Specialist automotive manufacturer PWR Holdings Ltd (ASX: PWH) share price is up over 6% after the company recorded 20% sales growth and a 28% profit jump in FY21.

If you’re new to the business, check out why I recently added PWR shares to my watchlist.

PWR goes from strength to strength

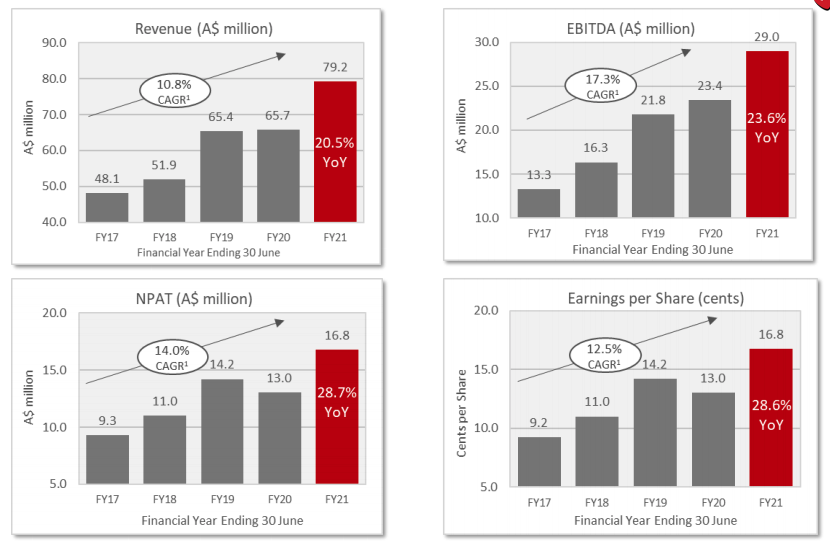

PWR’s key financial highlights from the year ending 30 June 2021 include:

- Revenue growth of 20.5% to $79.2 million

- Net profit after tax (NPAT) of $16.8 million, increasing 28.7%

- Free cash flow of $16.0 million, soaring 90%

- Final dividend of 6 cents per share fully franked, taking full-year dividends to 8.8 cents

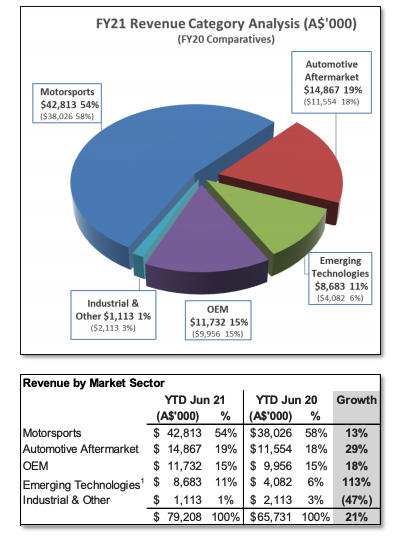

PWR experienced growth in all but one operating segment, with emerging technologies the standout.

On the investor call, CEO Kees Weel noted the company expects emerging technologies revenue to double for the next two years to eventually surpass motorsports in FY24/FY25.

The one segment that recorded negative growth, Industrial, is expected to become more of a focus in years to come.

Overall, revenue growth would have been higher if not for the strengthening Australian dollar.

The big jump in free cash flow was largely attributed to increasing sales and strong cost control, resulting in operating leverage.

Get ready for more growth

The recent completion of the AS9100 aerospace and defence quality certification positions the company as an accredited manufacturer and opens the door to new growth avenues.

Weel noted that the company will look at potential acquisition opportunities, however, is yet to find anything that beats the current organic growth within the business.

PWR’s revamped website will go live during August, which will increase its brand awareness and spur further sales.

To deliver on growth opportunities, PWR will increase its headcount to over 450 employees in the next 18 months, up from 363 at the end of FY21.

No financial guidance was provided.

My take

In my view, this was an awesome result by PWR. The company continues its track record of growing sales and profits for shareholders.

After listening to the investor call today, management seem very bullish on capitlising on new growth areas and diversifying beyond its autmotive roots.

After updating my valuation, I’ll be looking to make my first purchase of PWR shares in the near future.

If you’re looking to learn how to do your own ASX company valuations, take our free share valuation course, which takes you through 6 common share valuation techniques, step by step.

Or try our Beginner Shares Course if you’re just starting out. Both are free.