Deterra Royalties Ltd (ASX: DRR) is arguably the most simple business on the Australian Stock Exchange.

It’s the perfect candidate for investors looking for low-risk commodity exposure or fully franked dividends.

The simplest business in Australia

Deterra Royalties was spun out of Iluka Resources Limited (ASX: ILU) in 2020.

The business owns six royalty streams in its portfolio. However, the crown jewel (and main driver of profits) is Mining Area C (MAC) operated by BHP Group Ltd (ASX: BHP).

A royalty is a payment made by one party to another that owns a particular asset, for the right to ongoing use of that asset.

Deterra receives 1.232% of all revenue generated at MAC.

The easiest way to think of a Dettera is each quarter, BHP will send the company a cheque in the mail. Deterra then goes down to the bank, deposits that cheque and pays out 100% of profits as dividends.

It’s that simple.

More on MAC

MAC is an iron-ore rich mining location with a cost of operations below $20 per tonne.

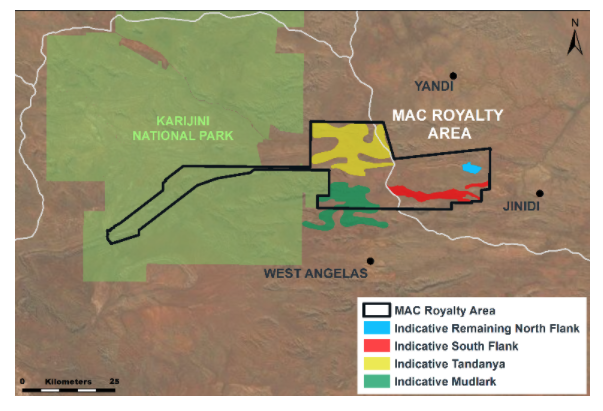

Current operations at North Flank (blue) and South Flank (red) are expected to continue for the next 30 years until 2050.

BHP has also identified potential future development and Tandanya (yellow) and Mudlark (green) which would extend the royalty life. BHP has stated previously “the long-term strategy for Mining Area C is to continue operations to 2073″.

Forget software-as-a-service

In FY21 the company received $145.2 million royalties revenue from 55.9 million dry metric tonnes, incurred $9.6 million in expenses, $47.3 million in tax and made a profit of $94.2 million.

Forget SaaS, that’s a 65% profit margin.

Currently, the business trades on about 21x earnings or a grossed-up dividend of 6.3%.

Key drivers of valuation

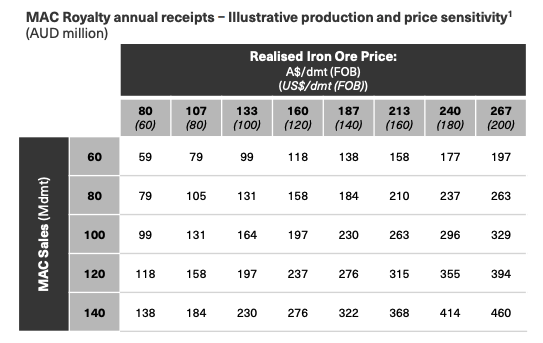

There are three key drivers of Deterra’s revenue and subsequent profitability:

- Iron ore price

- MAC sales volumes

- AUD/USD exchange rate

The below sensitivity table outlines the expected royalty revenue at MAC for a given iron price and sales volume out of the area. It helps give an overview of the expected returns investors can expect for a set of given variables.

The blue sky

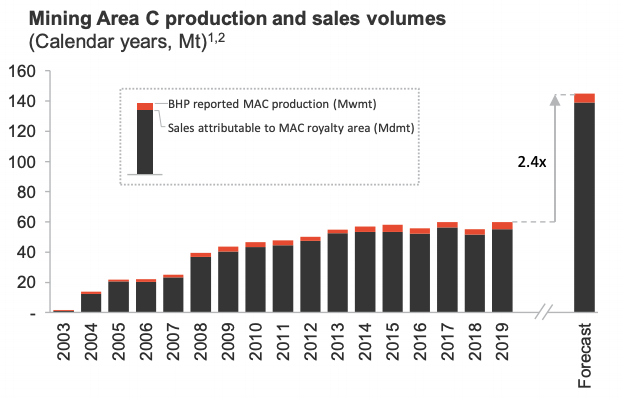

By 2023 and for the subsequent 30 years, Deterra is expecting MAC sales of 139 dry metric tonnes per year as South Flank expansion is completed.

This is a 2.4x jump in production and will provide organic growth in profits for the business.

MAC anunal production. Source: DRR December 2021 investor presentation

Why invest in Deterra when I could just buy the miners?

That is a great question. For example, Fortescue Metals Group Limited (ASX: FMG) just paid a $11 billion dividend.

However, investing in Dettera provides exposure to commodities with far lower risk.

You get exploration upside without the large capital requirements. Additionally, by taking a percentage of revenue, it doesn’t matter if the mine is running at a profit.

You get paid independent of the overall mine profitability. Essentially, Deterra is ranked above debt and equity owners in BHP.

My take

I personally don’t invest in mining businesses (it’s outside of my circle of competence), but if I was to dabble in the sector, Deterra would be my top pick.

It provides long-duration commodity exposure without the inherent operational or cost risk. Furthermore, it’s relatively easy to forecast and therefore value shares.

The share price will likely be volatile and trades in line with the overall iron price. But if you can look a little further out at the impending 2.4x increase in production, I think it offers upside.

If you’re looking to learn how to do your own ASX company valuations, take our free share valuation course, which takes you through 6 common share valuation techniques, step by step.

Or try our Beginner Shares Course if you’re just starting out. Both are free!