Telecommunications disruptor Aussie Broadband Ltd (ASX: ABB) share price is unmoved despite reporting an 84% revenue rise in FY21.

How did Aussie Broadband perform in FY21?

Key financial highlights for the year ending 30 June 2021 include:

- Revenue of $350.3 million, up 84% on FY20 and 3.6% ahead of prospectus forecast

- Gross margin of 28.1%, improving from 23.5% in FY20

- Earnings before interest, tax, depreciation and amortisation (EBITDA) before one-off items of $19.1 million, up 433% on FY20 and 55% ahead of prospectus forecast

- Cash on hand of $57.0 million up from $21.4 million in FY20

What led to the strong financial performance?

The strong financial performance was the result of growth in its residential and business customer base.

Aussie broadband increased its residential connections 50% to 363,350 in addition to increasing business connections 90% to 37,498.

Additionally, the business accelerated the rollout of its mobile services, increasing customers 102% to 25,606.

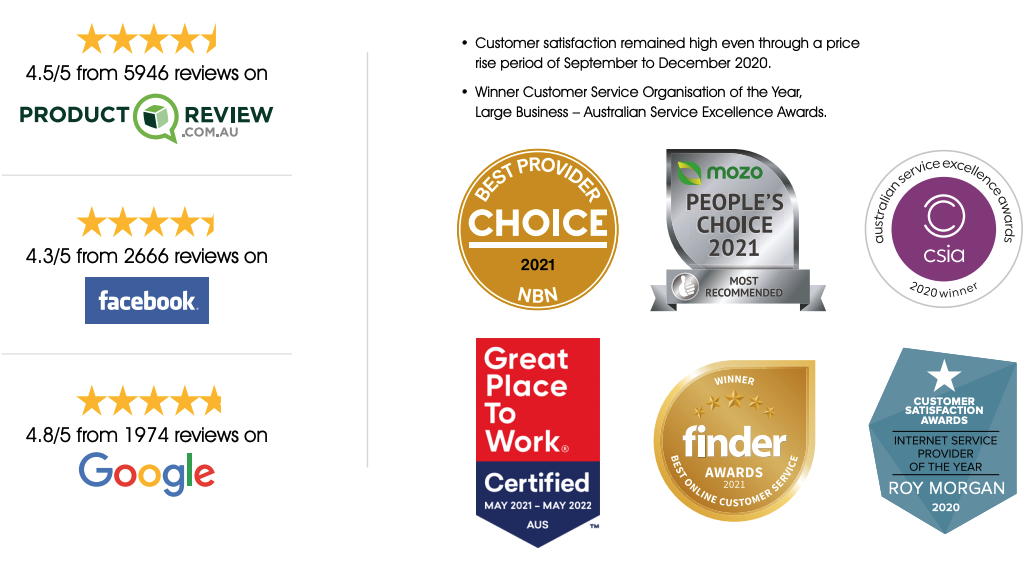

The aforementioned financial and operating metrics would not have been possible without Aussie’s focus on the customer. The company recorded only 5.76 complaints per 10,000 services and an average wait call time of just 138 seconds.

Commenting on the result Managing Director Phillip Brit said:

“We’re in business to change the telco game, and our staff are doing that each and every day with our high-quality network, clever technology and a focus on being good to our customers”.

What’s next for the Aussie Broadband share price?

The brilliant performance in FY21 has flowed into FY22. Aussie Broadband achieved a record sales month in July and is expected to beat this record again in August.

It will on board 32,000 white-label customers in the first half, and continue its fibre rollout to achieve $15 million in savings from FY23 onwards.

Management has not provided guidance for the year, instead, committing to quarterly market updates.

My take

Much of the result had already been signalled to the market, hence the muted share price response.

Positively, the momentum from FY21 has carried into FY22.

The business continues to take market share from the likes of TPG Telecom Ltd (ASX: TPG) and Telstra Corporation Ltd (ASX: TLS). Over 80% of all new connections sales are from customers switching providers and this trend is set to increase.

Moreover, Aussie Broadband is taking over 25% of all new internet connections despite its total market share only hovering around 5%.

I really like Aussie Broadband shares given its focus on customer service, something that’s been lacking in the industry.

As long as the business can maintain its sound reputation, I think the share price will continue to rise.