The Altium Limited (ASX: ALU) share price has fallen 8% at the open after the business released its full-year results.

How did Altium perform in FY21?

Key financial highlights for the year ending 30 June 2021 include:

- Revenue (including the TASKING division) of US$191.1 million, 1%

- Revenue from continuing operations of US$180.2 million, up 6%

- Operating expenses of US$120.2 million, up 12%

- Earnings before interest, tax, depreciation and amortisation (EBITDA) of US$60.0 million, down 3%

- Profit before tax of US$47.7 million, down 7%

- Profit after tax of US$35.3 million, up 79%

- Cash in the bank of US$191.5 million, up 106%

- Partially franked dividend (15%), in Australian dollars of 21 cents per share

- Total dividends of 40 cents per share in FY21

The company delivered strong second-half growth of 16% to achieves its full-year revenue guidance. From a division perspective, Octopart was the standout performer with sales up 42%.

Boards and Systems achieved a more modest growth of 2%. Revenue for the year was weighed down by negative performance in Manufacturing and Nexus segments, down 7% and 5% respectively.

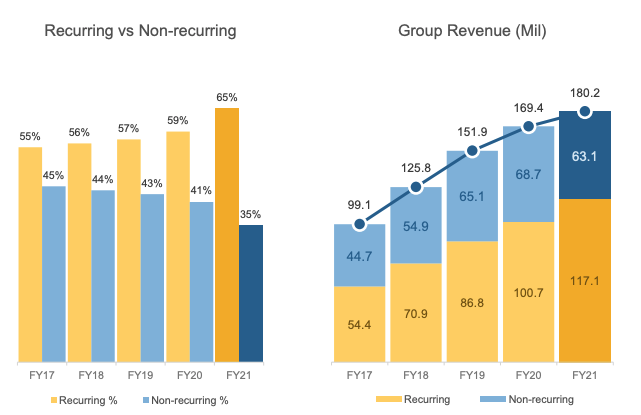

Altium improved the quality of revenue in FY21, with annual recurring revenue (ARR) increasing 29%. ARR now represents 65% of all sales.

The business’s new flagship cloud product Altium 365 performed admirably. The platform now has almost 13,000 monthly active users and over 6,000 monthly active accounts.

Looking at the bottom line, profit before tax was down 7% largely due to increases in employee wages. Positively, profit after tax increased primarily due to a substantially lower tax rate and subsequent tax expense.

Altium cash balance improved materially due to the sale of its TASKING business for $110.0 million.

What’s next for the Altium share price?

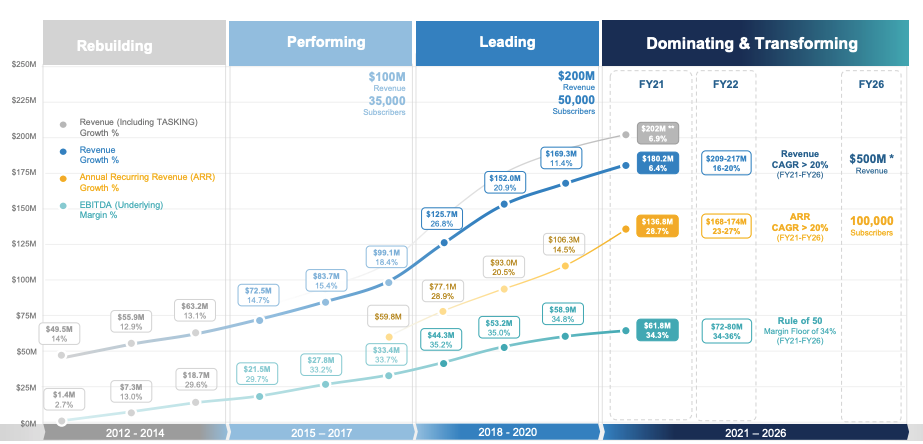

Due to the strong second-half performance, management is upgrading its expectations for FY22.

Revenue is expected to be land between US$209 million and US$217 million, representing 16-20% growth. Similarly, Altium is expecting ARR growth in the range of 23-27%.

The underlying EBITDA margin is expected to remain around historical levels of 34-36%.

Notably, management has moved its 2025 targets back one year to 2026. It has also removed its ambition of a 39-44% EBITDA margin by 2025.

My take

Overall, I think it was a good but not great result for Altium.

China and Octopart continue to perform strongly. Concerns over discounting to attract more customers have been alleviated with the 6% increase in sales from continuing operations.

However, some cracks are appearing across other divisions.

Moreover, despite the upgraded guidance provided today, the business has had to push out its five-year plan by one year and lowered margins.

No doubt Altium is one of the most well-run businesses on the Australian market, however, I’ll be watching from the sidelines for now.