The S&P/ASX 200 (ASX: XJO) dropped another 0.3% on Wednesday as the rally in the energy sector reversed, falling 2.2%.

The key driver was an announcement that OPEC+ expects the oil market to balance earlier than expected. Every major company fell with Santos Ltd (ASX: STO) and BHP Group Ltd

(ASX: BHP) both finishing 3.5% lower.

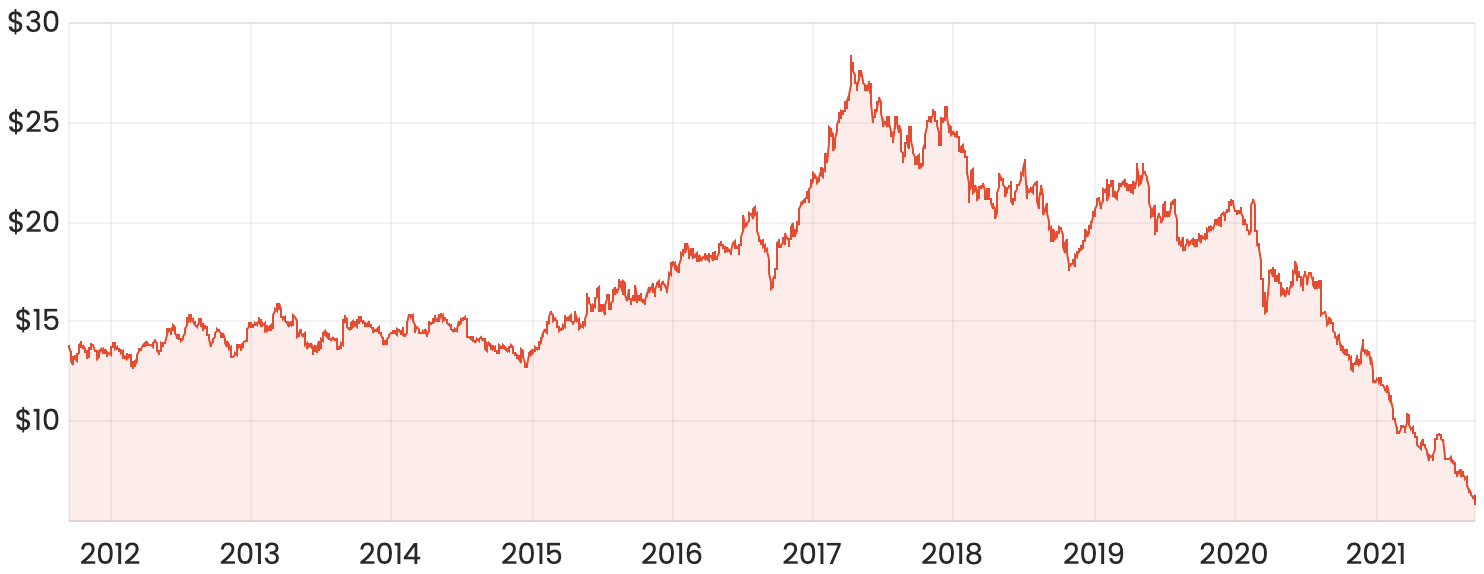

AGL hits record low

AGL Energy Limited (ASX: AGL) sent the utilities sector lower, falling 7.4% to an all-time low after a tumultuous few years. The selloff comes ahead of the group’s AGM at which it is seeking to split the company into two divisions. Origin Energy Ltd (ASX: ORG) outperformed in comparison, falling 3.5% given its larger gas exposure.

AGL share price – 10 years

Pilbara hits record

All the attention returned to the lithium sector with Pilbara Minerals Ltd (ASX: PLS) jumping 8.4% and outpacing the market after announcing the results of the second-ever auction on its Battery Metal Exchange (BMX).

The platform is used to sell unallocated concentrate from its Australia mine with the group achieving a price of US$1,420 per tonne, a long way from the US$400 received in September, explaining the incredible rally in the sector. Orocobre Limited

(ASX: ORE) was also 2.3% higher.

Featured: Inside the ACDC ETF

IRESS deal slowed, Qantas sets the date

Shares in technology software provider Iress Ltd (ASX: IRE) fell 3.9% as rumours spread that its potential buyer EQT may be seeking to reduce their offer or even pull out of the deal following due diligence.

Qantas Airways Limited (ASX: QAN) shares were flat despite announcing the resumption of international travel from Australia in December, beginning with the US, London and Singapore.

BT announces new CEO, healthcare & real estate outperform

Westpac Banking Corp (ASX: WBC) added 0.3% after announcing the new CEO of BT Financial Group, with Matthew Rady to take the reins of this business that remains on the selling block.

Healthcare and real estate continue to outperform on weaker days with CSL Limited (ASX: CSL) and Charter Hall Group (ASX: CHC) both adding 1.4%.

OECD calls out RBA

In macroeconomic news, the OECD has called for an independent review of the Reserve Bank of Australia, questioning why they have consistently failed to meet their economic targets of stable inflation and low unemployment. Quite an interesting suggestion given Australia’s relative success by comparison to the rest of the world.

ASX 200 today

The ASX 200 is heading towards a positive open on Thursday, following a positive lead from all three US benchmarks overnight. For all the latest, check out Rask Media’s US stock market report.