The Laybuy Holdings Ltd (ASX: LBY) share price jumped higher yesterday after it gave an update on its new Affiliate Marketing Network.

Laybuy’s Affiliate Marketing Network

Laybuy’s Affiliate Marketing Network gives UK shoppers using Laybuy access to hundreds of new retailers including Amazon, ASOS, Ebay, Levi’s and many more.

The network was launched at the end of August 2021 in the UK.

Co-Founder and Managing Director Gary Rohloff explained how the new product works: “Shoppers simply need to visit the Shop Directory in the Laybuy App and select the merchant that they wish to shop with. They then shop as normal but pay with the Laybuy Virtual Card, a single-use digital card that allows them to pay with Laybuy through the app.

“The “Virtual Card” will automatically be pre-populated into the relevant field on the merchant’s checkout, creating a seamless experience via the existing integrated BNPL offering, effectively reducing the shopping journey to just one click.”

Expectations exceeded

Laybuy said that the Affiliate Marketing Network has exceeded its projections. Since the launch in August it has processed orders and gross merchandise value (GMV) over 5x Laybuy’s one month forecast.

The company plans to further roll out the Affiliate Marketing Network and said that it forms a key part of the company’s growth strategy.

Laybuy in the UK

Laybuy said that it has been embraced by UK consumers since launching in 2019. In FY21 the value of goods purchased using Laybuy has increased by more than 500% year on year.

The company hopes that the launch of the Affiliate Marketing Network will accelerate its UK growth.

Laybuy share price decline

Final thoughts on the Laybuy share price

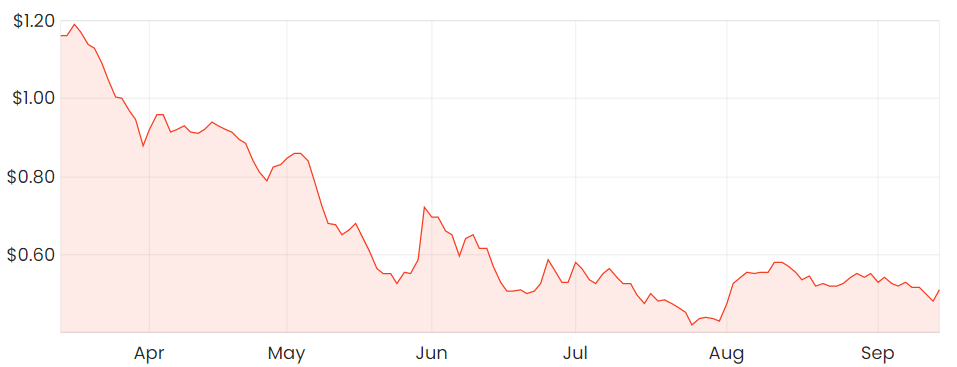

The Laybuy share price jumped up 8.3% on the back of the news yesterday. At the time of writing the share price is sitting flat today at $0.51.

However, when looking at the past six months the Laybuy share price has fallen by around 56%. Many of the BNPL shares have had a large share price decline since early 2021.

Over the past six months the Openpay Group Ltd (ASX: OPY) share price has fallen by 50%, the Zip Co Ltd (ASX: Z1P) share price is down 20% and the Sezzle Inc (ASX: SZL) share price is over 14% below its March 2021 level.

It’s difficult to say if the current Laybuy share price presents good value. A lot has changed in the BNPL world in those six months and competition is increasing.

Multiple competitors recently entered the BNPL space with Commonwealth Bank of Australia (ASX: CBA), Paypal Holdings Inc (NASDAQ: PYPL) launching their own BNPL offerings in the last year. Apple Inc (NASDAQ: AAPL) is reportedly thinking about an Apple pay later product.

If you’re looking to learn how to do your own ASX company valuations, take our free share valuation course, which takes you through 6 common share valuation techniques, step by step. Or try our Beginner Shares Course if you’re just starting out. Both are free.