Investigative software platform Nuix Ltd (ASX: NXL) share price has sunk 11% to $2.59 in morning trade after releasing its FY21 results.

Its been a rollercoaster ride for shareholders, with the Nuix share price initially doubling from its $5.31 IPO price.

Then allegations of insider trading by its CFO, cultural issues and two guidance downgrades resulted in the share price plummeting to now sit 53% below its IPO price at $2.59.

How did Nuix perform in FY21?

Key financial highlights for the year ending 30 June 2021 include:

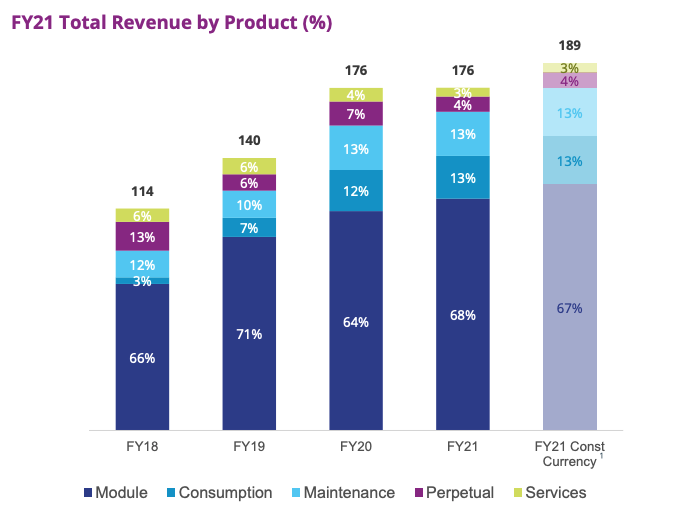

- Revenue of $176.1 million, unmoved from FY20

- Annualised contract value (ACV) of $165.6 million, down 1.2%

- Gross margin of 89.3%, up 1.1%

- Earnings before interest, tax, depreciation and amortisation (EBITDA) of US$30.2 million, down 52.1%

- Net profit after tax of -$1.6 million, down from $23.6 million in FY20

What led to the financial performance?

The headline numbers look pretty ugly, but it’s not all bad news for Nuix.

Removing the effect of currency movements, revenue for the year actually increased 7.4%.

Similarly, ACV which smooths out fluctuations associated with multi-year deals – increased 4.1% in constant currency. This was led by new business of $27.6 million and maintaining a low churn rate of 3.7%.

Overall, 93% of all revenue was recurring subscription revenue (module, consumption and maintenance).

The 52% drop in EBITDA is somewhat misleading, given it accounts for one-off IPO costs. Removing the effect of these and other non-recurring items, EBITDA increased 20.2% to $66.7 million.

Operating conditions remained difficult for Nuix with pandemic restrictions hindering sales staff ability to meet customers and subsequently sign new deals.

Commenting on the results and Nuix more broadly, Nuix Chairman Hon. Jeff Bleich said:

“Our technology is world leading and unique. Our customers have stuck with us in a competitive environment not out of sentimentality. It is because of the tremendous value our solutions bring to their operations. We recognise there are areas for improvement and necessary change. We must learn from recent challenges and ensure we address any underlying problems. We have been listening and we have been taking action. I’m confident we are in the process of emerging as a stronger business that can reach its incredible potential.

What’s next for the Nuix share price?

Nuix will continue to invest for growth in FY22, with further investments in engineering and sales teams.

Furthermore, it will look to expand into the nascent Governance, Risk and Compliance (GRC) market in addition to upsell and renewal of existing customers

My take

Given Nuix has no permanent CEO or CFO currently, I think the result is pretty decent.

For all the misdoings of the past, the underlying software is still very powerful and very sticky.

As investors, we have to see the forest from the tress. If the board and senior management can rejig the culture, bring in the right people and improve the product, I think Nuix will be a much better business in a couple of years time.

The big question is whether Nuix can execute.