Data centre builder and operator NextDC Ltd (ASX: NXT) share price is down 3.65% this morning to $13.00 after the business released its FY21 results.

How did NextDC perform in FY21?

Key financial results for the year ending June 30 2021 include:

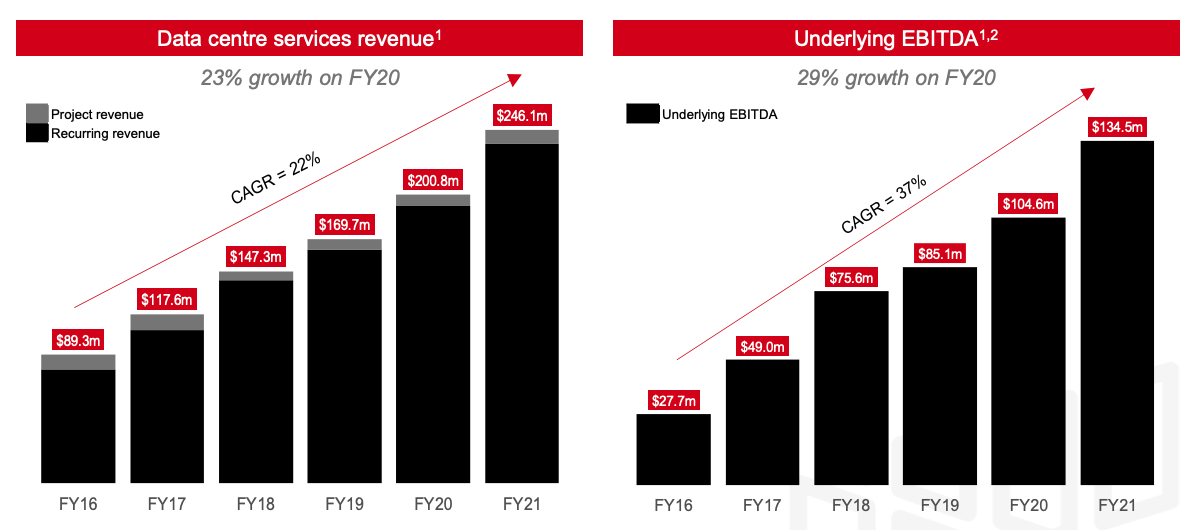

- Data centre services revenue grew to $246.1 million, growing 23% (upgraded guidance: $246 million to $251 million)

- Underlying earnings before interest, tax, depreciation and amortisation (EBITDA) of $134.5 million, up 29% (upgraded guidance: $130 million to $133 million)

- Statutory loss of $20.7 million, down from $45.0 million in FY20

- Operating cash flow of $133.3 million up 148%

Revenue for the year increased on the back of a 24% increase in billing utilisation and a 13% growth in customers and interconnections.

Additionally, the company increased its contracted utilisation by 5.5 megawatts (MW) to 75.5MW.

The total data centre capacity is currently 95.8MW.

Sales would have been higher if not for revenue per MW falling 8.4% to $4.03 million.

Operating expenses for the year increased 16% mainly due to increased corporate costs relating to investments and insurance.

As a result, EBITDA grew at a relatively higher amount to revenue, as NextDC achieved operating leverage.

The statutory loss was primarily the result of a non-cash $94.1 million depreciation charge and $63.6 million in finance costs.

Chief Executive Officer Craig Scroggie, commented:

“We are pleased to deliver on market expectations, with the Company’s FY21 results coming in ahead of the upgraded guidance provided at the time of NEXTDC’s 1H21 results in February. Today’s results are a testament to the Company’s pursuit of excellence, against a more difficult economic backdrop due to the COVID-19 global pandemic.”

What’s next for the NextDC share price?

NextDC will continue its datacentre rollout into FY22. Currently, the business has built 24% of its planned 400.1MW capacity.

Management is expecting strong growth in FY22 and provided the following guidance:

- Data centre services revenue in the range of $285 million to $295 million

- Underlying EBITDA in the range of $160 million to $165 million

- Capital expenditure in the range of $480 million to $540 million

My take

This was a great result by NextDC, especially the big jump in operating cash flow.

If I was a shareholder, I wouldn’t worry too much about the initial share price reaction this morning. Megaport Ltd (ASX: MP1) also had a similar sell-off in shares following its positive result.

Overall, management is executing its strategy of rolling out data centres. Given 76% of capacity is yet to come online, NextDC has many years of growth ahead.