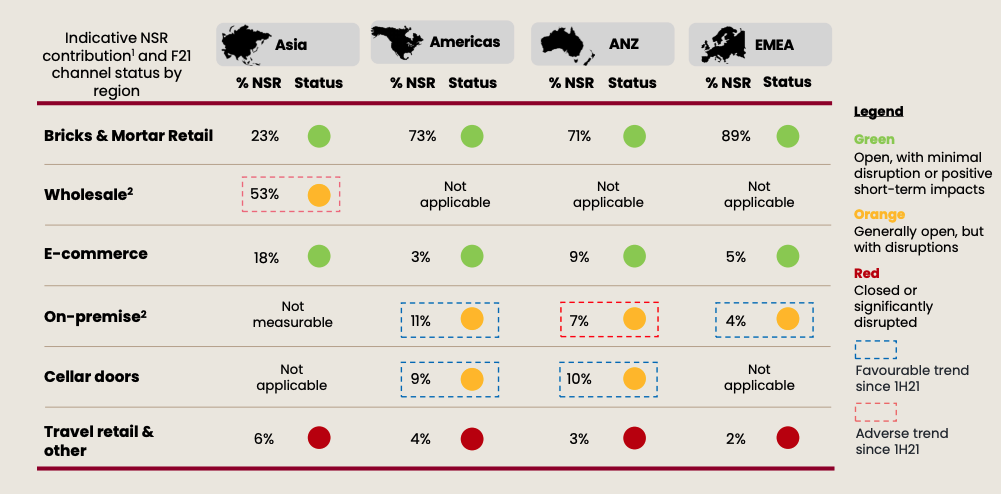

Treasury remains plagued by pandemic restriction across key markets.

On-premise and cellar door sales are typically higher margin the traditional retail, therefore the business should see a pick up in FY22 onwards.

Management reiterated its goal to “deliver sustainable top-line growth and high-single digit average earnings growth over the long-term”.

No quantitative guidance was provided.

My take

It was a solid result for Treasury Wine, given all the external challenges the business is facing.

However, the market has reacted negatively to the news in early trade, sending the share price down 2.29% to $12.40.

I’d be bullish on the reopening of borders for Treasury.

Customers will be dining out and spending up on premium experiences. Treasury Wines and its Penfolds brand are leveraged to benefit from this.

To keep up to date on all the latest news regarding Treasury Wine and the ASX, be sure to bookmark the Rask Media home page.

And to stay up to date with the flurry of reports this month, bookmark our ASX reporting season calendar.