The Boral Limited (ASX: BLD) share price has sunk 5.55% today to $6.47 after the company released an underwhelming FY21 result.

Boral is a manufacturer and supplier of construction materials including concrete, asphalt, cement and bitumen.

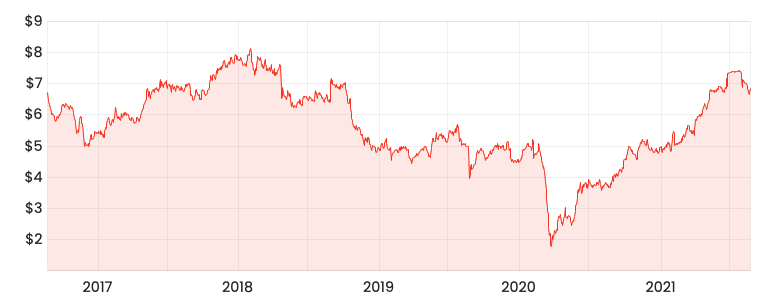

BLD share price

Weak construction impacts FY21

Key financial results for the year ending 30 June 2021 include:

- Revenue of $5.34 billion, down 7% from FY20

- Statutory profit of $640 million, a significant reversal from the $1.14 billion loss in FY20

- Revenue from continuing operations of $2.92 billion, down 6% from FY20

- Underlying profit after tax of $251 million, up 44%

Revenue was hit by lower volumes in Boral’s concrete and quarries reflecting less demand from infrastructure projects and lower housing starts.

The turnaround in statutory profit was largely due to a non-cash impairment charge in FY20.

The bump in underlying profit was achieved from Boral’s transformation project, which aims to strip out costs from the business. A total of $69 million was removed from underlying earnings.

The reason for the big difference between reported and underlying numbers is due to several asset sales conducted by Boral over the past year.

Given Boral’s share price performance over recent years, management has decided to divest non-core assets. These include:

- Sale of Midland Brick for AU$86 million

- Sale of Meridian Brick for US$250 million

- 50% sale of USG Boral for US$1.015 billion

- Sale of North American Building Products business for US$2.15 billion

- Sale of Timber business for AU$64.5 million

My take

Its been well publicised the takeover of Boral by the Stokes family Seven Group Holdings Ltd (ASX: SVW).

Now Seven owns 70% of the shares in Boral, I suspect the business will be integrated into the broader Seven Group.

Boral is primarily leveraged to the property cycle, thus making the business highly cyclical. It benefits when housing construction ramps up, and it suffers when activity dials down.

If I was a shareholder, I would be looking to invest my money elsewhere.

To keep up to date on all the latest news regarding Boral and the ASX, be sure to bookmark the Rask Media home page.

And to stay up to date with the flurry of reports this month, bookmark our ASX reporting season calendar.