The Mayne Pharma Group Ltd (ASX: MYX) share price continues its decline, dropping by 8.47% today. The Mayne Pharma share price may get worse after posting ordinary FY21 results.

Mayne Pharma is an Australian specialist pharmaceutical company, creating generic products you’ll find in pharmacies.

MYX share price

FY21 – a challenging year

The big headline in these results is net profit after tax (NPAT) doubled from -$92.8 million to -$208.4 million.

Why did it report such a bad bottom line?

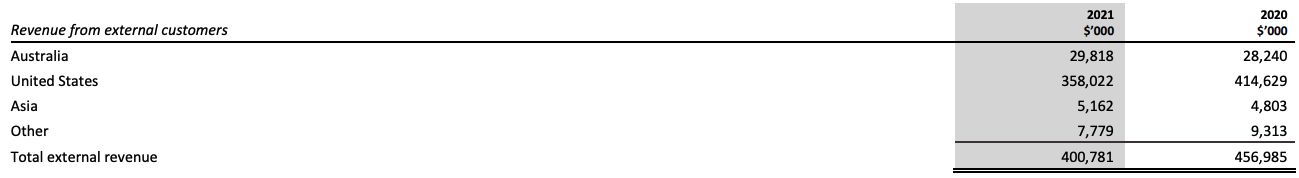

On the top line, Mayne Pharma experienced a high decline in sales of both its generic and specialised products, in particular in the United States.

Management advises this was impacted by new competition on key products and ongoing price pressures across the portfolio.

In particular, in the second half of FY21, its liothyronine product succumbed to pressure from two new competitors. As a result, sales declined 60% relative to the first half.

Services revenue remained steady, rising by $1.05 million.

The other big item that contributed to the heavy fall in NPAT was a ramp-up in impairment expenses. It jumped by $130 million.

Due to the higher level of competition, it appears management is less bullish about the prospects of some of its products in the US. This likely explains the rise in impairment expenses.

The slump in demand and revenue naturally resulted in lower operating cash flow, falling from $112 million to $58 million.

Management said Mayne Pharma’s performance will be influenced by factors like COVID, movements in the US dollars, the timing of FDA approvals, and competitor launches and withdrawals on key products.

My take

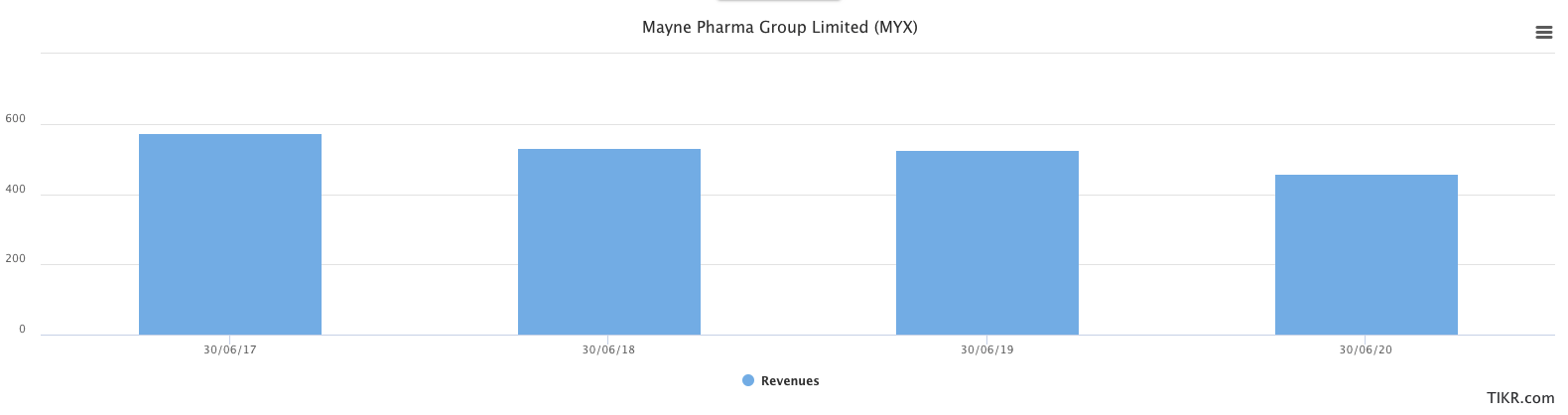

The recent downward trend of revenue is concerning, especially in light of recent competitive pressures. This is shown below.

The issue with selling generic products is that it tends to become commoditised as more competitors come to the market. This often leads to downward pressure on revenue and margins.

Generic products represent almost half of total revenue, and a majority of this is in the United States.

The pharma company needs to commercialise more specialised products like the recent product, NEXTSTELLIS to turn around the decline in revenue.

I’ll be avoiding Mayne Pharma given the decline in its core segment over recent years. Also, it falls outside of my circle of competence.

If you want to learn how to do your own ASX company valuations, take our free share valuation course, which takes you through 6 common share valuation techniques, step by step.

Or try our Beginner Shares Course if you’re just starting out. Both are free.