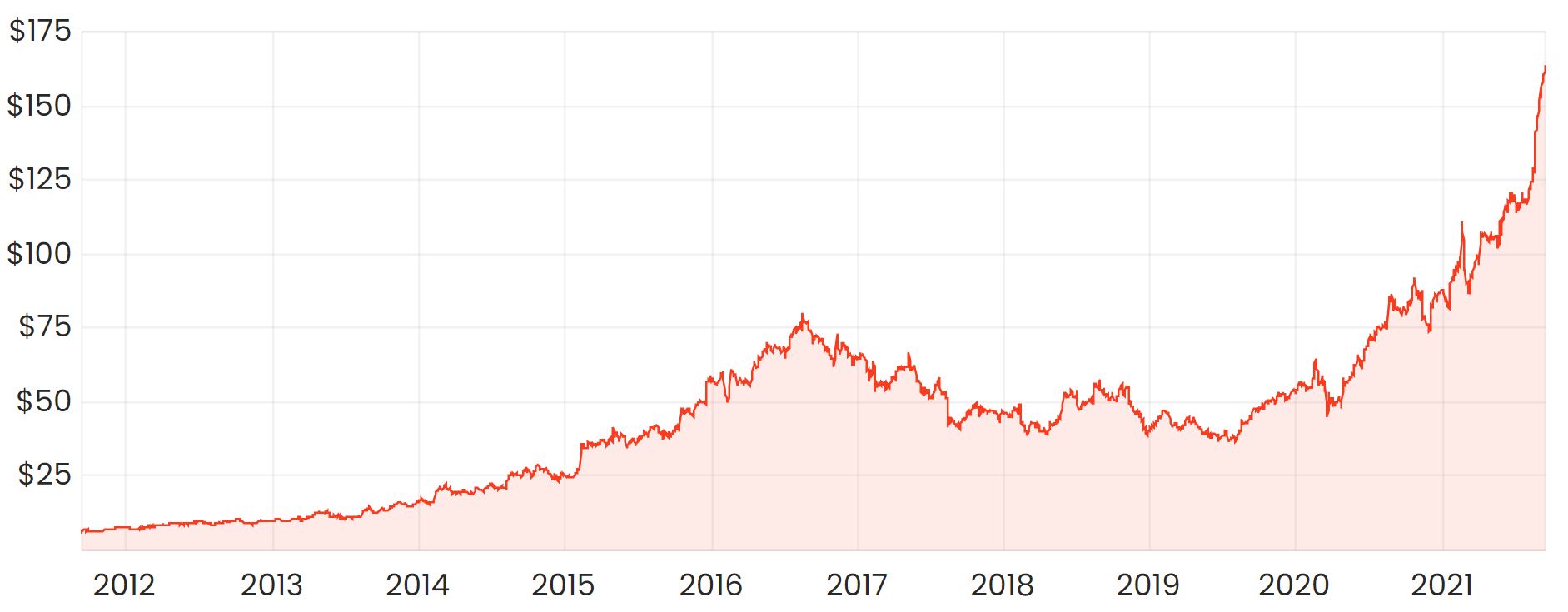

After a huge FY21 result, shares in Domino’s Pizza Enterprises Limited

(ASX: DMP) have reached new peaks at an all-time high of $165 per share in recent weeks.

The 10-year share price chart is what every long-term investor dreams of. However, given the parabolic trajectory recently, I’m sure many of us on the sidelines are wondering if it’s too late to be a buyer at these levels.

I had this same question last year at some point and learned a valuable lesson in the process.

DMP share price chart

Why I don’t bother with market timing

At some point last year, Domino’s shares were trading at around $80 apiece and were up 10% one day on the back of a broker upgrade.

I couldn’t bring myself to buy and was waiting patiently “for the pullback” which, as you’d probably guess, never came. My decision meant I missed out on a 100% gain all because I wanted to buy the stock for a dollar or so less.

My own experience isn’t even that bad when you consider that others have made the same mistake for other companies much earlier on in their growth phase. Can you just imagine if you were that person who was waiting for Amazon.com Inc (NASDAQ: AMZN) to pull back 5% back in the early 2000s?

If you truly are a long-term investor, I think it makes so much more sense to devote your time identifying the next potential winner rather than perfecting your market entry. In the long run, you can still achieve life-changing returns with quality companies even if you slightly overpay by 5% on the day.

Valuation still matters

This isn’t to say we can disregard valuation completely, however.

Investors should still have a strong understanding of metrics like the company’s total addressable market (TAM) and unit economics (retention, average revenue per user, etc), to get an idea of what must unfold to achieve compelling forward returns.

This can help to identify asymmetric opportunities where the upside potential exceeds the downside risk and vice versa.

Domino’s outlook

Domino’s is currently accelerating the pace of its store rollout strategy which will eventually see a store count of 6,650 stores in Japan and Europe by 2033 (currently 2,949).

Apart from a larger store network, I’d guess that more upside could result from improving its technology platform, expanding into new geographies, and larger brand presence from marketing initiatives

Are these opportunities baked into the current share price? Potentially. A discounted cash flow analysis would be a useful tool to assess intrinsic value.

If you’re looking to learn how to do your own ASX company valuations, take our free share valuation course, which takes you through 6 common share valuation techniques, step by step.

Or try our Beginner Shares Course if you’re just starting out. Both are free.