Today, I’m looking at two ASX growth shares I’d happily buy today.

Smartpay

Looking at a company’s share price chart over a short time period can often be an inaccurate representation of how the business is performing fundamentally. EFTPOS terminal distributor Smartpay Holdings (ASX: SMP) is a great example, with its shares down an odd 20% over the past few months.

Recent lockdowns in New South Wales and Victoria would be my guess as to why the sentiment has deteriorated recently. But let’s have a look at how the business has been traveling recently.

For context, Smartpay’s business is split in two. It has its mature New Zealand business, and its high growth Australian business. From a group level, it grew revenue 65% across the first quarter of FY22.

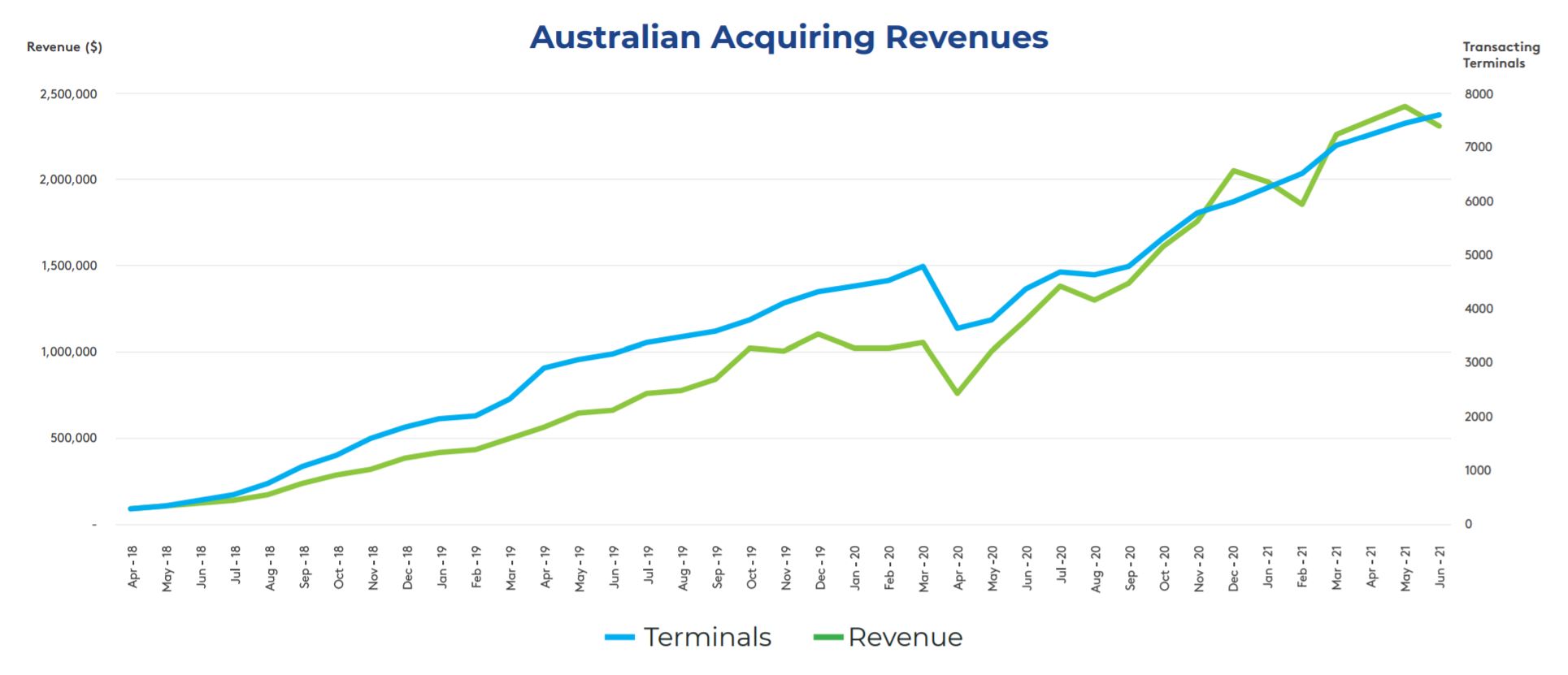

But its Australian segment actually grew revenue 158% and grew its terminal fleet to 7,306, up from 6,754 at the end of Q4 FY21.

Smartpay’s FY21 results revealed it made an after-tax loss of $15.2 million. But it’s worth noting the majority of this loss came from a non-cash fair adjustment of a convertible note. Smartpay is actually generating positive free cash flow, so don’t get too hung up on the accounting jargon.

Australian Ethical Investment

Shares in Australian Ethical Investment Limited (ASX: AEF) have had a stellar run over the past year and have pulled back slightly during this week.

The positive thematic around environmental, social and ethical (ESG) investing is likely to be a sustainable tailwind for years to come.

72% of its members are less than 44 years of age. This will allow funds under management to grow (FUM) as customers age and contributions rise with higher wages.

Australian Ethical’s valuation doesn’t look cheap. But as I explained in my recent article, it could offer some more upside if management is able to successfully execute.