Buy-now-pay-later leader Afterpay Ltd (ASX: APT) has reported a widening net loss of $159.4 million despite growing sales 90% in FY21.

Sales rocket, losses widen

Key financial highlights for the year ending 30 June include:

- Total group income of $924.7 million, jumping 78%

- Underlying sales increased by 90% to $21.1 billion.

- Earnings before interest, tax, depreciation and amortisation (EBITDA) minus significant items of $38.7 million, down 13%

- Marketing expenses ballooned 239% to $168.8 million

- Bad debts increased 106% to $194.9 million

- Statutory loss of $159.4 million, a significant drop from the $22.9 million loss in FY20

Afterpay’s income margin (the commission received from merchants) remained stable at 3.9%.

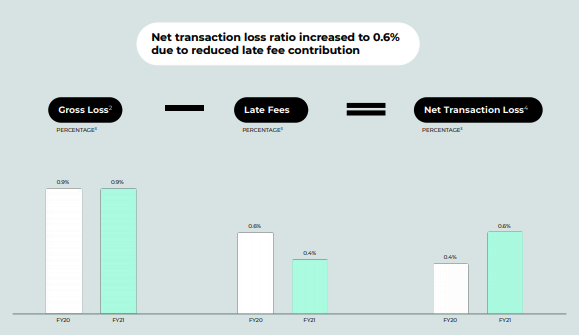

The net interest margin (the gross profit received after accounting for bad debts and finance costs) fell from 2.3% to 2.1%, largely due to a reduction in late fees.

This is somewhat concerning, given the net interest margin is effectively Afterpay’s gross profit. A 20 basis points movement downwards is effectively a 9% fall in gross profit.

The 13% fall in EBITDA is less worrying, given it is largely due to the increase in operating expenses to spur growth.

The statutory loss of $159.4 million was exacerbated by a number of one-off items including $59.0 million share-based payments and a non-cash fair value adjustment of $96.8 million.

From a regional perspective, sales in North America and Clearpay (Europe) were up 177% and 242% respectively in constant currency.

The more mature ANZ market grew sales at 44%.

BNPL continues to grab merchant and customer attention

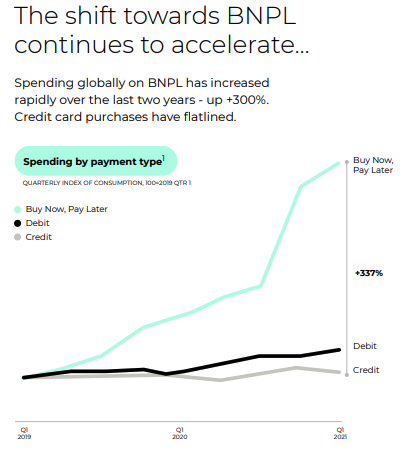

The company and broader BNPL sector continued to gain traction over FY21. Over the past two years, BNPL has increased over 300% whereas credit card purchases have stagnated.

Afterpay’s active merchants increased 77% to 98,200 and active customers increased 63% to 16.2 million.

In Afterpay’s most established ANZ region, the top 10% of consumers are now using Afterpay more than 60 times per year.

The company launched into new regions throughout the past year – Canada, Spain, France, and Italy.

Its global team grew in line with income, up 95% to 1,300 employees.

The additional hires were made across sales, marketing, technology and marketing divisions to support Afterpay’s growing expansion.

My take

There are two ways you can look at today’s result.

On one side of the fence, this is a business scaling rapidly, with 90% sales growth, increased merchants and active customers, who love the product.

On the other hand, sales are only up because of the jump in marketing, bad debts are ballooning and competition remains rampant with the likes of Zip Co Ltd (ASX: Z1P) and Paypal Holdings Inc (NASDAQ: PYPL).

Whichever lens you see this result through, this is a product gaining traction with a huge market opportunity.

To keep up to date on all the latest news regarding Afterpay and the ASX, be sure to bookmark the Rask Media home page.

And to stay up to date with the flurry of reports this month, bookmark our ASX reporting season calendar.