The Life360 Inc (ASX: 360) share price increased 5% to $9.30 today after the company upgraded its FY21 guidance.

Who is Life360?

Life360 operates a family safety platform that enables parents to communicate and keep track of their children.

The app enables location sharing, place alerts and driving reports among other features.

The company’s activities are predominantly located in the United States, however, Life360 is expanding into international markets.

How did Life360 perform in the first half?

Key financial results (in US dollars) for the first-half ending June 30 2021 include:

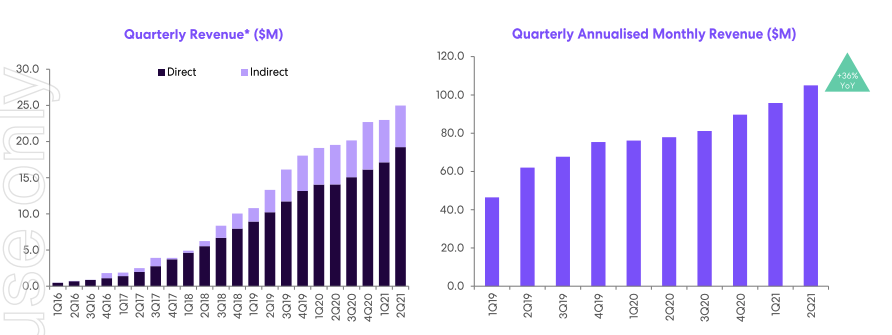

- Revenue of $48.0 million increasing 27%

- Annualised monthly revenue (AMR) in June of $105.9 million, up 36%

- Earnings before interest, tax, depreciation and amortisation (EBITDA explained) loss of $10.4 million compared to a loss of $7.1 million

- Cash burn of $5.8 million for the half, cash on hand of $50.8 million

Life360 benefitted from the reopening of economies during the first half, especially in its key market of the United States. This will likely continue as students return to school post-summer holidays.

Global monthly active users increased to 32.2 million, up 28% year on year.

Similarly, paying customers increased 19% to 1.0 million. The average revenue per paying customer increased 14% in the US and 4% in international markets, demonstrating pricing power.

The widening EBITDA loss was the result of increased marketing and development costs in the half to spur growth.

A notable marketing campaign that has encouraged product adoption is the newly created Family Safety Council.

Household names such as Vanessa Bryant, Tony Hawk

, Michael Phelps and Chris Paul sit on the board.

Why did the Life360 share price rise today?

Management increased guidance for annual monthly revenue (AMR) for December to $120 to $125 million. Previous guidance was for $110 to $120 million.

The market looked past the additional expenditure required to achieve this AMR growth.

Life360 will ramp up growth investments in brand, customer acquisition, development and joint initiatives with Jiobit.

As a result, the underlying EBITDA loss for FY21 is expected to be no greater than $15 million

My take

I thought this was a really strong result from Life360.

Active users will only increase as movement restrictions ease and children return to activities outside of the home.

This is definitely one for the watchlist to review again post reporting season.

To keep up to date on all the latest news regarding Life360 and the ASX, be sure to bookmark the Rask Media home page.

And to stay up to date with the flurry of reports this month, bookmark our ASX reporting season calendar.