The Rubicon Water Ltd (ASX: RWL) share price has made a big splash yesterday on the ASX, finishing its first day of trading up 63% to $1.63.

The company issued 42.8 million new shares for $1.00 in its IPO, which was gobbled up by three ethical funds leaving many investors unable to get a slice of the pie.

Who is Rubicon Water?

Founded in 1995, Rubicon Water is an Australian agricultural technology company focused on improving water efficiency.

The business designs, manufactures and maintains hardware and software, which is used by governments, water authorities and farmers to optimise irrigation systems.

Historically, irrigation has been a manual process. Going out to each site, turning taps on and off at all hours of the night (and morning). Furthermore, soil moisture, runoff, and waterlogging can all affect yields, which are difficult to measure manually.

Rubicon Water solves this issue by providing automated irrigation that can be accessed remotely. It provides the piping and irrigation system, in addition to the software that runs the whole operation.

It saves time, stress, manpower and ultimately reduces water use, which is a scarce resource.

Why is Rubicon Water listing?

Up until the IPO, Rubicon Water has been largely self-funded. The company is now listing to gain access to capital to supercharge its growth strategy.

Management has identified a growing pipeline of opportunities and is looking to invest today to provide returns in the future.

What makes this an interesting IPO?

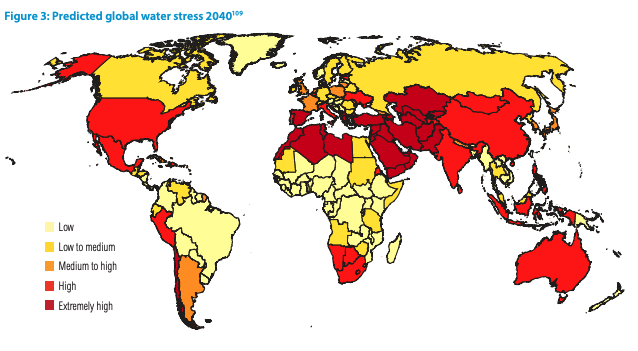

Water is a scarce commodity and thus its supply needs to be managed accordingly.

Rubicon helps governments and communities optimise water usage, particularly in emerging markets such as India, Pakistan and China, which account for close to half of the world’s global irrigated area.

Rubicon’s competitive advantage lies in its expertise and knowledge gained over 26 years of operations, evident from 218 patents registered across 21 countries.

The company is forecasting $80.4 million in revenue for FY21, earnings before interest, tax, depreciation and amortisation (EBITDA) of $13.8 million and a net profit of $7.5 million.

The board is strongly aligned with shareholder interests, owning 33.9% of the company. Notably, no directors sold any shares in the IPO.

Any potential risks?

Not so much of a risk, but 86% of revenue is from hardware sales. I’d expect (and hope) over time the software component of the business continues to grow since the hardware will already be installed and thus switching costs will be high.

Revenue has been somewhat stagnant over the past three years. The company recorded revenue of $71.3 million in FY18, $75.5 million in FY19, $64.8 million in FY20 (pandemic effected year) and forecasting $80.4 million in FY21. Profit growth has tracked a similar trajectory. More research needs to be done on the potential growth opportunities.

Lastly, Rubicon is somewhat vulnerable to its top five customers, which has ranged from 40% to 53% of total revenue. Again, more work needs to be done to attain if this is a large or small risk.

Final thoughts

Rubicon Water looks like an interesting company solving a universal problem – water scarcity (no wonder the ethical funds were all over it!).

I’d need to do some more digging into the growth runway and a closer look at the FY21 results when they get released.

Clearly, there is high demand in the market, given the 63% pop in the Rubicon Water share price.

I’m looking forward to tracking this business in its transition to public life.