This article contains two topics: the power of giving, and some rules for dealing with the answer to the question: “Is the stock market about to crash?”

~~~

On the latest episode of The Australian Investors Podcast, you can watch along as I explain why Rask donated $2,500 to one of our favourite charitable organisations, The Life You Can Save.

This is a charitable organisation that researches other charities for their effectiveness, then lists the most effective charities (globally), and makes it simple to donate to the best charities in one go. It was started by an Australian, Peter Singer.

At Rask, we were lucky enough to donate $2,500 last week because a year ago we set our Rask Invest members a challenge as part of our “Stock Game”.

Our members were asked to pick one company/stock and we would track the return of a ‘hypothetical’ $500 investment. Everyone, including Rask analysts and our members, played off to see who would win.

This year, the top 4 members got an award, ranging from six months of Rask Invest (worth $199) right up to a Rask Rockets Beyond membership (worth $2,000).

To make it a bit more fun, The Rask Group (our business) would donate the value of the top-placed hypothetical investment to a charity — capped at $2,500 (i.e. a 500% return).

I entered the draw with RPMGlobal Ltd (ASX: RUL) and my pick rose 67%. I know what you’re thinking, 67% is pretty great, right?!

Well, that only put me in ~20th place! That’s basically a participation award compared to some of our members’ stock picks.

At the very top, our best-performing member, Brant, picked a company I’d never heard of, Lake Resources NL (ASX: LKE). I’m not sure exactly what it does or anything about its future, but that’s beside the point.

Lake Resources rose to 17x in one year! That turned a measly $500 into over $8,000!

You know what I’m thinking…

Thank the universe we capped the donation at $2,500!

We had quite a few other great ideas (from Tony, Mom’s Spaghetti, Sam & Peter… the list goes on).

And I’m sure many of our Rask Invest members have some new ideas lined up in the next Rask Invest Stock Game for the year ahead.

At the end of the day, I was thrilled someone achieved more than a 5x return because a $2,500 donation (~$US1,800) is almost half of what’s needed to save a human life from malaria ($US4,000 – $US5,000).

The Life You Can Save has an easy to use calculator for you to assess how much your donation can do for humanity. It’s truly amazing to see what you can do with as little as $10.

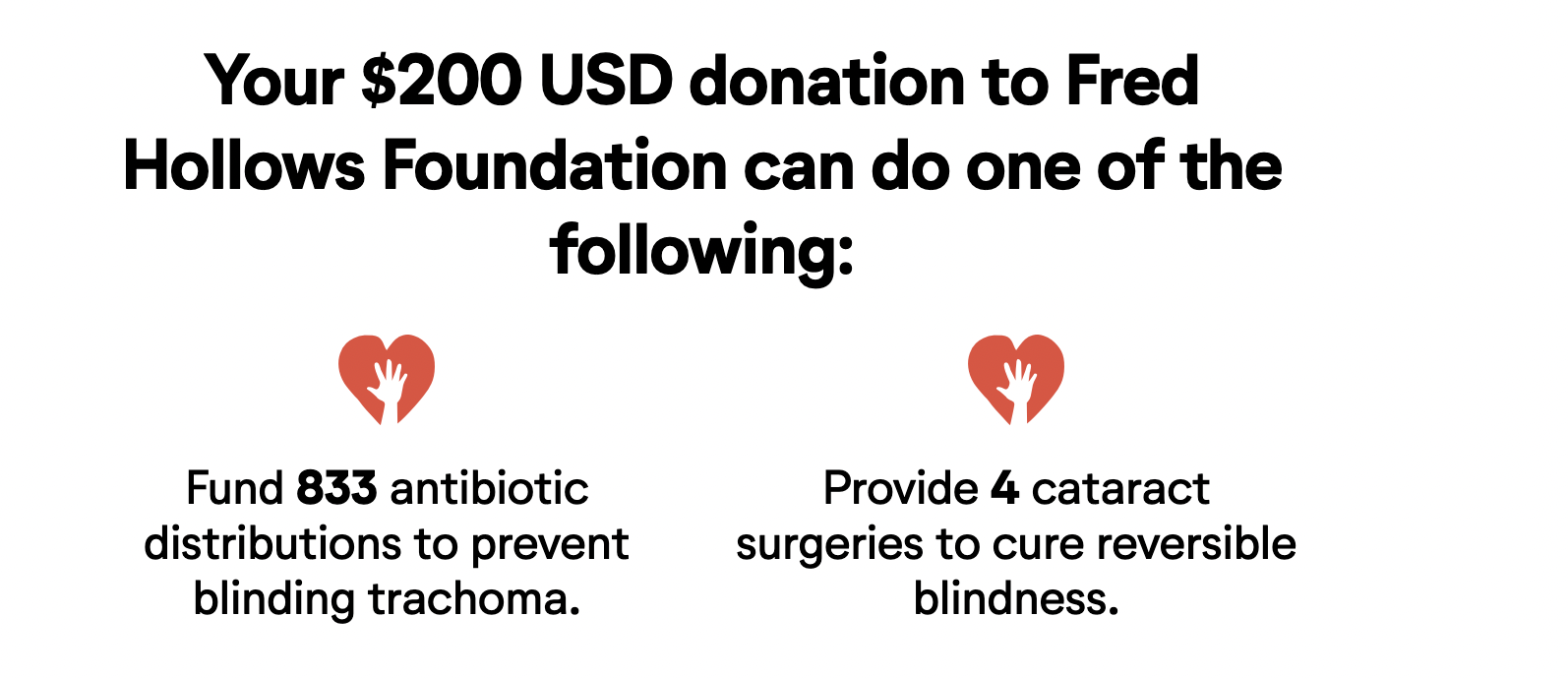

Here’s what $US200 could do right now if you donated to the Fred Hollows Foundation:

Just $US200, given at one time or over a year, could prevent hundreds of people from going blind.

