Harvey Norman Holdings Limited (ASX: HVN) share price will be on watch this morning after the company released a brilliant FY21 result with profits up 75.1%.

Currently, the share price is trending down 1.26% to $5.48.

How did Harvey Norman perform in FY21?

The key financial highlights for the 12 months ending 30 June 2021 include:

- Total systems revenue of $9.721 billion, an increase of 14.9%

- Earnings before interest, tax, depreciation and amortisation (EBITDA) of $1.457 billion, an increase of 54.2%

- Earnings before interest and tax (EBIT) of $1.233 billion, up 71%

- Profit before tax of $1.183 billion, an increase of 78.8%

- Profit after tax of $841.41 million, up 75.1%

- Fully franked dividend of 15 cents per share, total FY21 dividends of 35 cents per share

What led to the strong financial performance?

Customers have been spending more and more time at home due to pandemic restrictions on movement and subsequently increased work-from-home.

Despite stores being intermittently closed throughout the year, when households were able to get out they spent up big upgrading the family home.

“A common theme in the countries in which we operate has been low interest rates, strong housing prices and strong home renovations, booming stock markets and record household deposits. This has translated to unprecedented sales for the Harvey Norman® brands” – Harvey Norman 2021 Annual Report

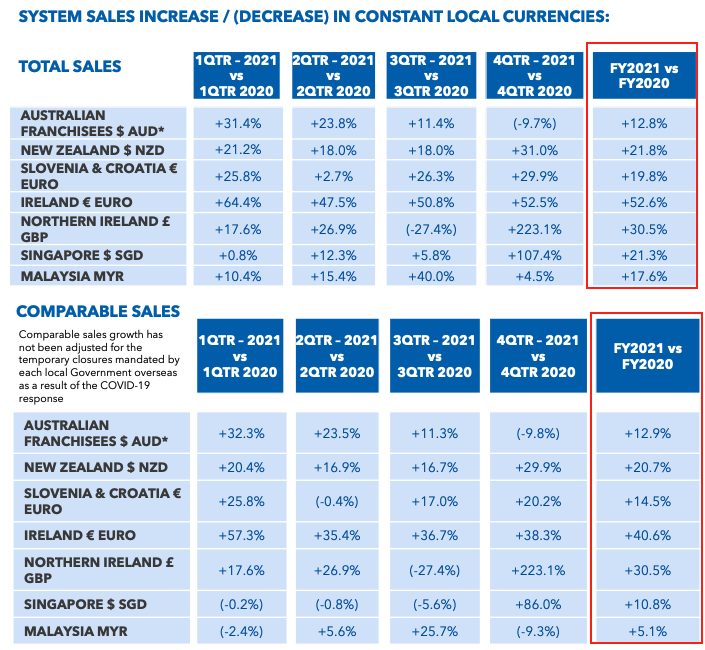

The business recorded positive total and comparable store growth across its network, with Ireland the standout performer.

In addition to the strong performing retail operations, Harvey Norman’s property portfolio also performed admirably.

The company owns 120 freehold properties across its geographies, which were revalued upwards by 11.8% to $355.90 million during the year.

What’s next for the Harvey Norman share price?

It’s been tough sailing for the start of FY22, with over 58% of the Australian population in lockdown. Additionally, Malaysia has been largely shut and New Zealand is also in lockdown.

As a result, total sales across these geographies have been negative compared to FY21.

However, countries that have limited or no movement restrictions such as Ireland, Northern Ireland, Slovenia, Croatia and Singapore have recorded total sales growth.

This is impressive given these economies are beginning to reopen and thus far have not had a big drop off in spending.

My take

Despite rolling lockdowns across its store geographies, Harvey Norman has delivered an impressive FY21 result.

The company also bowed to pressure and repaid the $6.02 million in Jobkeeper subsidies it received from the federal government.

What stood out to me was the trading update for the first two months of FY22. Where other retailers such as Accent Group Ltd (ASX: AX1) and Super Retail Group Ltd

(ASX: SUL) have experienced slowing demand in FY22, Harvey Norman is still delivering growth.

Despite this, I’m waiting to see how retailers perform over a longer period of normalised trading conditions before investing.