Digital property settlements platform and recent IPO PEXA Group Ltd (ASX: PXA) has exceeded revenue and earnings forecasts in its FY21 result.

Sales and earnings guidance beaten

Key financial results for the year ending 30 June 2021 include:

- Revenue up 42% to $221 million and 1% above prospectus forecast

- Gross margin of 86.7% improving 150 basis points

- EBITDA of $110 million soaring 114% and 2% above prospectus forecast

- Net profit after tax (NPAT) loss of $12 million

- Free cash flow of $84.9 million

The uptick in revenue was a result of a 37% jump in property transactions processed through the platform.

A proportionally larger jump in EBITDA compared to revenue was due to costs growing at a lower rate. This resulted in operating leverage with more cash dropping to the profit line.

The negative NPAT result was largely attributed to non-cash amortisation of intangible assets. Free cash flow is a better measure of PEXA’s profitability.

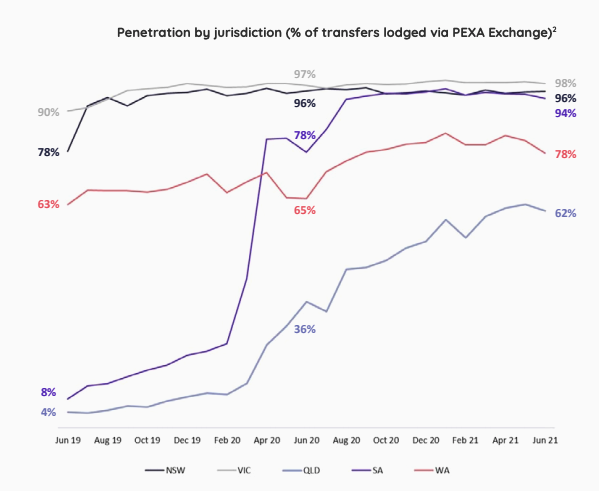

As at the reporting date, the business has an 80% market share of the Australian digital settlements market.

Growth to accelerate into FY22

PEXA has made positive progress in its UK market entry. The company has secured product testing with the Bank of England by partnering with lender-pilot groups.

Moreover, PEXA now has over 40 in house data specialists to develop a centralised property bureau for its PEXA Insights division.

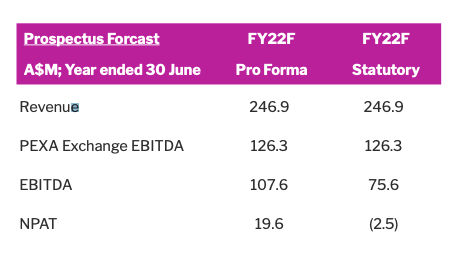

Management has reiterated its prospectus guidance for FY22.

Revenue is expected to be $246.9 million with an EBITDA of $107.6 million.

My take

Property has reported well so far, with REA Group Limited (ASX: REA) and Domain Holdings Australia Ltd (ASX: DHG) also providing strong updates.

I thought this was the best result PEXA could be reasonably expected to achieve.

It met or exceeded prospectus forecasts. Also, it provided a positive update on UK expansion. And reiterated prior FY22 guidance. However, the PEXA share price is unmoved on the update.

The only minor concern is the introduction of an interoperability pilot in QLD during 2022. This will likely lead to greater competition in the Australian digital settlements market.

As written previously, PEXA is an amazing digital infrastructure asset, however, the current share price reflects that.

Notwithstanding the positive growth update, I’ll be watching PEXA from the sidelines for now.

To keep up to date on all the latest news regarding PEXA and the ASX, be sure to bookmark the Rask Media home page.

And to stay up to date with the flurry of reports this month, bookmark our ASX reporting season calendar.