Despite a pleasing FY21 result, shares in diversified media company Nine Entertainment Holdings Ltd (ASX: NEC) finished the day nearly 10% lower on Wednesday.

Here’s a quick look at what the company had to report.

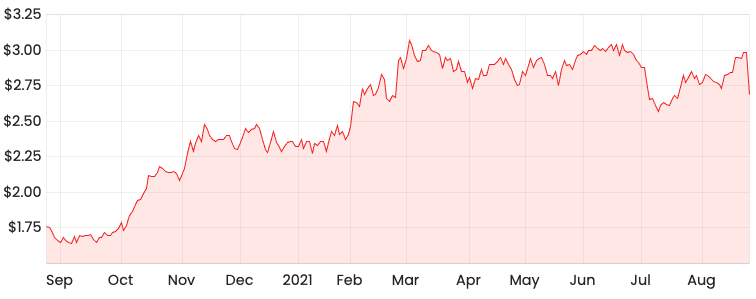

NEC share price

Nine’s FY21 highlights

Overall, Nine brought in $2.33 billion in revenue, an 8% increase on FY20.

Digital subscriptions for content including The Australian Financial Review were a key growth driver, which saw revenue tick over the $100 million mark for the first time.

Gains in digital channels were enough to offset losses from other parts of its publishing division. Print revenue tumbled as advertisements promoting travel and luxury goods were scaled back due to COVID-19.

Another strong performer was streaming service Stan, which now has over 2.4 million subscribers. Stan revenue increased 29% to $311.8 million and average revenue per user (ARPU) increased 7%.

Given the state of the Australian housing market, property listing website Domain Holdings Australia Ltd (ASX: DHG) was also a beneficiary throughout FY21. Nine owns a 60% stake in Domain, which reported an 11% increase in revenue across the year.

Group statutory profit rose to $184 million, compared to a net loss of $507.8 million in FY20.

A fully franked final dividend of 5.5 cents per share was declared.

Stan investment

Perhaps responsible for the 10% drop in the share price was management flagging increased costs within the launch of Stan Sport.

During FY21, Stan’s total costs also rose 29% in line with revenue growth as a result of the increased investment.

In FY22, management expects Stan Sport costs to be at the lower end between $70 million and $90 million, which is expected to reduce EBITDA in the short term.

Out of Stan’s 2.4 million active subscribers, 250,000 were members of Stan Sport.

My take on Nine’s result

All things considered, I think this was a fairly pleasing result from Nine. Media companies that earn advertisement revenue can often struggle in economic downturns, which is what has happened within parts of its publishing division.

The company is well-positioned however to have exposure to digital channels, which have managed to offset some of the underperforming areas of the business.

If I were a shareholder of Nine, I would be in full support of management channelling investment into Stan and entertainment content. This is a key growth asset and in my view, is worthy of more investment rather than other areas of the business.