The A2 Milk Company Ltd (ASX: A2M) share price has sunk 9.18% in morning trade to $6.23 after the company reported its FY21 results.

A2M share price

International border closures exacerbate internal issues

It’s been an underwhelming year for A2 Milk. Key financial results for the year ending June 30 2021:

- Revenue of $1.21 billion, falling 30.3%

- Gross margin of 42.3% compared to 55.9% in FY20

- Earnings before interest tax depreciation and amortisation (EBITDA) down 77.6% to $123 million

- Net profit after tax down 79.1% to $80.7 million

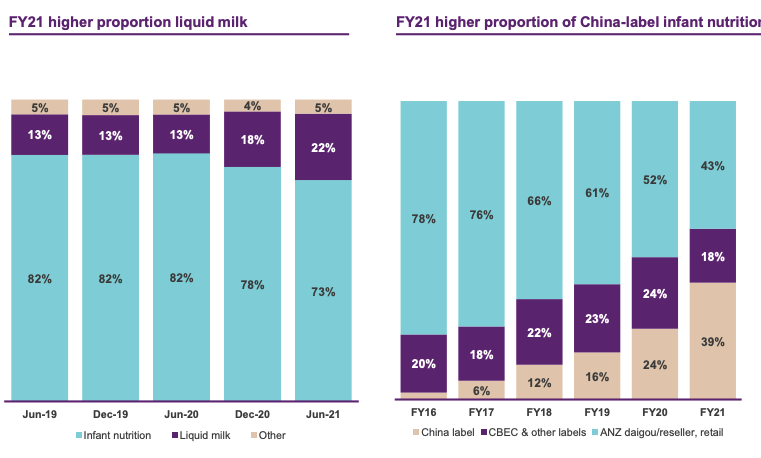

Closed international borders created enormous uncertainty for A2 Milk, as the company lost its daigou sales channel. This led to excess inventory and subsequent write-downs.

The company also experienced significant senior leadership turnover, with its CEO, Head of Asia and Chief Marketing officer exiting over the past 2 years.

To top it all off, the Chinese infant milk formula (IMF) market size has decreased, in addition to the emergence of strong competition from domestic brands. This led to discounting, eroding A2 Milk’s premium brand positioning.

Management took steps in Q4 to address inventory issues, writing off $109 million of stock. New hires were appointed and a growth strategy review was announced.

However, the damage has already been done.

Positively, sales of Chinese-labelled IMF increased 15.4% and liquid milk sales in Australia increased 10.8%. Furthermore, market share increased 10 basis points to 2.5% in China.

While revenue in the United States fell $2.5 million, this was more than offset by a $17 million reduction in EBITDA loss as management focused on increased conversion.

Outlook update for FY22

A2 Milk has opted not to provide guidance for FY22, however, provided the following commentary:

- Heightened competition in China and a shrinking addressable market

- Significant increase needed in brand investment (marketing)

- First-half FY22 revenue to be below 1H21

- A higher effective tax rate of 37%-39%

Management will also present its strategy review at the investor day in October.

My take

What a fall from grace.

The company is facing so many headwinds it’s hard to count on one hand.

Closed borders. Patent court cases. Management reshuffles. Changing consumer preferences. Inventory problems – just to name a few.

With the A2 Milk share price at levels not seen since 2017, the company is likely a takeover target. Nestle has reportedly been interested in the past and may have another look.

I’m avoiding it for the time being. I suspect there will be further ugly results to come.