Digital audio pioneer Audinate Group Ltd (ASX: AD8) has announced its FY21 results, reporting a 10% increase in sales.

In early morning trading, the market has reacted favourably to the news with the Aduinate share up up 1.81% to $10.69.

Audinate is the market leader in digital audio and video solutions. Its hardware allows devices to deliver signals over computer networks through its proprietary software platform rather than over cumbersome analog cables.

Sales growth restrained by pandemic and FX headwinds

Audinate’s key financial highlights from the year ending 30 June 2021 include:

- Revenue increase of 10% to $33.4 million

- Gross profit of $25.5 million, up 10%

- Earnings before interest, tax, depreciation and amortisation (EBITDA) of $3.0 million, jumping 50.1% on FY20

- Negative free cash flow of $2.8 million, an improvement from negative $4.6 million in FY20

- Cash & term deposits of $65.4 million

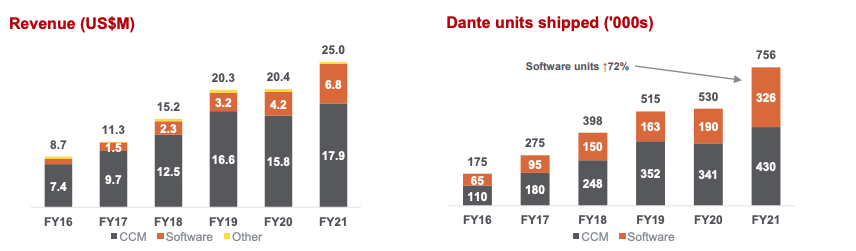

Audinate suffered from a strengthening Australian dollar in FY21. In US dollars, where the company makes its most sales, revenue increased 22.5% for the year.

Growth in units sold outpaced revenue, up 43%. This was attributed to a change in sales mix towards software products, which result in lower upfront fees.

The company recorded 105 design wins in FY21, a record for the company. It takes around 18-24 months from a design win to product release.

“Over the last twelve months the number of Dante-enabled products has increased to 3,255, which is now 19x the number of products of the next closest digital audio networking technology” – Audinate

Growth & FY22 outlook

Audinate has a record backlog of orders resulting in a strong July trading performance.

However, the business faces sales headwinds due to pandemic outbreaks in Malaysia and chip shortages.

Management flagged customers deferring new product launches and diverting resources as headwinds, which may impact new design wins in FY22.

At this stage, management does not expect new product delays to impact revenue due to strong existing customer demand.

The company will increase its employee headcount to over 170 (FY21: 135) to spur growth in video and cloud services.

No quantitative guidance was provided.

My take on Audinate’s results

Despite its dominant market position in audio, the business still has negative free cash flow and revenues of just $33 million.

Furthermore, if you take away the ~$1 million in government subsidies Audinate received, EBITDA for FY21 was stagnant.

Positively, Audinate recorded new client wins and increased the quality of its revenue by moving customers to recurring software subscriptions.

Also, the business has been significantly impacted by the pandemic, as public events such as concerts were cancelled.

Audinate trades on about 22x revenue or 29x gross profits. With 10% reported growth, this is a very rich multiple.

I believe this is a quality business, however at the current growth rate you are paying for a lot of blue sky.

I’ll need to update my valuation before giving a verdict on Audinate shares.

If you’re looking to learn how to do your own ASX company valuations, take our free share valuation course, which takes you through 6 common share valuation techniques, step by step.

Or try our Beginner Shares Course if you’re just starting out. Both are free.