Shipping software provider WiseTech Global Ltd (ASX: WTC) share price has gone bananas today, rocketing 40% after the company released its FY21 results and smashed market estimates.

WiseTech shares are currently in a trading halt after receiving a speeding fine from the Australian Stock Exchange.

The rapid share price correction is in response to a bumper FY21 result, which led to investors shorting the stock, rushing to exit their positions.

Global shipping volumes spur profit growth

Key financial results for the year ending 30 June 2021:

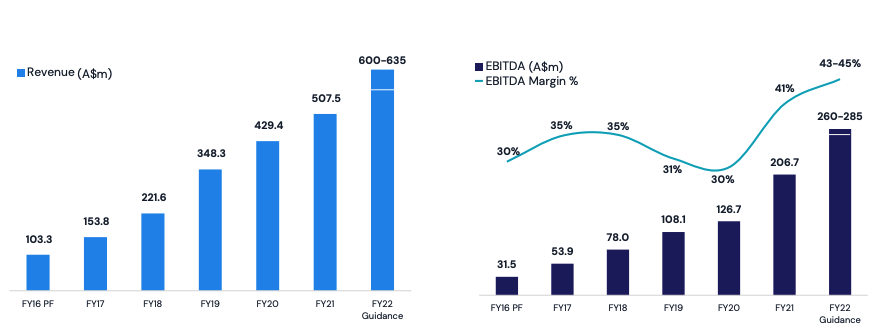

- Total revenue of $507.5 million, increasing 18%

- Recurring revenue is now 90% of total revenue

- A gross profit margin of 85%

- Earnings before interest, tax, depreciation and amortisation (EBITDA explained) of $206.7 million, rocketing 63%

- Free cash flow of $139.2 million, soaring 149%

- Final dividend of 3.85 cents per share fully franked

Excluding the foreign exchange movements, total revenue grew 24%.

WiseTech’s flagship software product CargoWise recorded a 31% jump in revenue as shipping volumes and utilisation surged.

The business retained its focus on product development, increasing research and development expenditure by 5% to $167.1 million.

Despite the big jump in profits, operating expenses for the year remained steady. The increase in R&D was offset in other areas of the business.

This led almost all of the excess revenue to drop to the profit line, increasing EBITDA and subsequently free cash flow.

Founder and CEO Richard White commented on current market conditions:

“We have continued to see a ‘goods-led’ recovery in global trade resulting in tighter capacity, congestion and higher rates in global logistics channels… In particular, we are seeing consolidation within the sector and increased investment in replacing legacy systems with integrated global technology, such as CargoWise”.

That party doesn’t stop there

If you thought FY21 was a bumper year, FY22 will knock your socks off.

WiseTech will continue its CargoWise expansion into new geographies across Europe, Asia and South America.

The software will also benefit from growth in users from seven large global freight businesses that currently have less than 10% of their expected users live on CargoWise.

Management is guiding for an 18%-25% increase in revenue for FY22.

EBITDA is expected to grow 26-38% and more costs are expected to be reduced from operations.

My take

Wowzas.

I thought Nanosonics Ltd (ASX: NAN) 25% jump yesterday was impressive. WiseTech has knocked that out of the park.

A common theme during reporting season is the increased costs for logistics with Treasury Wine Estates Ltd (ASX: TWE) and Breville Group Ltd (ASX: BRG) reporting rising shipping expenses.

WiseTech will indirectly benefit from this, as volumes and demand for integrated software rise.

I’ll be going back to my valuation and updating it for the increased growth forecasts to see if WiseTech’s share price offer value after its huge jump.

If you’re looking to learn how to do your own ASX company valuations, take our free share valuation course, which takes you through 6 common share valuation techniques, step by step.

Or try our Beginner Shares Course if you’re just starting out. Both are free.