Origin Energy Ltd (ASX: ORG) has delivered an underwhelming FY21 profit result led by low wholesale energy and oil prices.

The market has reacted negatively to the news sending shares down 2.52% to $4.26.

Poor market conditions translate to big declines

It was a difficult year for Origin, with the company recording weak financial results in FY21 including:

- Accounting loss of $2.291 billion, down from a profit of $83 million in FY20

- Underlying profit of $318 million, down 69%

- Free cash flow of $1.140 billion, down 30% from FY20

- Unfranked final dividend of 7.5 cents per share, FY21 total dividends of 17.5 cents per share

The dramatic fall in FY21 financial results was the result of poor market conditions in both its operating divisions.

Energy markets suffered lower wholesale prices, one-off network costs, reduction in higher-margin legacy contracts, increased gas supply costs and increased amortisation expense.

Integrated gas experienced lower realised oil prices. However, this was partially offset by lower operating costs and hedging gains.

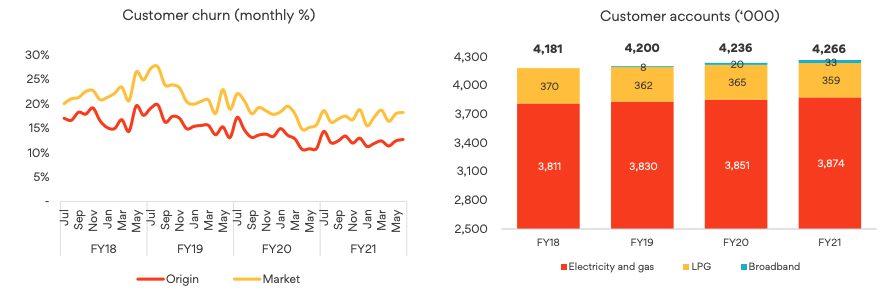

On the positive sign of the ledger, Origin improved its net promoter score to +6 leading to below average churn. It was also able to reduce its debt by $519 million to $4.6 billion.

Moreover, the business’ 20% stake in renewable energy play Octopus energy continues to perform well with increases in customer accounts and low churn.

Another difficult year ahead

The company is guiding for another tough year in FY22.

Positively, the integrated gas division is expected to rebound due to higher oil prices. However, the excess earnings will be offset by further falls in the energy market business.

As a result, Origin expects FY22 earnings before interest, tax, depreciation and amortisation to be between $1.85 billion to $2.15 billion (FY21: $2.048 billion).

My take

The best way to sum up Origin is through its FY21 dividend.

The company is paying unfranked dividends because it hasn’t paid enough tax to distribute franking credits.

The reason primary reason it hasn’t paid enough tax is that it hasn’t made accounting profits.

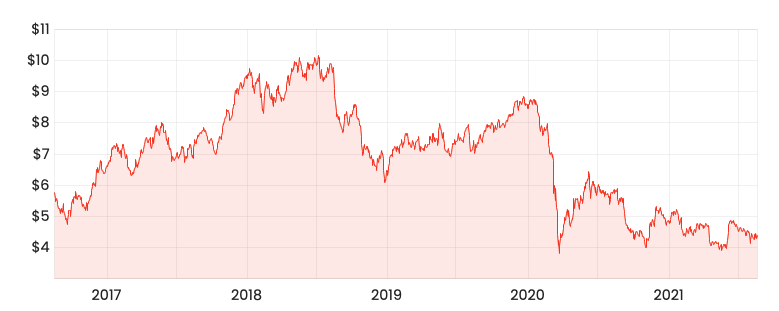

Origin is structurally challenged as the world moves to renewable energy rather than one based on coal and gas. This is evident by the share price movements over the past five years.

It’s a no-go zone for me.

To keep up to date on all the latest news regarding Origin and the ASX, be sure to bookmark the Rask Media home page.

And to stay up to date with the flurry of reports this month, bookmark our ASX reporting season calendar.