Online marketplace Redbubble Ltd (ASX: RBL) released its FY21 results to the market on Thursday. The market clearly didn’t know what to make of it at the time. The RBL share price fell on open by around 15% but recovered strongly during the day, finishing nearly 20% higher.

In other words, that was a 43% gain between yesterday’s low and high for Redbubble shareholders. What a dream for day traders (and an emotional rollercoaster for long-term investors).

For a detailed breakdown of the results, read my colleague Jaz Harrison’s article here: Result: Redbubble (ASX:RBL) share price on watch after a volatile FY21.

Why the RBL sell-off?

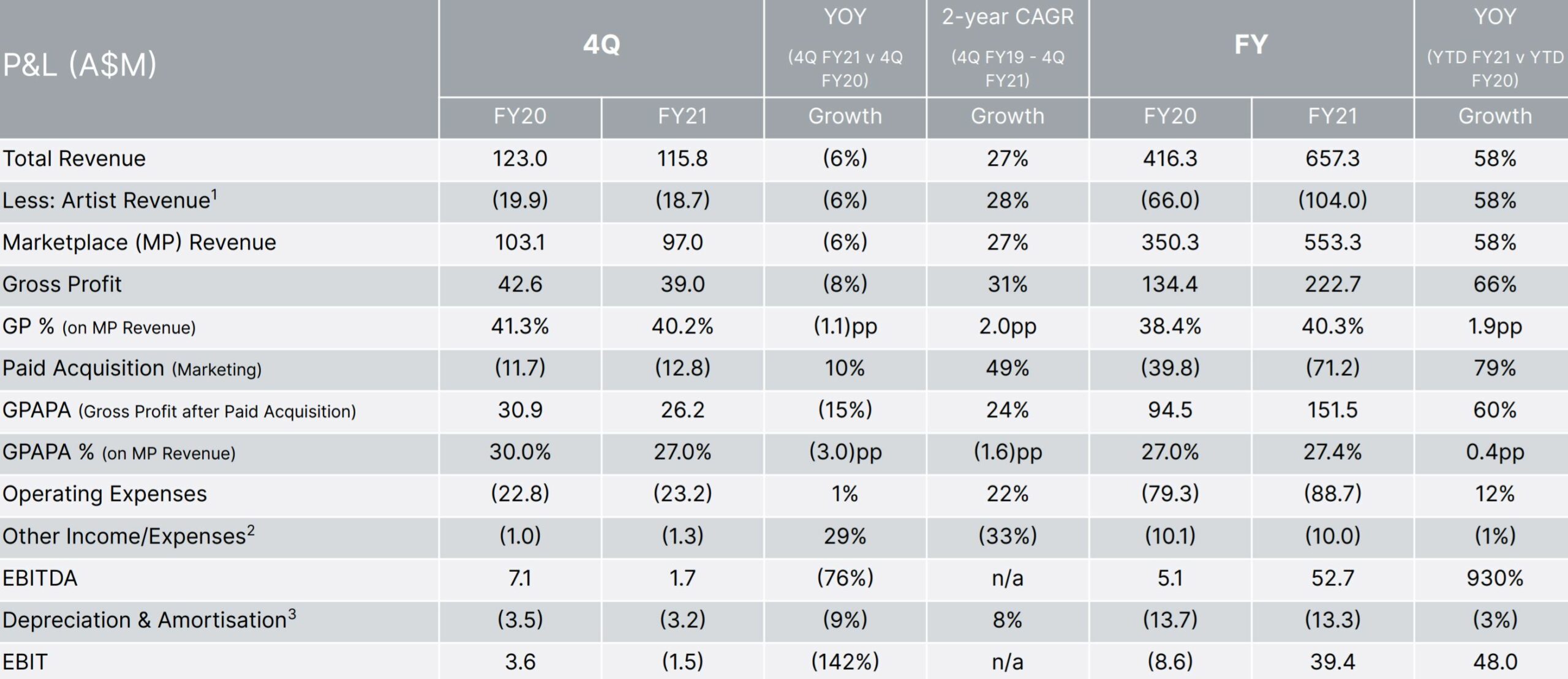

If I had to guess why so many chose to hit the sell button on market open yesterday, I’d say the reconstructed income statement, shown below, might have something to do with it. Taking a look at Q4 FY21, most of RBL’s metrics went backward compared to the same quarter in FY20.

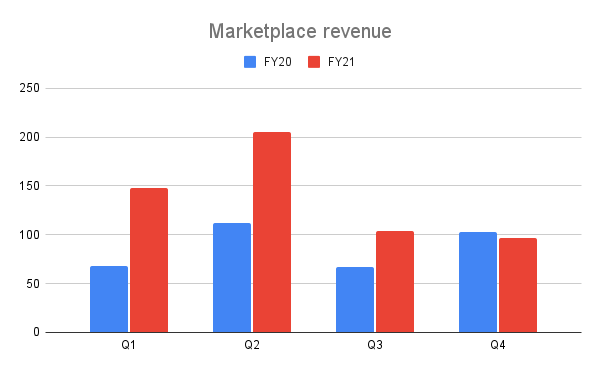

Redbubble’s Q4 marketplace revenue also fell compared to Q3. As you can see from the chart below, this didn’t happen in FY20. I think these figures might’ve been partly responsible for the early morning sell-off.

Redbubble MPR FY20 vs FY21

Going over the numbers

Redbubble brought in around $657.3 million in total revenue in FY21. After paying its artists $104 million, that leaves $553.3 in net marketplace revenue.

