The Healius Ltd (ASX: HLS) share price tumbled by 8% today, after releasing its FY21 results. Can the Healius share price bounce back over the long run?

Healius is a healthcare business that provides pathology, diagnostic imaging and operates day hospitals.

It competes with Sonic Healthcare Limited (ASX: SHL) and Capitol Health Ltd (ASX: CAJ).

HLS share price

FY21 results

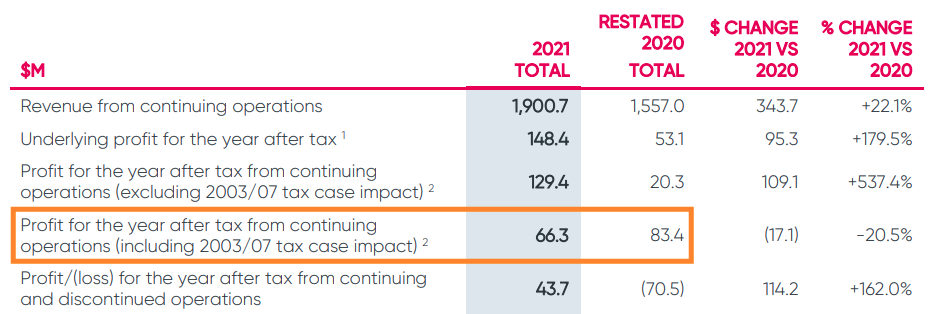

Despite the Healius share price dropping by 8%, it actually recorded a solid set of results as seen below.

But if you take a closer look, profit for the year after tax from continuing operations actually fell 20.5% relative to FY20 accounting for an adverse tax ruling.

Healius had to reduce its underlying net profit after tax by $82.1 million as the Court overturned an earlier decision in favour of the Australian Taxation Office.

I think this likely spooked the market, causing the fall in the Healius share price today.

But, how did its core business fare?

Healius’ core segment, pathology grew revenue by 25% to $1.45 billion, representing 75% of total revenue.

The other key segment is imaging, which lifted revenue by 8% to $406 million, constituting 22% of total revenue.

Both segments also performed exceptionally well on earnings before interest and tax (EBIT explained) level, pathology increasing by 103% and imaging by 41%.

In terms of group expenses, the two big movers were employee benefits expenses (7% jump) and consumables (36% increase).

Also, let’s not forget Healius sold off its Healius Primary Care (HPC) and Adora Fertility, enabling the business to focus on its specialist diagnostic and growing day hospitals segment.

My take on Healius

I’m surprised by the negative reaction from the market because the core business performed well.

If the adverse tax decision was the reason for the overreaction, I believe this could be an opportune time for long-term investors.

Its two biggest segments, in particular pathology, experienced strong growth and the sale of capital intensive operations has enabled it to devote more time and resources to its key business segments, which are higher margin.

For example, the divestment of HPC allowed investments in a new pathology laboratory and a greenfield imaging facility.

Current market valuations may not be accounting for the potential higher-margin revenue to come from these divestments. So, the valuation exercise would be an interesting one.

If you want to learn how to do your own ASX company valuations, take our free share valuation course, which takes you through 6 common share valuation techniques, step by step.

Or try our Beginner Shares Course if you’re just starting out. Both are free.