Commonwealth Bank of Australia (ASX: CBA) shares could be back in the spotlight after the official launch of e-commerce start-up Little Birdie.

What is Little Birdie?

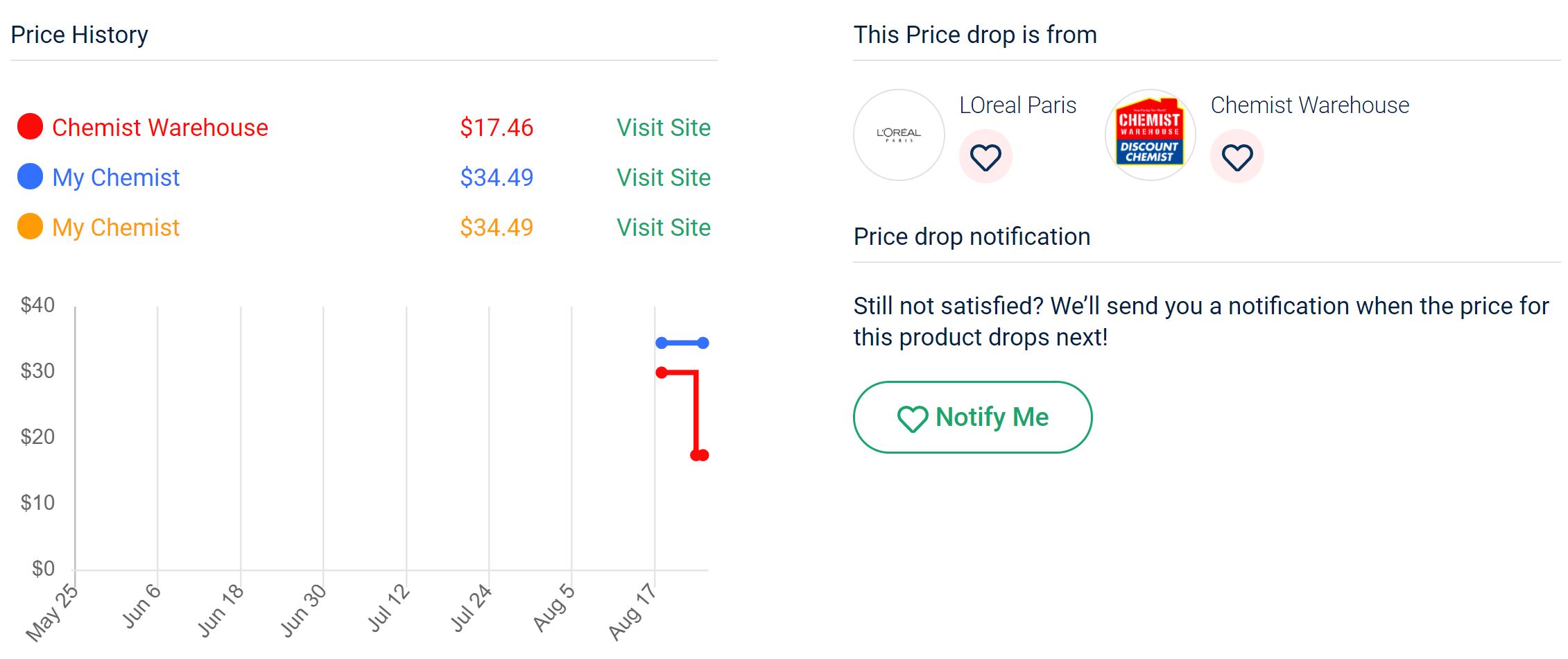

Little Birdie is an online retailing platform that can compare prices for products across other retailers. The AI-powered platform can also show a product’s pricing history and which retailer was offering the price.

After comparing pricing options, Little Birdie then redirects the customer to the retailer, such as JB Hi-Fi Limited

(ASX: JBH), Amazon, or eBay.

CBA investment

Back in May, it was revealed that CBA had invested $30 million into Little Birdie, or a 23% stake in the business.

Why did CBA do this?

