The Nanosonics Ltd (ASX: NAN) share price has gone bonkers this morning, up 18% to $6.99 as the market reacts to its latest product release.

Who is Nanonsonics?

Before delving into the result, let’s briefly review what Nanosonics does.

Nanosonics focuses on high-level disinfection (HLD). The company has developed hardware (Trophon and Trophon2) that cleans and disinfects ultrasound probe equipment.

Once the capital unit is installed, the company then sells consumables and services to maintain the hardware.

It’s similar to the razor and blade model. The hospital pays an upfront fee to purchase the hardware (razor) and then Nanononics sells consumables (blades) over the lifetime of the product.

How did the company perform in FY21?

Now onto the update. Key financial results for the year ending FY21 include:

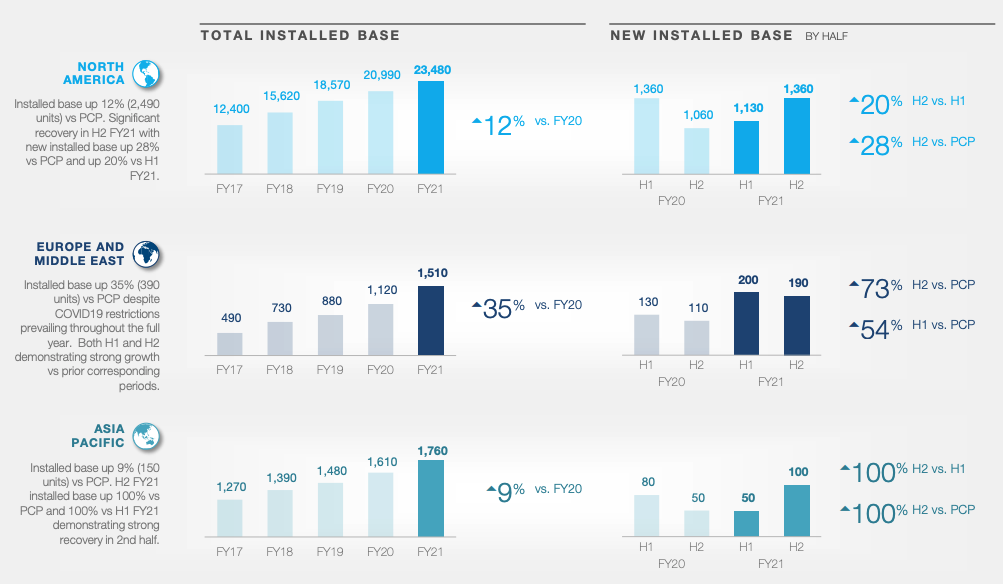

- Installed base up 13% to 26,750 units

- Total revenue up 3% to $103.1 million

- Earnings before interest and tax (EBIT) of $10.8 million, down 7% from FY20

- Net profit after tax of 8.6 million, sliding 15% from FY20

Sales rebounded strongly in the second half of FY21 after Nanosonics experienced a notable first-half fall in sales due to pandemic restrictions

The company recorded an 11% full-year decrease in capital revenue. However, this is primarily the result of currency headwinds. In constant currency, capital revenue was up 8%.

Positively, Nanosonics recorded consumables and service revenue growth of 8%. In constant currency, this jumped 20% for the year.

Overall revenue would have risen 12% if not for currency impacts.

From a geographic standpoint, Europe and the Middle East and the Asia Pacific recorded growth of 38% and 42% respectively. Albeit this is off a small base.

North America – the main driver of sales for Nanosonics, recorded stagnant growth due to the aforementioned impacted first-half.

However, the region finished the year strongly with sales up 42% in the second half compared to the first half.

Earnings for the year were down on FY20, primarily due to operating expenses and research and development (R&D) expenditure outpacing growth in sales.

What is the new product?

Shares have rocketed this morning due to news of Nanosonics new product Nanosonics Coris.

The product provides flexible endoscope cleaning.

An endoscope is a long, thin tube entered into the body to observe an internal organ or tissue.

The company notes that “more healthcare-associated outbreaks have been linked to contaminated endoscopes than any other medical device”.

My take

So far the healthcare sector has performed admirably with Pro Medicus Limited (ASX: PME) and CSL Limited (ASX: CSL) also recording sound results.

Nanosonics has guided for double-digit growth in FY22 driven by a return to normal levels of ultrasound procedures across the globe.

This is a quality, profitable company with a big R&D pipeline delivering on a global scale.

I think Nanosonics has many years of growth ahead. However, I’d need to do more due diligence before purchasing shares.

To keep up to date on all the latest news regarding Nanosonics and the ASX, be sure to bookmark the Rask Media home page.

And to stay up to date with the flurry of reports this month, bookmark our ASX reporting season calendar.