The Openpay Group Ltd (ASX: OPY) share price is going nuts on the news of securing a contract with HP.

Openpay is a buy now, pay later (BNPL) provider in Australia, New Zealand and the UK. It also entered into the US market at the end of 2020 under the brand name Opy.

Openpay offers OpyPro which is a business-to-business (B2B) software as a service (SaaS) product for companies to manage trade accounts end-to-end. OpyPro streamlines applications, credit checks, approvals and account management into one system.

Openpay partners with HP

Openpay said that it has secured HP Inc (NYSE: HPQ) as an OpyPro partner, with HP set to start using OpyPro this quarter. The agreement with HP is for an initial term of two years with an option to extend for a further two years.

Management said that OpyPro will integrate with HP’s e-commerce systems to deliver an “enhanced and simplified” buying experience for business customers.

Openpay said that its funding partner Lumi will provide HP’s 30 day credit term funding for business buyers in Australia. This enables OpyPro to operate as a capital-light, high transaction-volume SaaS product.

Management said that this is the first time it is able to put the partnership with funding partner Lumi into action.

Management comments

Openpay CEO and Managing Director Michael Eidel said: “We are delighted to have signed HP as our second B2B contract win, adding another household name to our growing list of iconic partners. This deal demonstrates Openpay’s ability to attract top tier business partners as we work to make the business-to-business payment experience easier and more efficient.”

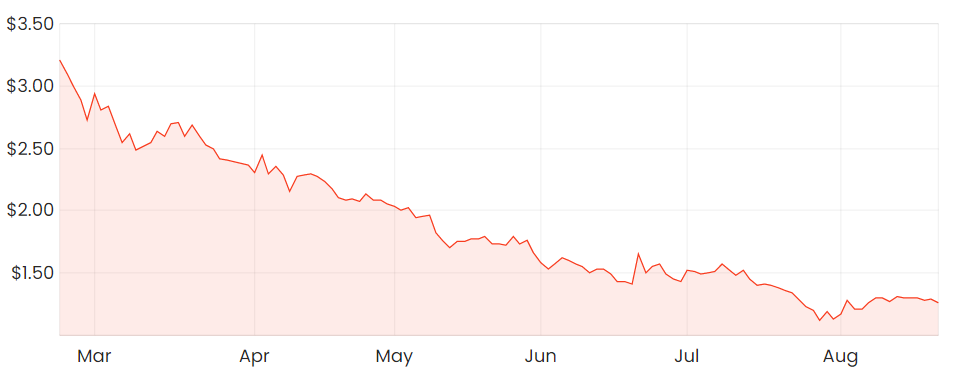

Openpay share price 6 month decline

Final thoughts on Openpay and the share price

The Openpay share price was up around 10% in early reaction to the news. It has fallen back a little now and is up around 7% at the time of writing. Although if we look over the past six months the Openpay share price dropped a whopping 56%.

From the surface it looks like Openpay is making good moves to make it stand out from the very competitive BNPL crowd. However if I were looking to buy Openpay shares I would want to seriously assess whether this is the right price to buy at, considering the share price volatility over the past two years.

If you’re looking to learn how to do your own ASX company valuations, take our free share valuation course, which takes you through 6 common share valuation techniques, step by step. Or try our Beginner Shares Course if you’re just starting out. Both are free.