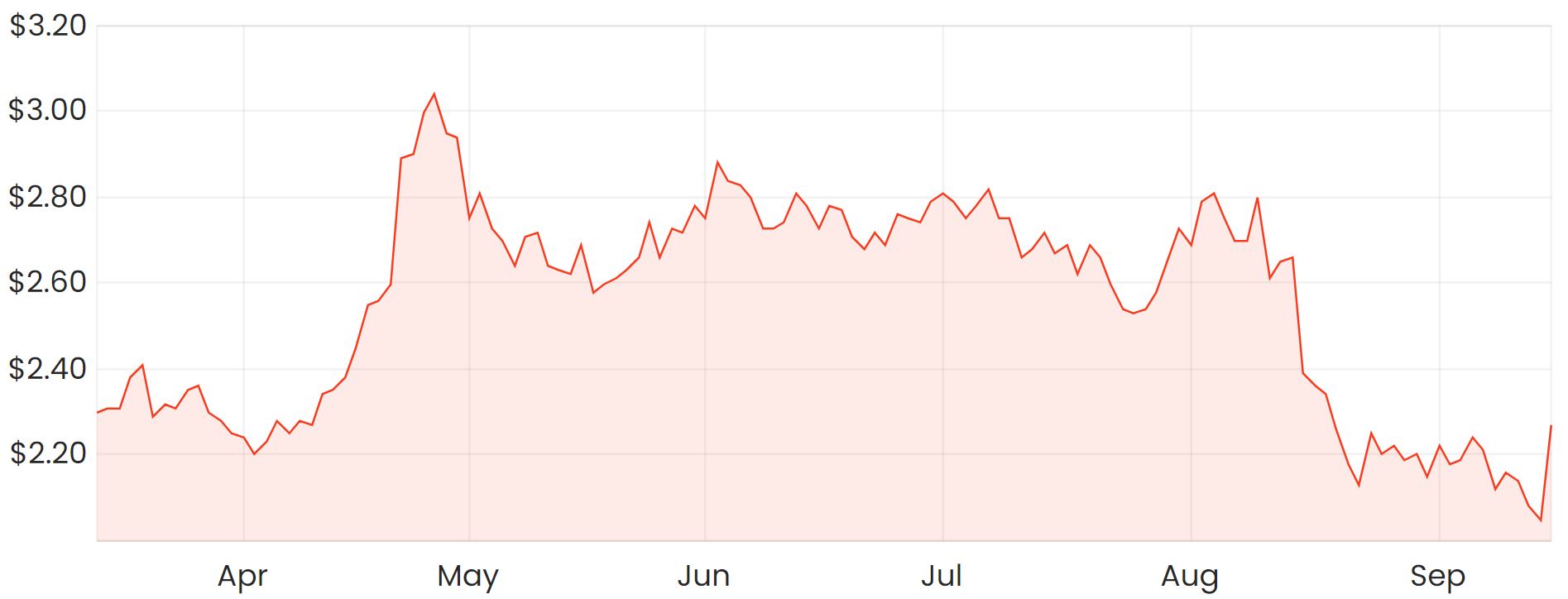

After being brutally sold off in recent weeks, shares in Accent Group Ltd (ASX: AX1) made a strong recovery today, finishing nearly 11% higher.

Despite releasing a bumper FY21 result, Accent Group’s shares have lost around 20% of their value since the start of August.

Accent Group has a diversified and popular range of brands including The Athletes Foot, Hype DC, Platypus, Vans, DrMartens and Timberlands

just to name a few.

FY21 results recap

A clear COVID beneficiary, Accent Group’s online sales exploded during FY21, which now account for nearly 21% of total group sales.

A huge 48.5% jump in online sales helped group revenue reach $1.14 billion, a 20% increase on FY20.

Earnings per share (EPS) grew 38.2% to 14.21 cents, putting its shares on a trailing Price/Earnings (P/E) ratio of 16.

Accent Group now has a total store network of 638, which it plans to grow to 700 by the end of FY22.

Why are shares falling?

The negative sentiment is being felt broadly across the retail sector, with shares in other retail winners like Super Retail Group Ltd (ASX: SUL) falling in recent weeks.

The market is likely weighing up the previous COVID tailwinds and questioning how sustainable these high growth rates might be moving forward. This is likely why Accent Group’s shares are trading on an undemanding earnings multiple of 16.

My take on Accent Group’s shares

It’s worth remembering that Accent Group was a fast-growing business prior to COVID, even though the pandemic has undeniably provided a boost to an extent.

Growth rates could likely slow down as it’s cycling off such strong comparable periods. But if its store rollout goes well through its new brands such as StyleRunner, I think it’s likely that the share price will rise in line with the earnings (profits) it can also continue to grow.

With a large growth runway and a grossed-up dividend yield of 6.8%, I consider Accent Group to be of the higher quality ASX retailers.