This brilliant update on investing well for the long run first appeared in Rask’s Weekly newsletter, delivered straight to your inbox. Enter your email address anywhere on a Rask website, take a free investing course or become a member to receive our weekly investing emails.

The Collectors

This week, inside our members-only investment service, Rask Invest, I shared a very special investor report, A DIY Investment Guide.

I’d been meaning to release this guide to members for over 6 months.

This guide contained a video, podcast, full write-up, and a 14-page PDF Workbook. It’s a Rask Invest members-only update. You can click here & join today for $399. In doing so, you will get our ASX investor coverage and 6 months of analyst stock ideas.

In truth, I think the core idea behind the guide was too important not to share. So, in this article I’m going to give you a taste of what you should be doing with your portfolio right now…

Is this you?

Most investors spend their life being a ‘collector’ of investments.

One month you’re buying XYZ Company Ltd stock, the next you’ve invested with ABC Global Fund.

At the same time, you’ve been shovelling cash into an investment property, and maybe even dabbling in that ‘great new idea’.

A few years pass, or a decade or two later, and — presto!

You’ve got yourself an unwieldy collection.

You are now, The Collector.

You might be experiencing The Collector’s Dilemma right now.

Reporting Season has just rolled off and you probably had some ASX company results that left you excited. Others made you worried, nervous… and everything in between.

Those emotions may have come from stocks you bought years ago, or maybe even some ETFs that you own but don’t really understand.

If you have some managed funds, a crypto wallet, properties or ‘Other’, it’s easy to see how most of us become Collectors, with a portfolio that seems to be more effort than it’s worth.

From an admin perspective being a Collector is a nightmare.

But from an emotional perspective, it’s more than a headache.

Our services, like Rask Rockets, Rask Invest or Rask ETFs, help our members stay on top of their small-cap shares, ASX stocks and ETFs (across most asset classes).

However, a personal portfolio is just one part of the bigger picture in a proper wealth building strategy.

For example, you also need to consider your property, Super, cash savings and how you’ll carefully manage your taxes.

To be sure: I think there’s nothing wrong with being a Collector in the beginning. If you spend too long worrying about ‘what might be’ in 10 years from now, you’ll never invest.

But, the problems with being a Collector inevitably start to show their ugly head 5 or 10 years into the journey.

And by then the decision to ‘right the ship’ often involves costly capital gains tax bills and perhaps even a $4,000 trip to a financial planner.

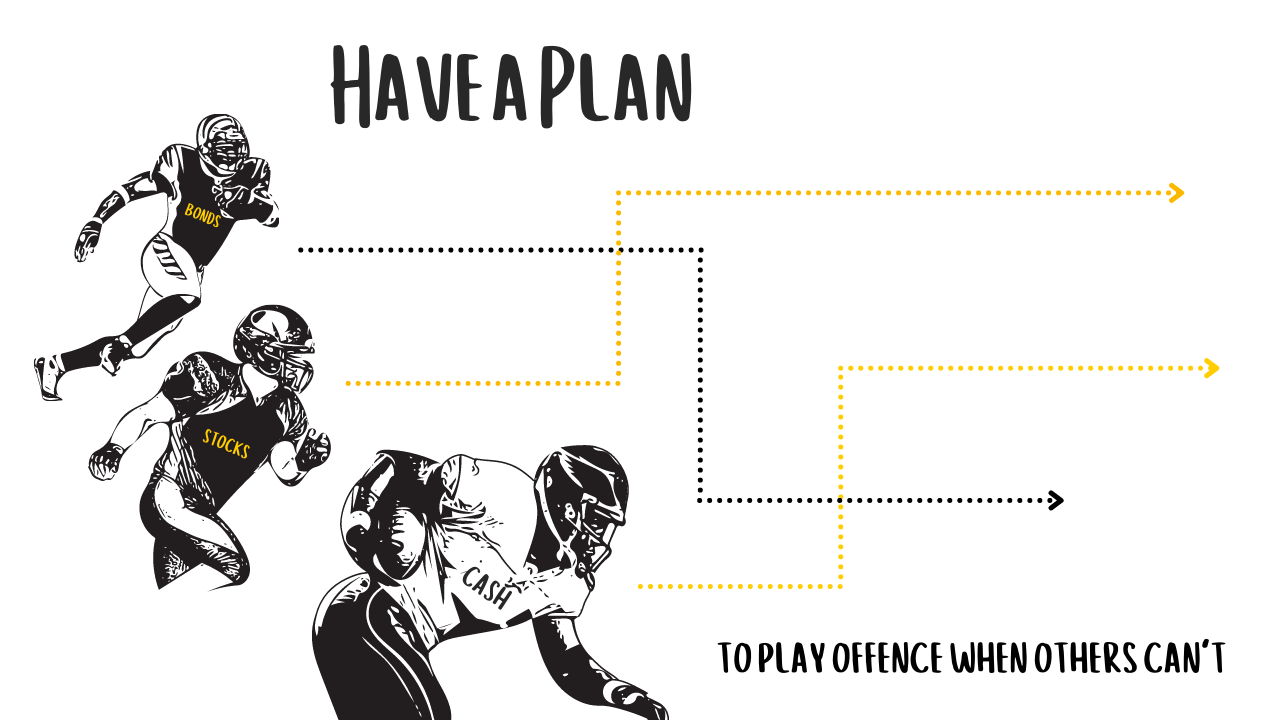

The easiest way to stop yourself from being The Collector is to have a plan. It doesn’t need to be complicated.

Some thought leaders suggest the best ‘investment plans’ can be summarised on half a piece of paper.

Example:

“I will invest 75% of my portfolio in stocks and funds/ETFs focused on the stock market, the final 25% will be defensive options and income plays. I will rebalance any time I’m 10% out of balance.”

Short & sweet.

So, why does a simple plan like this work?

I go into great detail in my Rask Invest update, but the simple fact is this:

If you (and your partner, if appropriate) sit down to take stock of your assets, your long-term financial goal, and set a simple strategy (see above) — you can play offence when others play defence.

But more than that, having any type of plan will help you take some of the emotion out of your investment decisions — at the exact time you need to make them (i.e. during a market crash).

Having a plan brings you comfort during a crash. That comfort gives you conviction.

Start today

If you’re a Rask Invest member, log-in now and access our full resources and downloads.

If you’re not a member yet, consider making a Google Doc or fire up Microsoft Word to answers questions like these:

- What’s my long-term financial goal?

- What is my investment strategy?

- What will I invest in to achieve my goals?

- How will I manage my tax?

- How many positions will I hold?

- When will I rebalance?

Store your document in a safe place, and make it password-protected, for later use.

Just the act of answering these questions made me think deeply about how we structure Rask Invest and how I plan to create lifelong wealth for my family.

I reckon you’ll be glad you did the same…

Let me know how you go by saying g’day on my Twitter or Instagram.

5 stock ideas on this week’s Australian Investors Podcast

This week on The Australian Investors Podcast, Dr Anirban Mahanti from 7Investing and myself answered some listener questions on Strategic Elements & a2 Milk Company (ASX: A2M).

Then, we dove straight into 5 of our top stocks from Reporting Season.

It’s a great episode for stock ideas, stories, learning and… a bit of analyst banter. Tune-in to laugh and stock talk!