Fast-fashion jeweller Lovisa Holdings Ltd (ASX: LOV) has seen profits rise 43% in FY21 despite the ongoing impact of pandemic restrictions.

However, it’s been the 56% increase in sales over the first eight weeks of FY22, which has got the market excited.

Shares are up 20% today to $19.80 on the back of the result.

LOV share price

Profit grows 43% despite ongoing restrictions

Key results for the year ending 30 June 2021 include:

- Revenue up 18.9% to $288.0 million

- Gross Margin of 77% with gross profit up 18% to $221.0 million

- Earnings before interest and tax (EBIT explained) increased by 39.4% to $42.7 million

- Net profit after tax (NPAT) of $27.7 million, jumping 43.3%

- Final Dividend of 18.0 cents per share, 50% franked

Its been a turbulent year for Lovisa given the ongoing pandemic restrictions placed on retailers in various geographies.

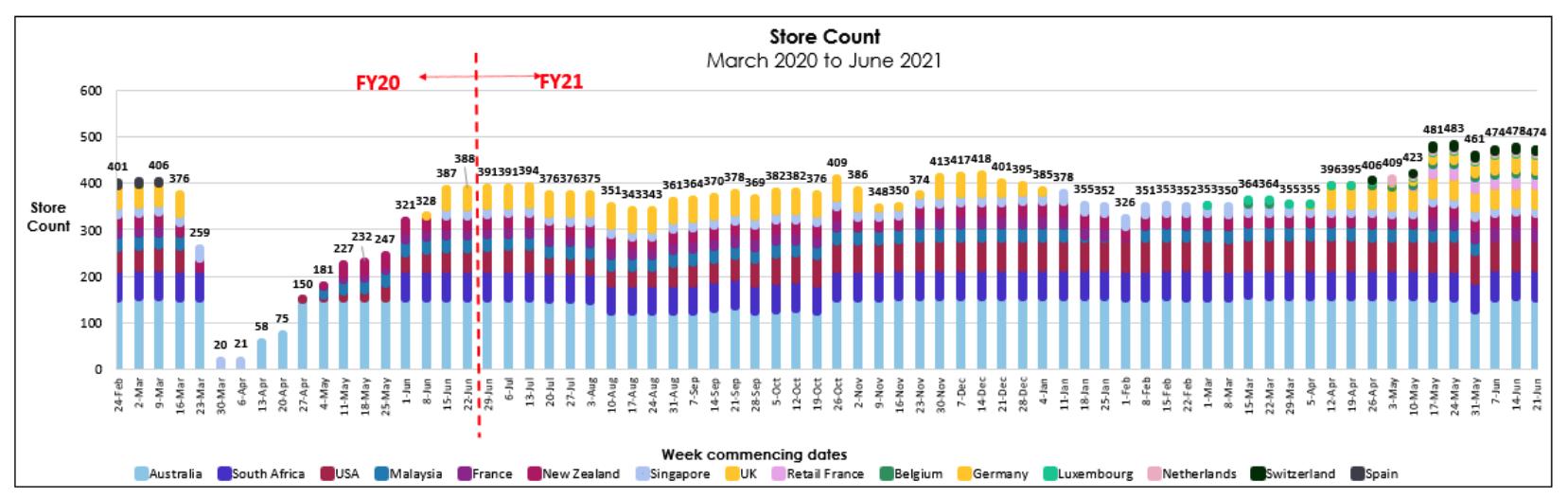

Despite this, comparable store sales increased 8.1% in FY21. Additionally, the extra 109 new stores contributed meaningfully to sales growth.

Lovisa now has a store network of 544, with 72% of outlets located outside of Australia.

From a regional standpoint, the US was the standout performer recording 83% growth. Australia and Africa also grew 26% and 18% respectively.

Conversely, Asia and Europe sales declined 29% and 4% respectively as ongoing restrictions limited in-store shopping.

The company noted that logistics and shipping costs weighed on margins, however, this was offset in other areas such as wages and rent reductions.

FY22 looks to be bigger and better

The completion of the Beeline acquisition in Europe has introduced six new markets for Lovisa.

87 of the 114 stores acquired have been converted and will provide growth for FY22.

Management announced trading for the first eight weeks of FY22 has soared 37.8% in comparable sales for the same period in FY21. Furthermore, total sales are up a whopping 56%.

This is despite 106 stores or 19% of the store network remaining closed due to pandemic restrictions.

My take

Lovisa will benefit from the reduced restrictions and the reopening of borders. Customers will be attending more events and travelling abroad, which will likely result in new purchases of discretionary items.

The business isn’t the first to report rising costs in shipping, with Treasury Wine Estates Ltd (ASX: TWE) and Breville Group Ltd (ASX: BRG) also reporting increases.

Overall, this is an awesome result with even better guidance.

I’ll be undertaking a valuation of the company in the coming weeks to see if Lovisa’s share price represents value.

If you’re looking to learn how to do your own ASX company valuations, take our free share valuation course, which takes you through 6 common share valuation techniques, step by step.

Or try our Beginner Shares Course if you’re just starting out. Both are free.