If you strip out the $57 million in mask sales in FY21, that leaves an underlying figure of $497 million, which is still up from $350.3 million in FY20. In other words, an increase of over 40%.

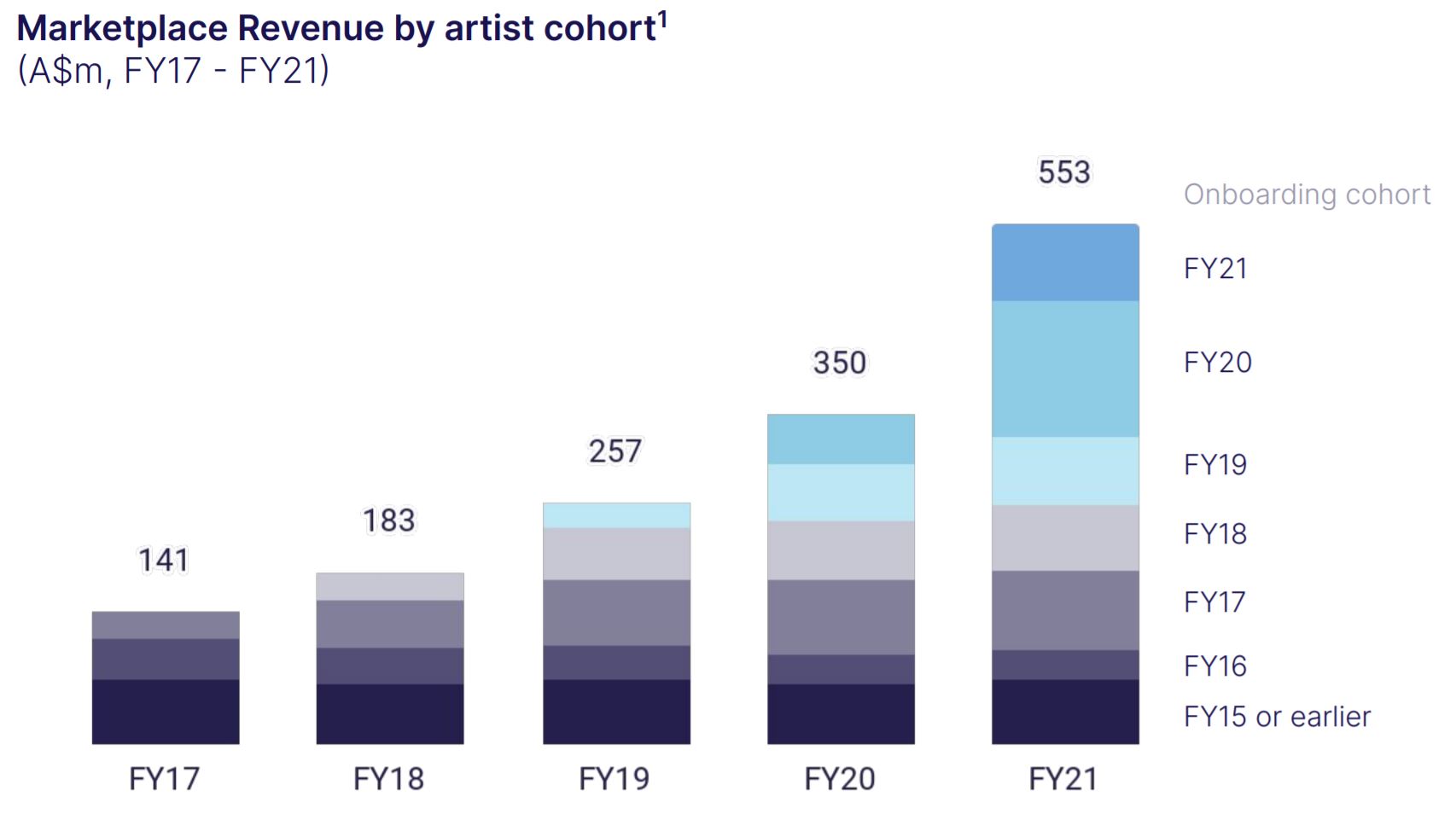

Worth noting are the figures around Redbubble’s artists that use its platform. Over 256,000 new artists joined Redbubble during FY21, a 54% increase. Artists subsequently brought in a record $104 million during the year.

The below chart is also a good indication of Redbubble’s artist retention. It shows that artists who joined years ago are still engaged with the community and are actually growing their sales.

In an ideal world, more artists will attract more customers to the platform, creating a positive feedback loop where some network effects are further unlocked.

Final thoughts

Fears that Redbubble was a one-hit COVID beneficiary, alongside company’s like Etsy Inc (NASDAQ: ETSY) and Pinterest

Inc (NYSE: PINS), has previously put a damper on its market valuation.

To add fuel to the fire, investors with a shorter time frame were also disappointed when management laid out a plan with long-term aspirations to CY24. Given that Redbubble has had such a strong last year, FY22 results will likely come in softer compared to the prior period comparatives.

As a long-term investor, I don’t hold the same concerns. As long as it can keep adding and retaining artists and customers, Redbubble is a company I’m happy to hold on to, but it is high risk.

If you’re looking to learn how to do your own ASX company valuations, take our free share valuation course, which takes you through 6 common share valuation techniques. Or try our Beginner Shares Course if you’re just starting out.