Talk about impact investing…

Here are some other great reasons to consider setting up a regular financial donation, as part of your budget, to help our community save another life:

- Anything over $2 is tax-deductible for Aussies.

- Giving to charity has been shown to boost your mental & physical health

- Health benefits can include: lower blood pressure & increased self-esteem (I’d say that’s a pretty handy ‘life hack’ during lockdown)

How’s this: donating your time to charity could… wait for it… help you live a longer life.

When you look at the functional MRIs of subjects who gave to various charities, scientists have found that giving stimulates the mesolimbic pathway, which is the reward center in the brain — releasing endorphins and creating what is known as the “helper’s high.” – Cleveland Clinic

As investors, our money can pay interest in more ways than one. And right now, there’s a lot of bonus interest up for grabs with people in need — it’s for them and for you.

Click here to find a list of the best charities, rated by Australian Professor Peter Singer’s The Life You Can Save.

Is the stock market about to crash?

You: finally, some stock market commentary!

If it wasn’t for lockdowns I’d be willing to bet the most popular topic at (covid safe) BBQs would be “is the stock market about to crash?”

When prompted, my answer is almost always the same:

- The market is getting closer to the next market crash than the last one (think about that for a second…), but

- The market crashes on average every 4-8 years, and

- The 5,000 most popular technical analysis rules to time the market don’t work (see Massey Uni study), but it’s worth noting…

- The stock market has proven to be the number one place to invest for the long term (based on over 100 years of history), and…

- Studies show the longer you hold a diversified portfolio, the better your returns will be, therefore…

- One of the best things you can do is invest your extra capital immediately (note: “extra capital” = anything left over after your emergency cash savings and those 2-3 year financial goals you have, like a European holiday or a new car); finally, that means…

- Stock market investing is for life — not the next market crash.

If you’re worried about stocks or ETFs in your portfolio. Consider selling them. Sure.

But don’t do it because you’re scared of ‘the market crashing’. Sell them for good reasons like rebalancing your portfolio or because you may need the money in 2-4 years.

After all, if you’re inclined to worry about the market now — when things are going well — how are you going to feel when it finally crashes? Probably frozen with fear. Unable to act on anything other than fear. That’s how most rookie investors felt during the depths of the Covid crash in 2020.

In doing so, they wiped away (potentially) hundreds of thousands of dollars from their Super or investment accounts by selling at the worst possible times.

Keep your personal finances in check, costs low, forget the financial media, focus on what you own and why, stay invested, and add money regularly. If the market crashes, add more — not less.

Write this plan down now so you don’t forget these simple but effective rules when you need them most. A plan is your map against going off the reservation during the next crash.

Finally…

Remember that by investing in the stock market for the long run — whichever way you do it, ETFs or shares — you’re putting your money to work at the pointiest end of where the most sustainable value is created for all of society.

Great companies are led by great people who solve the biggest problems we face. By investing in companies on the stock market, you’re betting on capitalism to work and optimism to prevail.

Take, for instance, Zoom Inc (NASDAQ: ZM).

Where would the business world or your Friday virtual cheese & wine night be without Zoom! That only exists in its current form because people needed it most during Covid.

This week, on The Australian Investors Podcast, we take a look at some great companies — including Zoom. As you’ll hear/see on the show, as the world has transitioned online Zoom’s growth has been incredible.

We also take a look at software company Altium Ltd (ASX: ALU), database management business Pointerra Ltd (ASX: 3DP), payments business StoneCo (NYSE: STNE), and the virtual reality business known as Unity Inc (NYSE: U).

So many great companies growing fast.