The goal is to eventually integrate the Little Birdie shopping content into CBA’s mobile app. That’s around 11 million CBA customers who will receive personalised offers based on their spending habits with data collected from the app.

These purchases could then be financed through Klarna, which CBA also has a stake in, or its own recently announced buy-now-pay-later (BNPL) product.

Summary

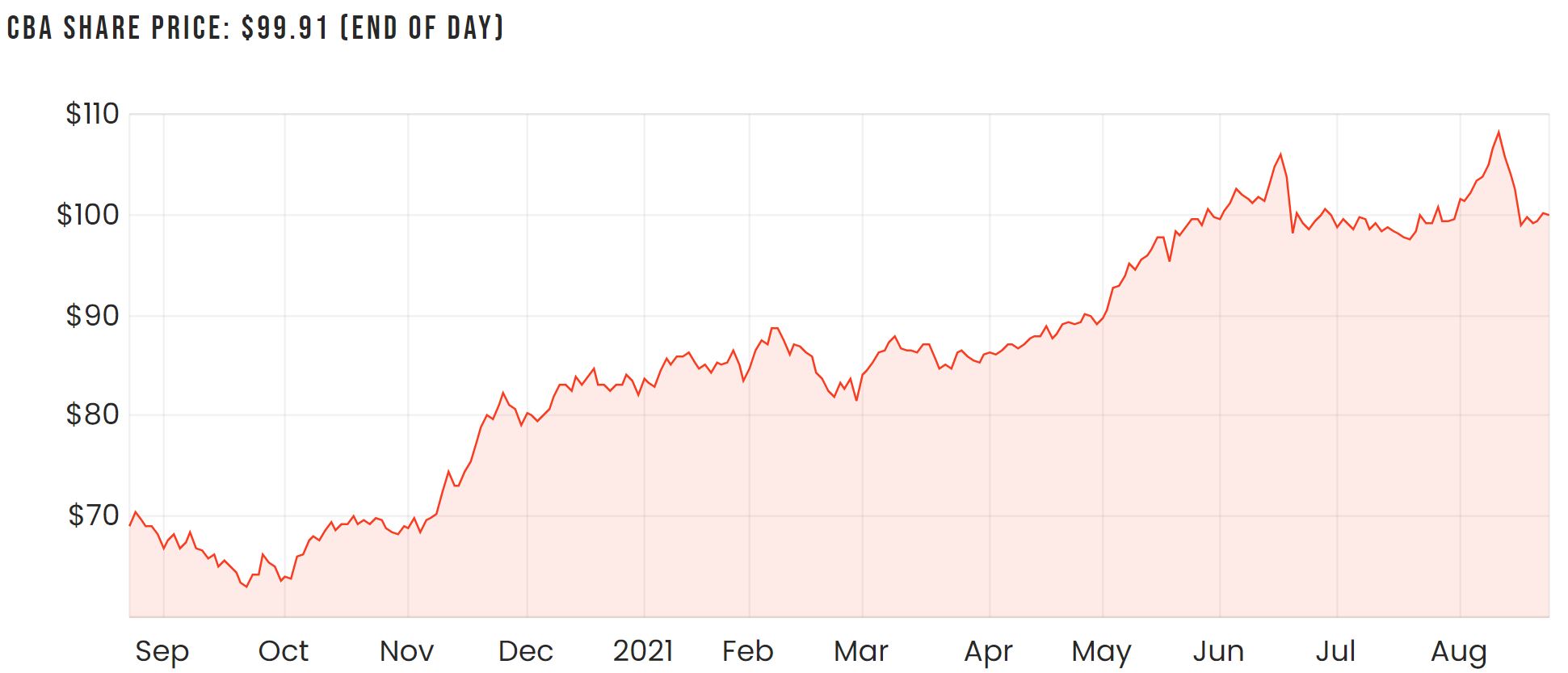

The launch of Little Birdie probably won’t budge CBA’s share price in the short term. But it could provide some longer-term value as customers are incentivised to use their app as they’re rewarded with personalised offers.

While CBA is investing heavily in technology and innovation away from typical banking products, something else worth considering is its valuation, which you can read about here

.