The global leader in implantable hearing devices, Cochlear Limited (ASX: COH) has seen underlying profit jump 54% in FY21 as elective surgery rebounded across the globe.

However, the market has reacted negatively to the update, sending the Cochlear share price down 5.83% to $241.16 at midday.

Profits soar as sales rebound

Cochlear’s key results from the year ending 30 June 2021 include:

- Cochlear implants (CI) unit sales up 15% to 36,456

- All divisions – CI, services and acoustics – recording double-digit growth

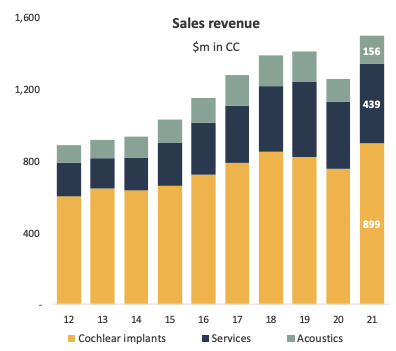

- Revenue up 10% to $1.493 billion in constant currency

- Underlying net profit up 54% to $237 million

- Final dividend of $1.40, FY21 total dividend of $2.55

10-year revenue profile. Source: COH FY21 presentation

CI growth was spurred by 20% growth in the developed markets as elective surgery returns to pre-pandemic levels.

The US, Japan and Korea delivered strong unit growth as a result of market share gains and new product launches.

Growth in emerging markets increased, albeit at a slower rate of 10% with surgeries returning at a more subdued pace.

China is back to growth while parts of Eastern Europe and the Middle East have recovered well. Conversely, volumes in India and Brazil remain still markedly lower.

Acoustics and services division also recorded 22% and 19% growth respectively.

Similar to CI, the recommencement of consultations and surgeries led to the sales bump. However, Acoustics remains below FY19 levels whereas services are now tracking above.

The company achieved its own underlying profit guidance, however, it was lower than what analysts were expecting.

Strategy and guidance for FY22

Cochlear plans to capitalise on its leading 60% market share position by bringing new offerings to market. Eight products and services have achieved FDA approval over the past 18 months.

The company will also continue its awareness campaign to encourage governments and societies to prioritise hearing health, especially in emerging markets.

Management has earmarked a net profit range for FY22 from $265 million to $285 million.

This represents a 12% to 20% increase in underlying net profit from FY21.

My take on Cochlear’s result

I thought it was a great result by Cochlear given the difficult operating conditions and various movement restrictions in several countries.

Underlying profit was at the upper-end of management’s guidance range. Moreover, the company flagged further growth in FY22.

The Cochlear share price has had a decent run in 2021, up over 30% prior to today’s announcement, which may explain investors taking profits on the result.

Cochlear will benefit as the world reopens again, as more elective surgeries are scheduled. I really like the business, but before purchasing shares I would need to do a valuation of the company.

If you’re looking to learn how to do your own valuations, take our free share valuation course, which takes you through 6 common share valuation techniques, step by step.

Or try our Beginner Shares Course if you’re just starting out. Both are free.